and the distribution of digital products.

State of Babylon Q1 2025

- Babylon Genesis went live and became the first Bitcoin Supercharged Network (BSN). The Layer-1 will serve as the coordination layer for Babylon’s security-sharing protocol upon the launch of Phase-3.

- Phase-3 will mark the beginning of Babylon Genesis’ full security sharing capabilities as other BSNs begin to be secured by Bitcoin. BSNs that have committed to leverage Babylon Genesis include the likes of BOB, Osmosis, and Sui.

- The BABY token launched with an airdrop that distributed 6% of the initial token supply. A liquid staking ecosystem emerged with protocols like SatLayer (cBABY), Escher (eBABY), and MilkyWay (milkBABY).

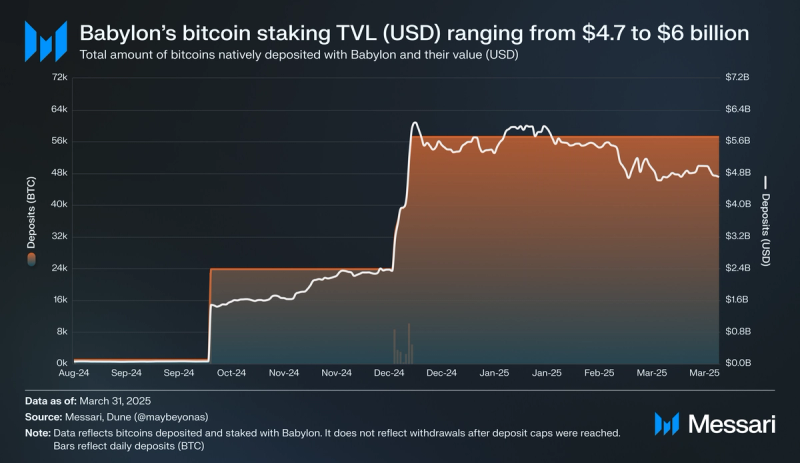

- Babylon’s bitcoin staking TVL (BTC) of 57,167 BTC equated to 0.29% of Bitcoin’s circulating supply. Cumulative bitcoin staking deposits (USD) ranged from a high of $6 billion in January to a low of $4.62 billion in March.

- 47,493 BTC was liquid staked by the end of Q1 2025, a 14.6% QoQ increase. Lombard ended the quarter with a TVL (BTC) of 21,062 BTC, up 32% QoQ as LBTC became the 4th largest bitcoin derivative and reached 0.1% of bitcoin’s circulating supply.

Babylon (BABY) was co-founded in 2022 by David Tse and Dr. Fisher Yu. Their original inspiration stemmed from a research paper on Bitcoin security co-authored with the founder of EigenLayer, Sreeram Kannan. Babylon offers a security-sharing protocol that leverages Bitcoin to help secure Bitcoin Supercharged Networks (BSNs), aka Layer-1 (L1) and Layer-2 (L2) networks. This is facilitated through “Babylon Genesis,” an L1 built on Cosmos whose native token is BABY.

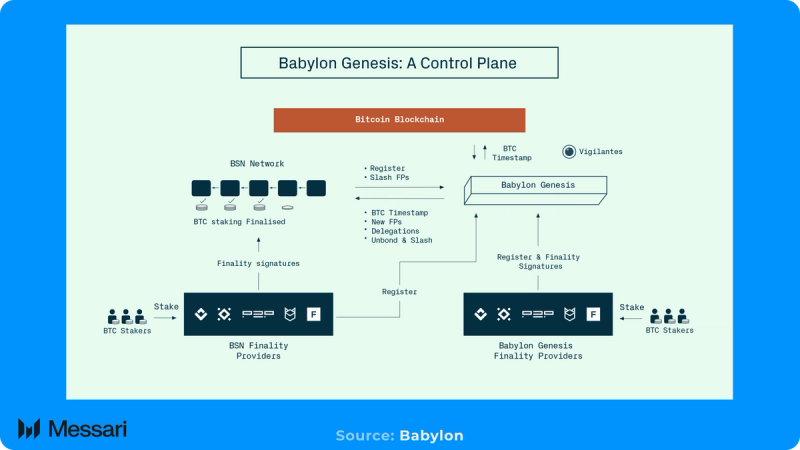

Through Babylon’s bitcoin staking protocol, bitcoin tokenholders that desire yield can deposit (stake) bitcoins to provide security for BSNs, which includes Babylon Genesis itself. Staked bitcoins are delegated to Finality Providers (FPs), which serve as the validators that secure BSNs. Despite Bitcoin’s lack of smart contracts, Bitcoin’s scripting language is used to engineer stake slashing to punish misbehaving FPs. For a full primer on Babylon, refer to our Initiation of Coverage report.

