and the distribution of digital products.

State of Avalanche Q1 2025

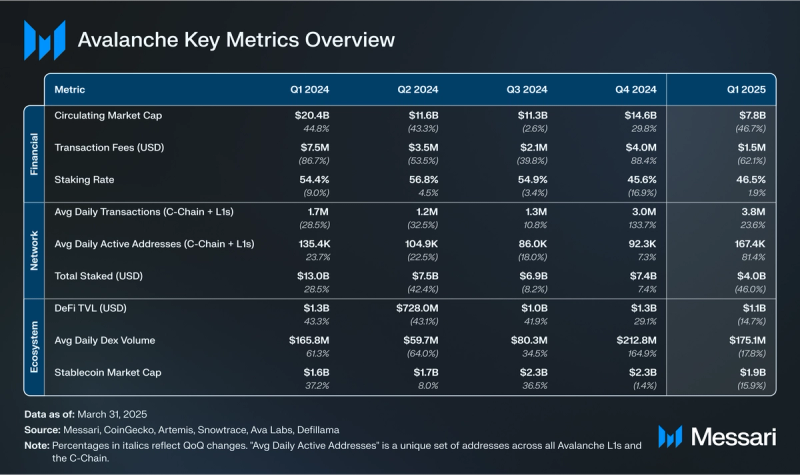

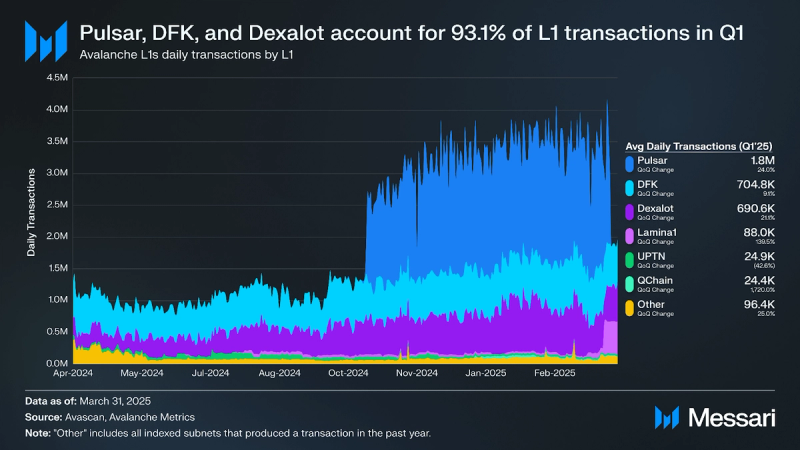

- Daily average transactions across Avalanche grew 23.6% QoQ to 3.8 million, driven by Pulsar (1.8 million daily transactions) and new Layer-1 launches. Active addresses across Avalanche L1s rose 146%, signaling robust user engagement.