Babylon’s roadmap consists of three phases. Phase-1 attracted bitcoin deposits but did not implement stake slashing. It consisted of three capped deposit rounds and saw an ecosystem of liquid staking protocols emerge, including leaders like Lombard and Solv. Phase-2 introduced stake slashing with the launch of Babylon Genesis as the first BSN secured by Babylon. Phase-3 will launch Babylon Genesis’ full security sharing capabilities as other BSNs become secured by Bitcoin.

To fund development, Babylon has raised $96.8 million, including an $8.8 million seed round, $18 million Series A, and $70 million Series B. A full list of investments in Babylon can be found in Messari Fundraising.

Website / X / Discord / Telegram / Docs / GitHub / Forum

Phase-1

Leading up to the launch of Babylon Genesis, also known as Phase-1, Babylon attracted 57,290 BTC in staking deposits through three capped deposit rounds. In Q1 2025, Babylon’s cumulative staking deposits (USD) ranged from a high of $6 billion on Jan. 30, 2025, to a low of $4.62 billion on March 11, 2025. Notably, the Babylon staking deposit data used does not reflect bitcoin withdrawals, which have marginally reduced Babylon’s bitcoin staking TVL (BTC) over time.

Deposited bitcoins are considered to be staked. Stakes last a maximum of 64,000 Bitcoin blocks (~15 months), after which they are considered to be expired and can be withdrawn. Depositors can elect to unbond their bitcoins at any time. After an unbonding period of 1,008 Bitcoin blocks (~seven days), the stake is considered to be expired and can be withdrawn. This process is manually performed by a Covenant Committee that operates within a 6-of-9 multi-signature scheme that approves unbonding transactions.

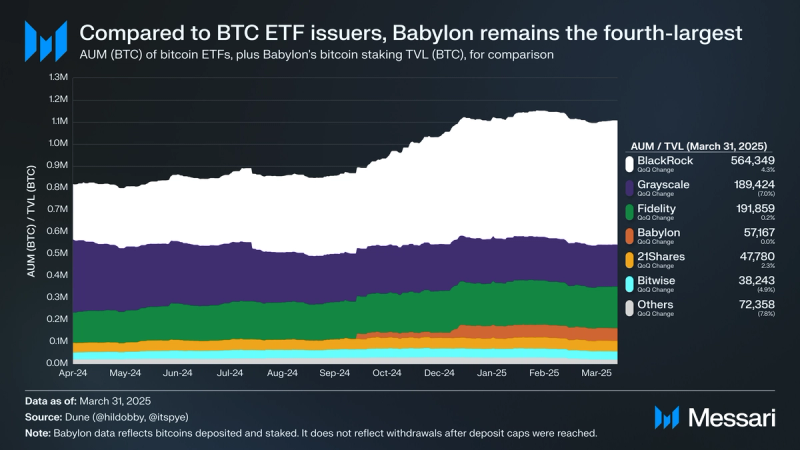

Babylon versus ETFs

Babylon’s bitcoin staking TVL (USD) totaled $4.37 billion at the end of Q1’25. In total, Babylon’s bitcoin staking TVL (BTC) equated to 0.29% of Bitcoin’s circulating supply, or 57,167 BTC. Exchange-traded funds (ETFs) for bitcoin launched in January 2024. Assets under management (AUM) for these products are continually increasing and ended Q1’25 with a total AUM (BTC) of 1.1 million. When compared to Bitcoin ETFs, Babylon's protocol had accumulated the fourth-highest amount of Bitcoin, behind BlackRock, Grayscale, and Fidelity.