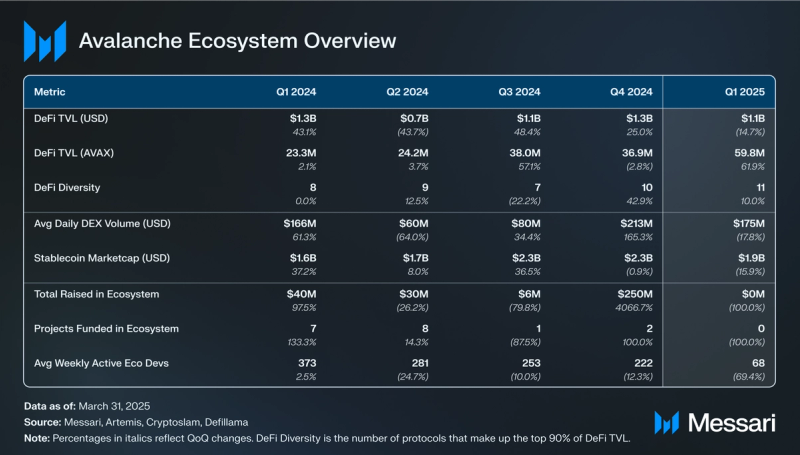

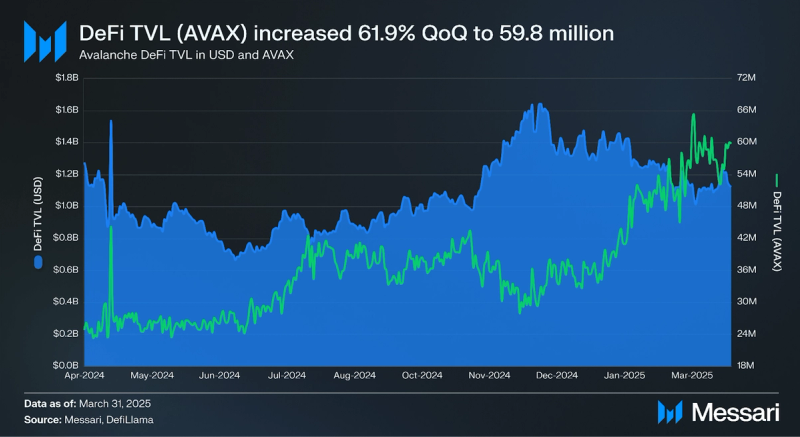

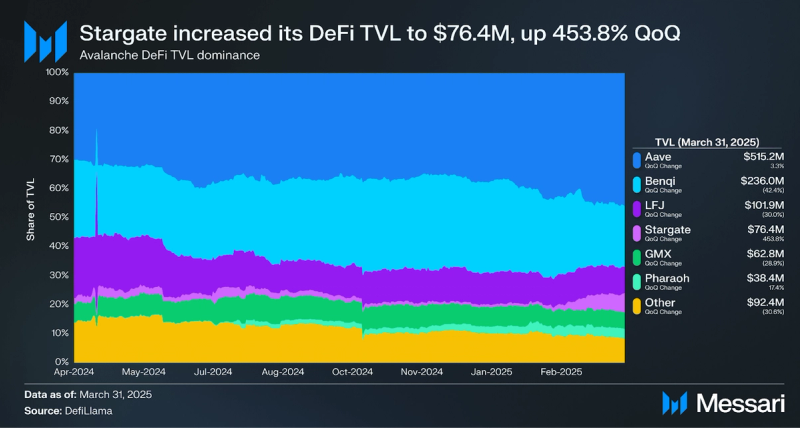

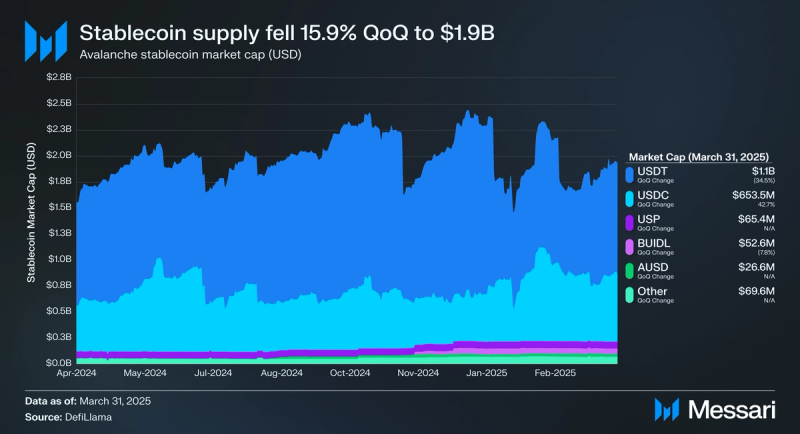

- Avalanche’s DeFi ecosystem grew 61.9% QoQ in TVL (AVAX). Aave expanded its dominance, while LFJ retained DEX leadership despite volume compression. Stablecoin flows adjusted with USDC taking market share from USDT.

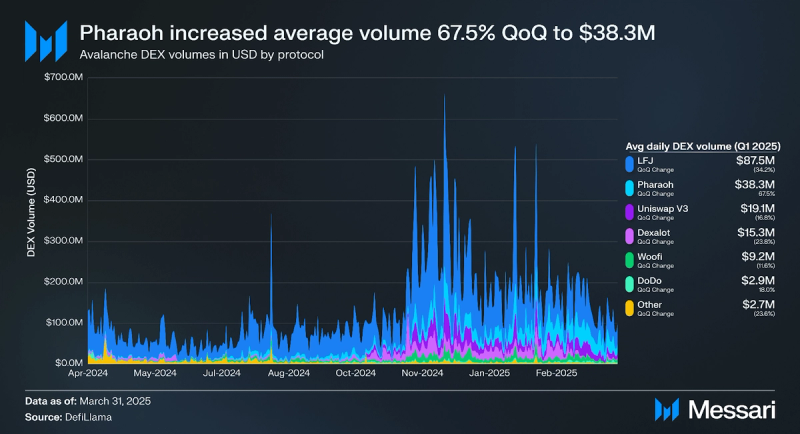

- Pharaoh increased average daily volume (USD) 67.5% QoQ to $38.3 million. Overall, average daily DEX volume on Avalanche C-Chain fell 17.8% QoQ to $175.1 million.

- Notable enterprise integrations included Wyoming’s selection of Avalanche for the WYST stablecoin, Robert Rodriguez's tokenized film project with Republic, and land record digitization in India’s Dantewada district.

- Avalanche-based games and platforms like Pulsar, Beam Nodes, and Warpchain drove network engagement. Gunzilla’s acquisition of Game Informer and Haunted Space’s cross-platform release reinforced Avalanche’s expanding gaming footprint.

Avalanche (AVAX) is a Proof-of-Stake (PoS) smart contract platform for decentralized applications. Avalanche differentiates itself by creating and implementing a consensus family known as "Avalanche consensus."

Following years of research, the Avalanche mainnet was launched in September 2020 and featured the release of a multichain framework utilizing three chains: the P, X, and C chains. Each chain plays a critical and unique role within the Avalanche ecosystem, and when combined, they create the Primary Network. Avalanche consensus and the Primary Network are designed to support sovereign, interconnected blockchains known as Avalanche Layer-1s (L1s).

Avalanche L1s run the same Virtual Machines (VMs) with their own customizations. L1s enable different properties of reliability, efficiency, and data sovereignty. They allow the creation of custom networks for different use cases while isolating high-traffic applications from congested activity on the Primary Network. To stay up-to-date with all things Avalanche, visit the Avalanche Portal.

Key Metrics Financial Analysis

Financial Analysis Market Cap & Transaction Fees

Market Cap & Transaction Fees

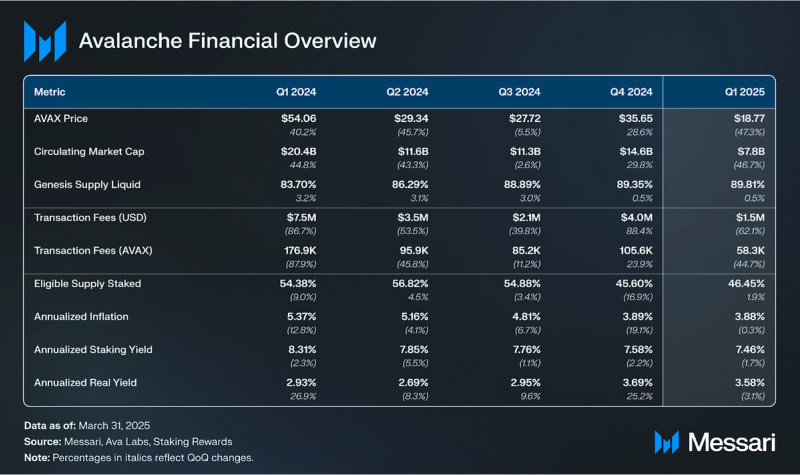

AVAX’s circulating market cap fell 46.7% QoQ to $7.8 billion. This decreased its circulating market cap rank amongst all tokens from 11th to 15th. Transaction fees (AVAX) decreased 44.7% QoQ from 105,600 to 58,300. Transaction Fees (USD) decreased by 62.1% QoQ from $4.0 million to $1.5 million, driven by token price depreciation and the Avalanche9000 upgrade, which decreased the C-Chain minimum base fee by 96%.

Supply DynamicsAVAX has a fixed supply of 720 million. At the genesis block, 360 million AVAX was minted. This genesis supply was distributed to various allocations over differing vesting periods. Over Q1 2025, the liquid genesis supply increased from 89.4% to 89.8%. The genesis supply is projected to be fully vested by December 2030 when the Foundation’s allocation fully vests. A full breakdown of AVAX vesting schedules can be found on Messari’s Token Unlock page in the new Avalanche Messari Portal.