Phase-2Babylon GenesisAfter a four-month testnet period and bug bounty competition on Sherlock, Babylon Genesis went live on April 10, 2025. Babylon Genesis is Babylon’s Layer-1 network (L1), built on Cosmos with BABY serving as its native token. The launch featured day-one support from Anchorage Digital, BitGo, Union, and Axelar.

Phase-2 formally began on May 8, 2025, after a series of network upgrades. This phase activated stake slashing, whereby Babylon Genesis stakes can be slashed in the case of misbehaving FPs. Phase-3 will launch Babylon’s full security sharing capabilities as other BSNs begin to be secured by Babylon.

Babylon Genesis facilitates Babylon’s security-sharing protocol that helps secure Bitcoin Supercharged Networks (BSNs). Babylon Genesis was the first BSN to go live and serves as the coordination layer for Babylon’s security. Babylon continues to invest and grow its ecosystem of planned BSNs, some of which include:

- BOB: An Ethereum L2 focused on bitcoin-based DeFi with $234.7 million in TVL (USD) at the end of Q1’25. BOB’s architecture also leverages BitVM to enable trust-minimized bridges that inherit security from Bitcoin and facilitate interoperability with other L1s.

- Osmosis: Osmosis is Cosmos’ flagship DEX that supports assets across the Cosmos ecosystem, having facilitated over $38 million in all-time trading volume. The protocol was approved to become a BSN after a successful governance proposal by OSMO stakers.

- Sui: A general-purpose Layer-1 network with $1.23 billion in TVL (USD) at the end of Q1’25. Sui is based on the MoveVM, whose core technical differentiation is the replacement of accounts with objects.

- Manta Network: A general-purpose Ethereum L2 with $17.5 million in TVL (USD) at the end of Q1’25.

- BirdLayer: A trading-focused Arbitrum L3 with $18.4 million in TVL (USD) at the end of Q1’25.

- Corn: An Ethereum L2 with $1.3 million in TVL (USD) at the end of Q1’25. Corn is focused on bitcoin-based DeFi and utilizes BTCN, a tokenized version of bitcoin, as the network’s gas and rewards token.

As for the ecosystem atop Babylon Genesis, early growth was seen in April 2025 as Tower launched the initial version of its Babylon-native decentralized exchange (DEX), dubbed “BabyDEX.” Tower allows users to trade in pools containing Babylon-related assets, like BTC and BABY liquid staking tokens. Tower users earn points for using the protocol. Point accrual includes Tower points, but also extends to protocols like MilkyWay, Union, Escher, and SatLayer. In the future, Tower plans to expand with a v2 dubbed “Tower DEX,” and launch its upcoming TWR token.

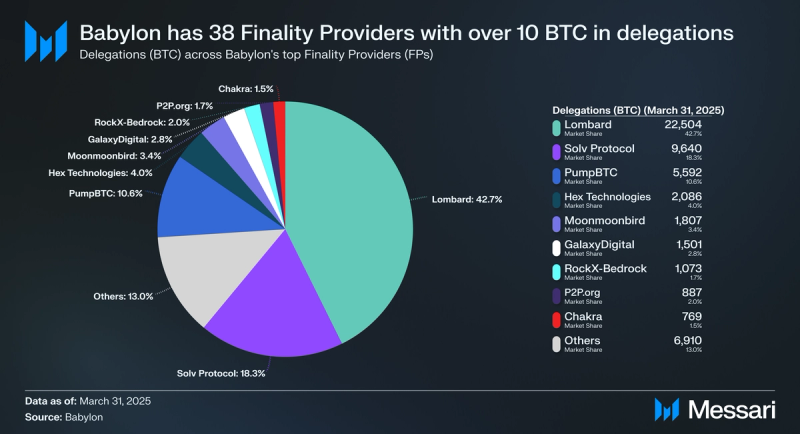

Finality Providers

By the end of Q1 2025, 38 Finality Providers (FPs) had 10 or more bitcoins delegated to them. The top three FPs were liquid staking protocols (Lombard, Solv, and PumpBTC) that made up 71.5% of Babylon’s total delegated bitcoins, which totaled 52,769 at the end of the quarter.