All transaction fees on Avalanche are burned, and validators and stakers are rewarded with the remaining 360 million AVAX, which are distributed as inflationary staking rewards. Inflation is according to a dynamic schedule depending on the amounts staked and time staked. As more users stake AVAX for more extended periods, more AVAX is issued as inflationary staking rewards. The annualized inflation rate in Q1’25 stayed flat at 3.9%, while the eligible supply staked grew from 45.6% to 46.5%.

Network Analysis

In Q1 2025, when aggregating transactions across the C-Chain and all Avalanche L1s, average daily transactions grew 23.6% QoQ to 3.8 million, up from 3 million in Q1’24. Led by the Pulsar, which accounted for 47.1% of all transactions, finishing the quarter with 1.8 million average daily transactions. Over the same period, average daily active addresses (DAAs) increased by 81.4% QoQ to 167,400, up from 92,300 in Q1’24.

Avalanche C-Chain Usage

Usage

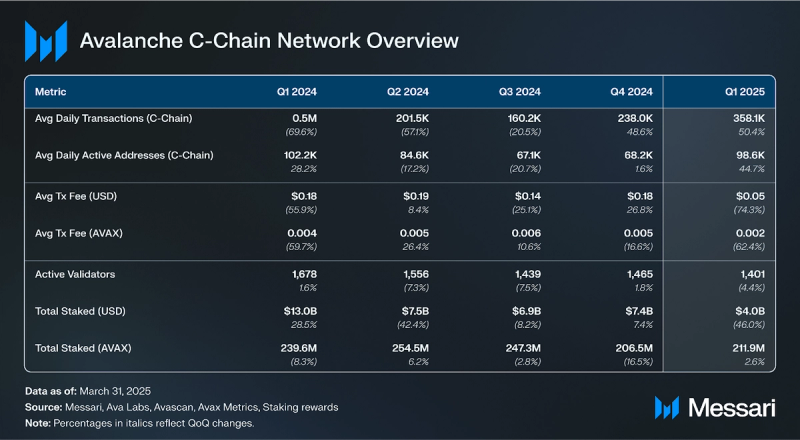

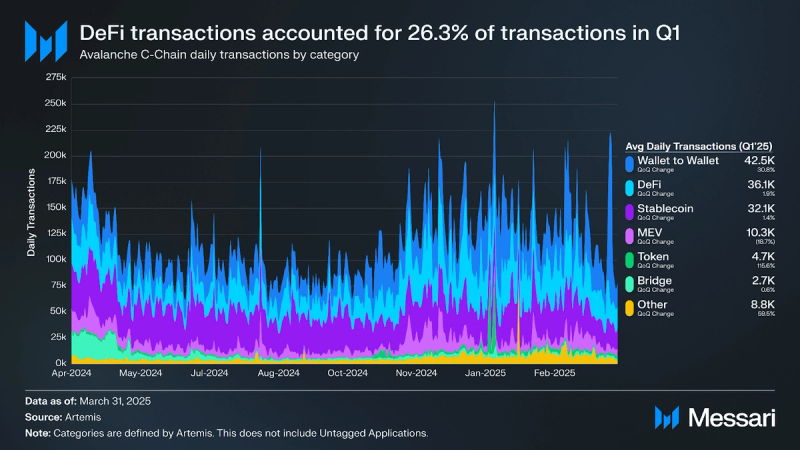

In Q1 2025, Avalanche C-Chain average daily transactions increased 50.4% QoQ from 238,000 to 358,100. Wallet-to-wallet and token-related transactions were the largest beneficiaries of the increase in C-Chain daily transactions.

Wallet-to-wallet was the largest category, with a 31% share and an increase of 30.1% QoQ, from 32,500 to 42,500. DeFi transactions were second, growing 1.9% QoQ from 35,500 to 36,100. Closely behind were stablecoin transactions, increasing 1.4% QoQ from 31,600 to 32,100.

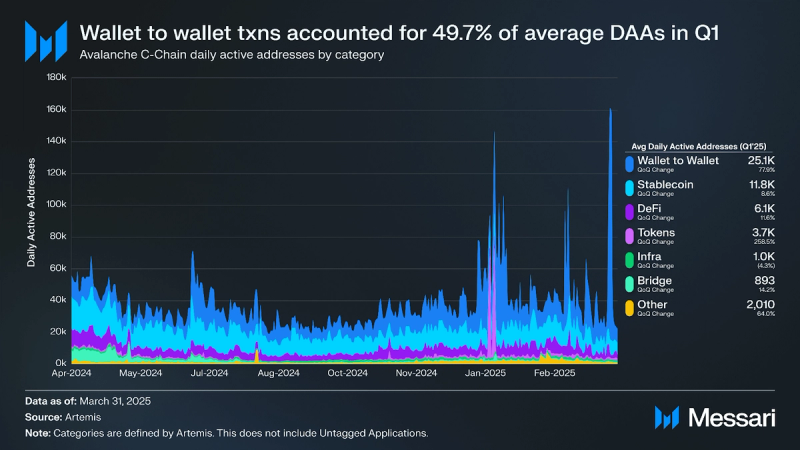

Similar to transactions, daily active addresses (DAAs) interacting with protocols increased in Q1 2025. Token-related transactions were the largest gainer in DAAs, growing 258.5% from 1,000 to 3,700. Wallet-to-wallet was the largest category by DAAs, with a 49.7% share and an increase of 77.9% QoQ from 14,100 to 25,100. DAAs in stablecoin transactions were second, increasing 8.6% QoQ from 10,900 to 11,800.

Security and DecentralizationAvalanche uses a Proof-of-Stake (PoS) consensus mechanism known as “Avalanche Consensus.” Avalanche’s P-Chain is responsible for validator coordination and staking operations. Both C-Chain and X-Chain utilize the entire P-Chain validator set for consensus. To determine if a transaction is valid, validators on Avalanche use repeated sub-sampling voting of a minor, random subset of all validators. Consensus occurs once a sufficient majority of validators agree over consecutive rounds. Both the necessary majority and consecutive rounds are configurable. Additionally, the more tokens staked/delegated to a validator, the more influential that validator is in the consensus process.

Technical DevelopmentsAvalanche9000

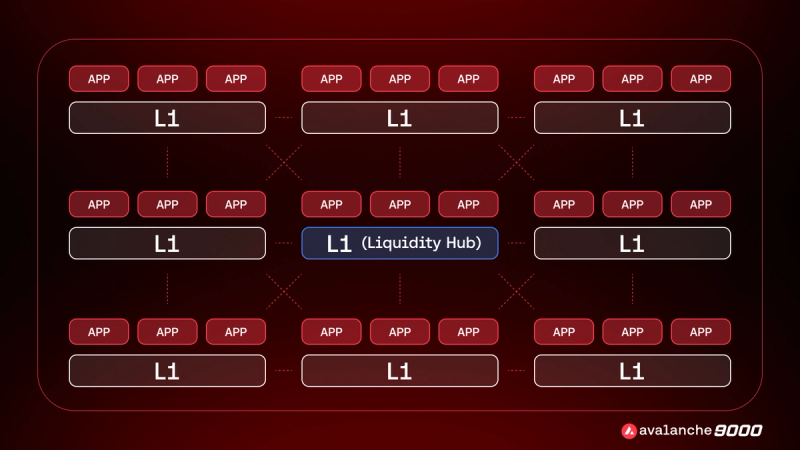

Technical DevelopmentsAvalanche9000The Avalanche team introduced the Avalanche9000 upgrade in September 2024, before going live on mainnet on Dec. 16, 2024. Avalanche9000 made launching an Avalanche L1 easier and has been labeled as “the largest network upgrade since mainnet launch”. The majority of the upgrade is the implementation of ACP-77. This ACP replaces ACP-13 and reworks how validation for Avalanche L1s works. This proposal removed the P-Chain validator requirement, thereby separating L1 validators from P-Chain validators. Instead, L1s will pay a dynamic fee to P-Chain validators. This upgrade will combine the C-chain, the network of Avalanche L1s, and Avalanche Interchain Messaging (ICM).

The Primary Network is now the economic hub that powers Avalanche9000. Liquidity flows easily between other Avalanche L1s, allowing new L1s to immediately access the economics of the Primary Network at launch. The graphic above showcases how every L1 is connected through Avalanche ICM. his architecture unlocked (1) complete control to customize L1 staking economics, gas tokens, and more, (2) open and permissionless validator sets to increase decentralization, (3) regulatory compliance built-in with geo-restrictions and custom permissions, and (4) scaling with any virtual machine to maximize performance.