Babylon’s Finality Provider diversity score was 12 (i.e., the number of FPs receiving 90% of delegations) at the end of Q1’25, down from 13 in Q4’24. Real-time staking data across Babylon, inclusive of all FPs and their delegation amounts, can be seen on the Babylon Staking Dashboard.

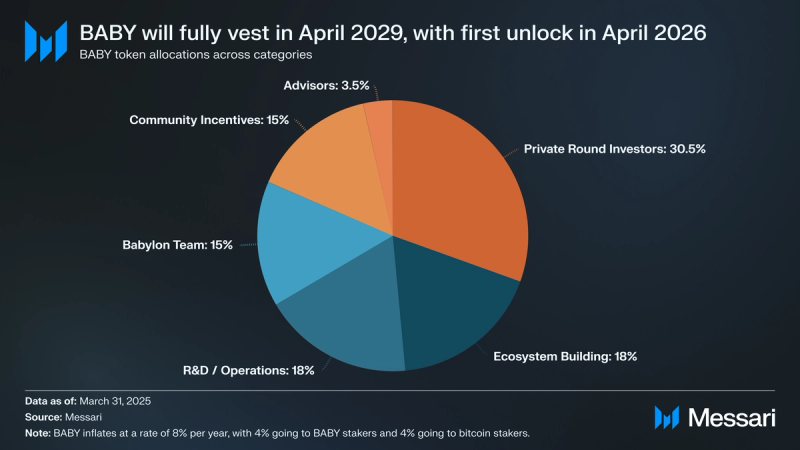

BABY TokenAllocations

The BABY token launched on April 10, 2025, with an initial token supply of 10 billion. Tokens were allocated to the following areas:

- Community Incentives (15%): 1.5 billion BABY tokens are managed by Babylon Foundation and are fully liquid. Up to 400 million BABY within this allocation can be staked, with all staking rewards being allocated back for future community incentives.

- Airdrop (6%): Babylon’s airdrop distributed 600 million BABY to stakers and FPs that earned points during Phase-1. Notably, users that staked via liquid staking protocols could claim BABY tokens from their respective protocols.

- Binance Marketing (1.2%): 121.6 million BABY is set to be unlocked for Binance marketing campaigns in October 2025.

- Ecosystem Building (18%): 1.8 billion BABY are to be used for grants, bounties, investments, marketing, and acquisitions.

- These tokens vest over three years, with 25% unlocked upon Babylon Genesis’ launch and the rest linearly vesting after a one-year cliff unlocks another 25% of the allocation.

- Up to 800 million BABY within this allocation can be staked, with all staking rewards being allocated back for future ecosystem building.

- R&D / Operations (18%): 1.8 billion BABY will fund Babylon Foundation operations and “research and development activities for protocol and infrastructure development and advancing native use cases of Bitcoin.”

- These tokens vest over three years, with 25% unlocked upon Babylon Genesis’ launch and the rest linearly vesting after a one-year cliff unlocks another 25% of the allocation.

- Up to 800 million BABY within this allocation can be staked, with all staking rewards being allocated back for future R&D and operations funding.

- Private Round Investors (30.5%): 3.05 billion BABY are allocated to early private round investors like Paradigm, Polychain Capital, and Hack VC.

- These tokens vest over four years, with linear vesting beginning after a one-year cliff unlocks 12.5% of the allocation.

- Investors can stake all tokens within this allocation after the one-year cliff lapses, earning liquid token rewards.

- Team (15%): 1.5 billion BABY are allocated to the core Babylon team.

- These tokens vest over four years, with linear vesting beginning after a one-year cliff unlocks 12.5% of the allocation.

- Core team members can stake all tokens within this allocation after the one-year cliff lapses, earning liquid token rewards.

- Advisors (3.5%): 350 million BABY are allocated to advisors.

- These tokens vest over four years, with linear vesting beginning after a one-year cliff unlocks 12.5% of the allocation.

- Advisors can stake all tokens within this allocation after the one-year cliff lapses, earning liquid token rewards.

BABY serves various functions:

- Transaction Fees: BABY serves as the gas token for Babylon Genesis, facilitating transactions and smart contract execution.

- Governance: BABY facilitates Babylon’s governance. Tokenholders that stake tokens with a validator can propose and vote on protocol changes and network upgrades.