Avalanche9000 included the Etna Upgrade. Aside from the previously mentioned ACP-77, Etna also introduced the following ACPs:

- ACP-125: Reduce C-Chain Minimum Base Fee: Reduced the minimum base fee from 25n AVAX to 1n AVAX. Since implementing dynamic fees, the base fee for a transaction has been pinned to the minimum, suggesting the minimum base fee is higher than the market demands.

- ACP-103: Add Dynamic Fees to the X-Chain and P-Chain: Added dynamic fees to the P and X-Chains in preparation for multidimensional dynamic fees.

- ACP-113: Provable Virtual Machine Randomness: Proposed a mechanism to generate verifiable, non-cryptographic random number seeds. This will allow developers to build more versatile applications since the current state of development is limited by the platform’s deterministic block execution limits.

- ACP-20: Ed25519 p2p: Implemented Ed25519 public keys and signatures into the network and ProposerVM.

- ACP-131: Activate Cancun EIPs on C-Chain and L1-EVM chains: Implemented five EIPs included in Ethereum’s Cancun upgrade.

- ACP-118: Standardize P2P Warp Signature Request Interface: Changed how AppRequest payloads are sent so they are received in a VM-agnostic manner.

The Etna upgrade will also include nomenclature changes, developer incentives and tooling, multichain solutions powered by Core, and partner launches.

Other Technical DevelopmentsIn Q1’25, one ACP was activated on testnet, and was activated on mainnet in April 2025:

- ACP-176: Dynamic EVM Gas Limits and Price Discovery Updates: Named as the Octane Upgrade, this ACP improves the handling of blocks that consume large amounts of gas by using the same mechanism that ACP-103 used to determine the base fee of a block.

There were 32 indexed Avalanche L1s that produced a block in Q1 2025:

- Apertum (Q1 Launch)

- Beam

- Blitz

- Coqnet (Q1 Launch)

- Dexalot

- DFK

- DOS

- Feature

- Growth (Q1 Launch)

- GUNZ (Q1 Launch)

- Henesys (Q1 Launch)

- HighOctane

- Innovo

- Intersect (Q1 Launch)

- Lamina1

- MELD

- NUMBERS

- ONIGIRI

- PLAYA3ULL Games

- PlayDapp

- PLYR PHI

- Pulsar

- QChain

- Shrapnel

- StraitsX

- Step Network

- Space (Q1 Launch)

- Tiltyard

- TradeX (Q1 Launch)

- UPTN

- XANA

- Zeroone

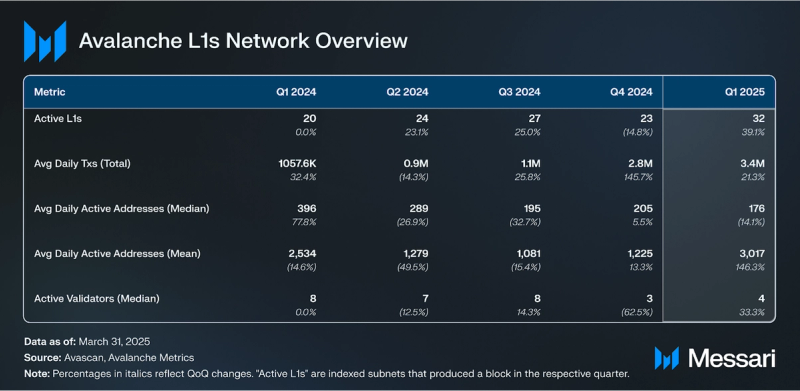

Transactional activity was up in Q1 2025 for most Avalanche L1s. Daily average transactions across all L1s was 3.4 million, up 21.3% QoQ from 2.8 million. The largest gainer by far was QChain, up 1,720% QoQ to 24,400 average daily transactions. QChain is the L1 for Quboid, a chain designed for real-time, compliant loyalty settlements. However, Pulsar remained the leader, up 24% QoQ to 1.8 million average daily transactions for Q1. Pulsar is a new massive multiplayer online real-time strategy (MMORTS) game that launched at the end of Q3’24. Lamina1 was also a notable gainer, up 139.5% QoQ to 88,000.