- Staking: BABY that is staked is slashable and increases the cryptoeconomic security that Babylon is able to provide to its BSNs, strengthening incentives across the ecosystem.

- Rewards: BABY stakers earn additional BABY rewards through inflationary emissions. Specifically, BABY inflates at a rate of 8% per year, with 4% going to BABY stakers and 4% going to bitcoin stakers.

A minimum deposit of 50,000 BABY is required to initiate a proposal, with initial discussions occurring on the Babylon Forum. The voting period is three days, with a quorum of 33.4% and an approval threshold of 50%. However, if 200,000 BABY is deposited to support a proposal, the proposal enters an expedited voting period of one day, which requires the same quorum of 33.4% but an approval threshold of 66.7%. Notably, if stakers do not vote, their voting power is inherited by the validator they have staked with.

In April 2025, all eight governance proposals were approved. Most of these proposals were inconsequential to the average stakeholder and related to whitelisting ecosystem teams such as Tower, Interchain Labs, Union, Persistence Labs, SatLayer, to deploy smart contracts on Babylon Genesis.

A liquid staking ecosystem revolving around BABY has also begun to emerge. Protocols like SatLayer (cBABY), Escher (eBABY), and MilkyWay (milkBABY) allow users to stake BABY tokens and receive a liquid staking token representing their underlying staked BABY position. This increases capital efficiency and enables further utility for tokenholders as they participate in the emerging DeFi ecosystem on Babylon Genesis.

Liquid Staking Ecosystem

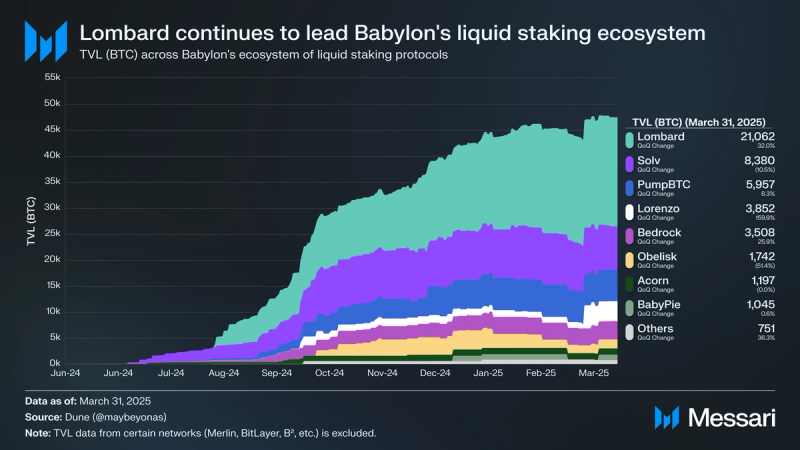

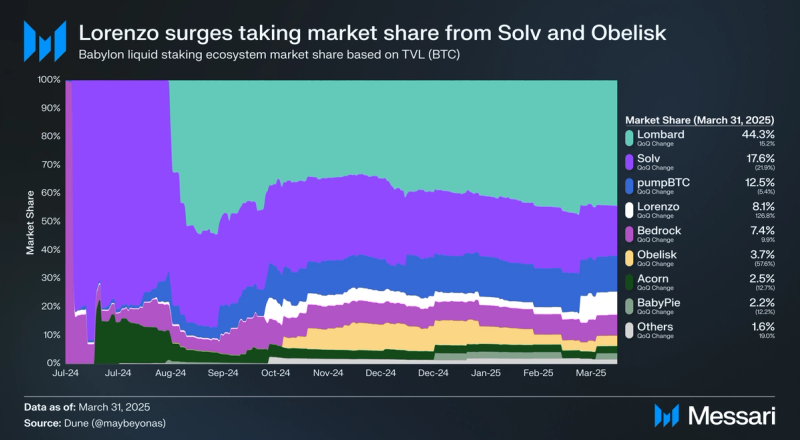

The majority of Babylon’s bitcoin deposits come from its ecosystem of liquid staking protocols. These protocols accept bitcoin deposits from users regardless of whether or not Babylon is accepting additional deposits. In return, users receive liquid staking tokens that can be used across DeFi. When Babylon opens bitcoin staking deposits, protocol-held bitcoins are natively deposited (staked) with Babylon.

By the end of Q1’25, 47,493 BTC had been liquid staked, an increase of 14.6% QoQ, up from 41,457 at the end of Q4’24. Lombard continued to be Babylon’s leading liquid staking protocol by a wide margin:

- Lombard (LBTC): Ended Q1’25 with a TVL of 21,062 BTC, up 32% QoQ and reaching 0.1% of bitcoin’s circulating supply. This resulted in LBTC going from 5th to 4th largest bitcoin derivative behind WBTC, BTCB, and cbBTC. LBTC’s DeFi utilization rate was 69% by the end of the quarter, indicating high user engagement. During the quarter:

- Lombard expanded its DeFi integrations with protocols such as SparkLend, Aave, BOB, Mizu, and Moonwell, all of which distribute Lux points as part of the Luminary Program.

- Lombard expanded native support to five networks as Sui and Sonic were added, though over 88% of LBTC’s supply still lives on Ethereum.

- Lombard launched the Lombard Security Consortium, a group of 14 leading institutions like OKX, Galaxy, Wintermute, and Amber Group, which come to consensus to facilitate Lombard protocol transactions like mints, redemptions, staking, and bridging.

- Lombard launched its Kaito Leaderboard and year-long yapper campaign with $1 to $5 million in rewards.

- Solv (xSolvBTC): Ended Q1’25 with a TVL of 8,380 BTC, down 10.5% QoQ. During the quarter:

- Solv rebranded as SolvBTC.BBN to xSolvBTC, and raised $10 million in a Microstrategy-style Bitcoin Reserve Offering (BRO).

- Solv launched its SOLV token on Jan. 17, 2025, on exchanges like Hyperliquid and Binance. The initial airdrop to Season 1 points holders totaled 7.25% of the total supply.

- Solv expanded its DeFi integrations with protocols such as Soneium, Mizu, Corn, Morpho, Movement, and Sonic, all of which distribute Solv points under Season 2.

- PumpBTC (pumpBTC): Ended Q1’25 with a TVL of 5,957 BTC, up 8.3% QoQ.

- PumpBTC launched the PUMP token on April 1, 2025, rewarding users that accumulated points across Season 1 and Season 2 by airdropping 9% of PUMP’s token supply.

- PumpBTC raised 1,240 BNB tokens worth $753,000 by selling 5% of PUMP’s token supply via an Initial DEX Offering (IDO)

- PumpBTC expanded its DeFi integrations with protocols such as BulbaSwap, Neo, Kernel, Napier, Segment, Mizu, and Kaia, all of which distribute PumpBTC points under Season 3.

Other bitcoin liquid staking protocols include Lorenzo (stBTC), Bedrock (uniBTC), Obelisk (oBTC), Acorn (aBTC), BabyPie (mBTC), Allo (alloBTC), pSTAKE (yBTC), and Kinza (kBTC).

Babylon’s liquid staking diversity score was five (i.e., the number of liquid staking protocols comprising 90% of Babylon’s liquid staking TVL) at the end of Q1’25, down from six at the end of Q4’25. The top five were Lombard, Solv, PumpBTC, Lorenzo, and Bedrock. Obelisk, Acorn, BabyPie, Allo, Kinza, and pSTAKE made up the remaining amount.