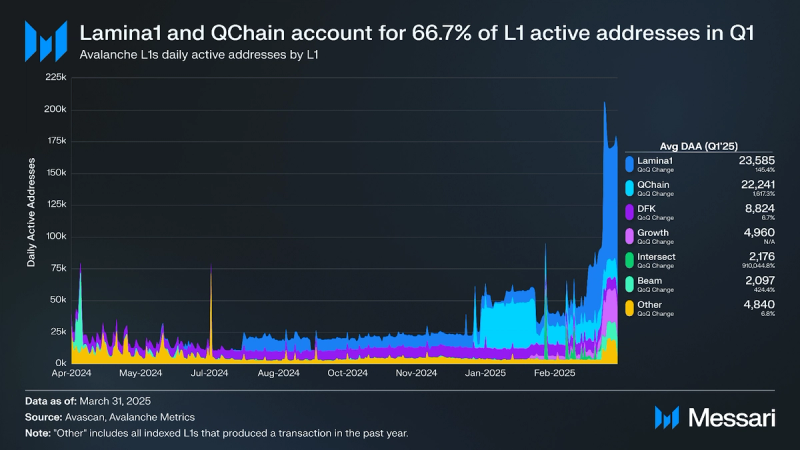

Daily active addresses (DAAs) on each individual Avalanche L1s were up in Q1 2025, with average DAAs increasing 146.3% QoQ from 1,225 to 3,017. The largest L1 by active addresses was Lamina1, a digital content creation chain. Lamina1 and QChain accounted for 66.7% of all active addresses in Q1.

Ecosystem Analysis DeFi

DeFi

Avalanche C-Chain DeFi TVL (USD) decreased from $1.3 billion to $1.1 billion in Q1 2025, a 14.7% QoQ increase. By the end of the quarter, Avalanche ranked as the 10th highest chain by TVL (USD). TVL (AVAX) increased 61.9% QoQ from 36.9 million to 59.8 million.

The top three protocols by TVL on Avalanche C-Chain continued to represent the bulk of TVL in Q1’25:

- Aave: The largest protocol by TVL, saw its TVL increase 3.3% QoQ from $498.8 million to $515.2 million. However, Aave’s TVL dominance decreased from 37.7% to 45.9%.

- Benqi: The second largest protocol by TVL, decreased 25% QoQ from $409.9 million to $236 million. By the end of Q1’25, Benqi’s TVL dominance was 21%, down from 31%.

- LFJ: The third largest protocol by TVL, fell 30% QoQ from $145.5 million to $101.9 million to. By the end of Q1’25, LFJ’s TVL dominance was 9.1%.

Average daily DEX volume (USD) on Avalanche C-Chain decreased in Q1’25, falling 17.8% QoQ from $212.8 million to $175.1 million. There were 43 DEXs on Avalanche by the end of the quarter, a net addition of four. Despite increasing competition, the leading DEX, LFJ, remained dominant. LFJ’s Average daily DEX volume (USD) decreased 34.2% QoQ from $133 million to $87.5 million. In Q1’25, the top five DEXs by average daily trading volume (USD) were:

- LFJ: $87.5 million (50% of volumes)

- Pharaoh Exchange: $38.3 million (21.9% of volumes)

- Uniswap V3: $19.1 million (10.9% of volumes)

- Dexalot: $15.3 million (8.8% of volumes)

- Woofi: $9.2 million (5.3% of volumes)

Avalanche C-Chain’s stablecoin market cap was $1.9 billion by the end of Q1’25, down 15.9% QoQ from $2.3 billion. Compared to other networks, Avalanche had the 9th largest stablecoin market cap. Fiat-backed stablecoins like USDT and USDT represented 88.9% of the stablecoin supply on Avalanche. USDT decreased 34.5% QoQ to $1.1 billion (55.1% of stablecoins on Avalanche), while USDC increased 42.7% QoQ to $653.5 million (33.8% of stablecoins on Avalanche).

Enterprise and RWAsIn Q1 2025, Avalanche announced the following updates related to Evergreen, which allows anyone to create an L1 with customizable KYC/AML requirements and unique privacy capabilities, and other enterprise and real-world asset (RWA) adoption initiatives:

- In March 2025, Robert Rodriguez launched Brass Knuckle Films in partnership with Republic, utilizing Avalanche to tokenize film financing, allowing fans to invest and participate in the filmmaking process.

- In March 2025, the Wyoming Stable Token Commission selected Avalanche as one of six blockchains for deploying WYST, the first fiat-backed stable token issued by a U.S. state.

- In March 2025, the Dantewada District in India digitized over 700,000 land records on Avalanche using Zupple’s LegitDoc, enhancing transparency and accessibility.

- In February 2025, Inversion announced the launch of an Avalanche Layer-1 to facilitate a crypto-native private equity strategy, aiming to acquire and operate established businesses on-chain.

- In February 2025, Littio, in collaboration with OpenTrade, introduced EURO IBAN accounts powered by Circle’s EURC and Avalanche, expanding banking options for users in Latin America and Europe.

- In January 2025, Mastercard and Ava Labs co-authored a whitepaper on asset tokenization, highlighting Avalanche's role in enhancing efficiency and compliance in financial markets.

- In January 2025, BlackRock launched the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on Avalanche via Securitize, with Avalanche C-Chain becoming the second-highest TVL network for the fund.

Q1 2025 was a busy quarter for gaming on Avalanche, with the following notable events:

- In March 2025, Gunzilla Games acquired Game Informer, rehiring its staff and planning to revive the print publication, aiming to maintain journalistic independence.

- In March 2025, Beam Nodes went live, enabling users to claim Node Tokens and participate in securing the Beam network through staking and delegation.

- In February 2025, Warpchain (WARP), a new Avalanche Layer-1, launched to provide infrastructure and tools for sustainable Web3 gaming economies.

- In February 2025, Haunted Space, an open-world space exploration game, announced its upcoming release on PlayStation, Xbox, and PC, integrating AI-driven features powered by Avalanche C-Chain.

- In February 2025, Lightning Forge Gaming received an infraBUIDL(AI) grant from Avalanche to develop AI-powered gaming innovations, including trainable AI agents and automated tournaments.

- In January 2025, Avalanche co-sponsored the Parallel Prime Championship, supporting Web3 gaming events and tournaments.

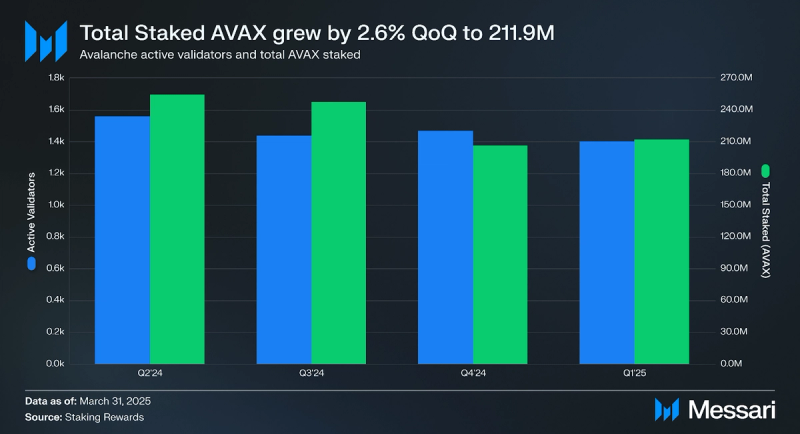

In Q1 2025, Avalanche saw a 23.6% QoQ increase in average daily transactions across Avalanche L1s, reaching 3.8 million. This growth was driven by Pulsar (1.8M daily txs) and QChain (up 1,720% QoQ). Daily active addresses on Avalanche L1s grew 146.3% QoQ to over 3,000 daily, led by Lamina1 and QChain. DeFi TVL (AVAX)rose 61.9% QoQ to 59.8 million, while TVL (USD) decreased 14.7% to $1.1 billion. Aave’s TVL grew 3.3% QoQ to $515M, dominating 45.9% of Avalanche C-Chain’s DeFi TVL. Stablecoin market cap on Avalanche C-Chain fell 15.9% to $1.9 billion, though USDC rose 42.7% QoQ. While the number of active validators fell 4.4% QoQ to 1,401, total stake (AVAX) increased 2.6% to 211.9 million.

Avalanche’s enterprise and gaming ecosystems continued to see growth. Eight new Avalanche L1s launched in Q1 2025, including projects like Growth, GUNZ, and TradeX. In enterprise adoption, Avalanche was selected by the Wyoming Stable Token Commission to issue WYST, became the backbone for over 700,000 digitized land records in India’s Dantewada district, and enabled tokenized film financing via Brass Knuckle Films and Republic. On the gaming side, Avalanche saw infrastructure growth with the launch of Beam Nodes and Warpchain, while game titles like Pulsar and Haunted Space drove user engagement.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.