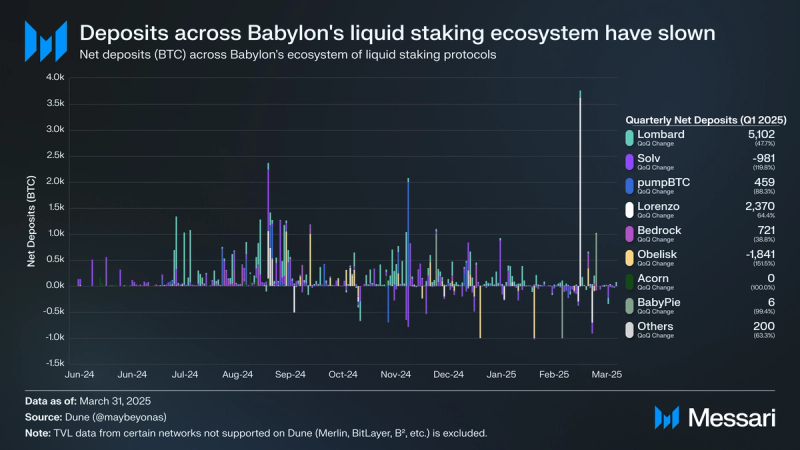

Quarterly net deposits (BTC) were positive for most of Babylon’s liquid staking protocols in Q1’25. However, the rate of growth slowed as most protocols saw less bitcoin deposited in Q1’25 than Q4’24, with some even seeing net withdrawals:

- Lombard: 5,102 BTC deposited, down 47.7% QoQ as it maintained its lead in TVL and saw the highest net deposits among all bitcoin liquid staking protocols.

- Solv: 981 BTC withdrawn, a decrease of 119.8% QoQ in terms of net deposits, though the protocol remained Babylon’s 2nd largest liquid staking protocol by TVL.

- PumpBTC: 459 BTC deposited, down 98.3% QoQ, though the protocol remained Babylon’s 3rd largest liquid staking protocol by TVL.

- Lorenzo: 2,370 BTC deposited, up 64.4% QoQ as the protocol continued to see outsized growth, having jumped from 6th to 4th place in terms of Babylon’s liquid staking TVL.

- Bedrock: 721 BTC deposited, down 38.8 % QoQ though the protocol remained Babylon’s 5th largest liquid staking protocol by TVL.

- Obelisk: 1,841 BTC withdrawn, a decrease of 151.5% QoQ in terms of net deposits as the protocol fell from 4th to 6th place in terms of Babylon’s liquid staking TVL.

In December 2024, Babylon Foundation launched a Delegation Program. Babylon Foundation’s Delegation Program supports FPs by delegating stake toward accepted providers, helping to diversify the active set of FPs.

Prospective FPs were able to apply for delegation by Jan. 31, 2025. The duration of Babylon Foundation delegations is six months, after which extensions can be requested for outstanding performers. Notably, FPs that operate exclusively as liquid staking protocols, and any FPs with delegations that exceed 10% of total delegated amount, are ineligible to join or remain in the program.

Other ActivitiesIn Q1 2025, Babylon Foundation took part in several other activities:

- In March 2025, Babylon Foundation hosted global meetups in cities like Tokyo, Ho Chi Minh City, Seoul, Istanbul, Taipei, and Jakarta.

- In February 2025, Babylon Foundation hosted Bitcoin Renaissance at ETH Denver, a one-day event that saw over 850 attendees and 70 speakers.

- In February 2025, Babylon Foundation co-hosted Bitcoin Tech Carnival in Hong Kong.

- In January 2025, Babylon Foundation invested in Fiamma to collaborate on building trust-minimized Bitcoin bridges powered by BitVM2. Bridges are live on testnet for networks like Babylon Genesis, Arbitrum, BOB, ZKsync, and Monad.

Babylon began Phase-2 after the launch of Babylon Genesis and its native token, BABY, which had 6% of its initial token supply airdropped to early users. Babylon Genesis became the first Bitcoin Supercharged Network (BSN), and will serve as the coordination layer for Babylon’s security-sharing protocol upon the launch of Phase-3.

There were 47,493 BTC liquid staked by the end of Q1 2025, a 14.6% QoQ increase. Lombard continued to lead the Babylon liquid staking ecosystem, ending the quarter with a TVL (BTC) of 21,062 BTC. This was an increase of 32% QoQ as LBTC became the 4th largest bitcoin derivative and reached 0.1% of bitcoin’s circulating supply.

Babylon Foundation was active throughout the quarter, hosting events like Bitcoin Renaissance at ETH Denver, Bitcoin Tech Carnival in Hong Kong, and meetups around the world. The Babylon Foundation’s Delegation Program began, supporting Finality Providers (FPs) and helping to diversify the active set of FPs. Users can look forward to the commencement of Phase-3 as Babylon Genesis and its network of FPs begin to coordinate Babylon’s vision of providing security for BSNs like BOB, Osmosis, and Sui.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.