and the distribution of digital products.

State of Akash Q4 2024

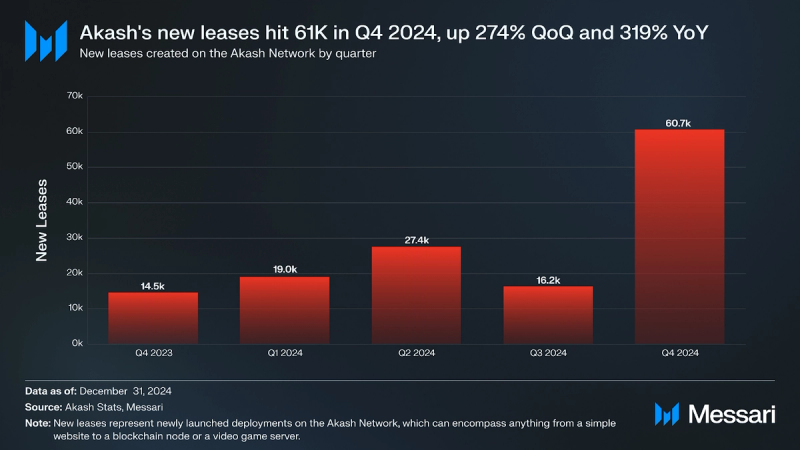

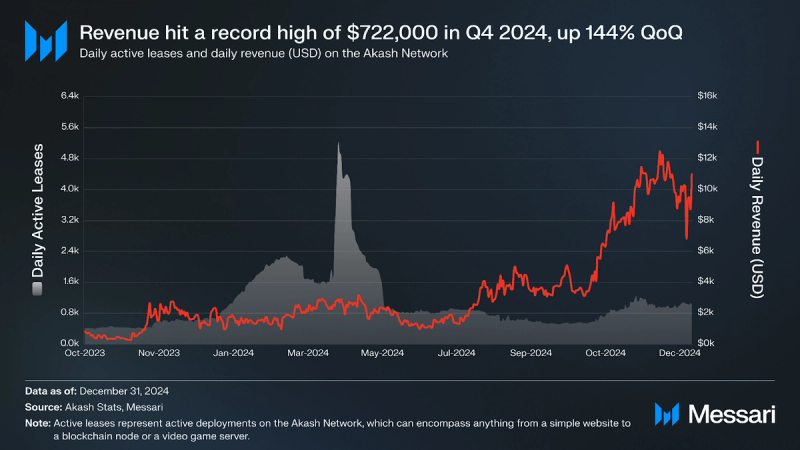

- Akash recorded $742,000 in lease revenue, marking a 144% QoQ and 565% YoY increase. New leases grew 274% QoQ to 61,000, driven by demand for AI and compute-intensive tasks.

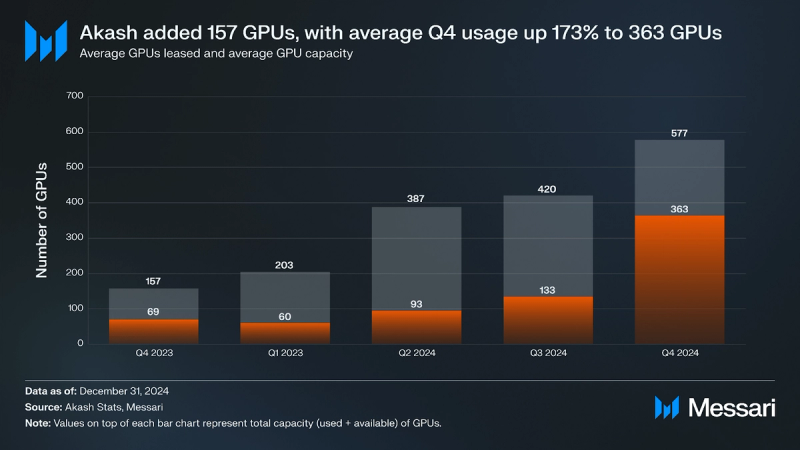

- GPU capacity grew 37% QoQ to 577 units, with usage increasing 42% QoQ to 363 units, reflecting heightened adoption of high-performance workloads like AI and machine learning.

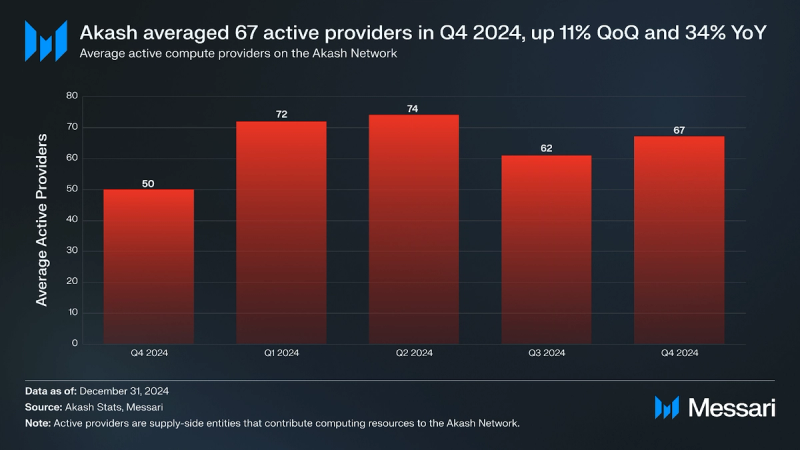

- Active providers increased by 11% QoQ to 67, supported by the $10 million Provider Incentives Pilot 2 program, which targeted GPU expansion for enterprise applications.

- The beta release of Akash Console 2.0 introduced fiat payment options and free trials, enhancing user accessibility. Strategic partnerships with Sentinel Scout, Passage, and Witness Chain enabled new use cases, including AI workflows and decentralized data validation.

Akash (AKT) is a decentralized cloud computing marketplace that facilitates the buying and selling of compute resources. It is an open-source, permissionless protocol that provides an alternative to today’s centralized cloud services (i.e., AWS, Azure, and Google Cloud). Akash aims to leverage the global amount of underutilized server capacity, which can range from 5% to over 30%. The Akash marketplace functions via a reverse auction, giving users the ability to name a price and describe the resources they want for deployments. Akash’s decentralized network of compute providers runs its open-source software and competes to provide resources, often at a fraction of the cost of big cloud providers. Specifically, Akash hosts containers where users can run any cloud-native application (e.g., AI workloads, gaming servers, blockchain nodes, and websites). Akash offers extensive cloud management services like Kubernetes, which can be used for hosting and managing containers. Additionally, Akash supports decentralized AI applications such as Venice.ai, AkashChat, and AkashGen, reflecting its role in enabling AI infrastructure.

Akash is a Tendermint-based blockchain built using the Cosmos SDK. Marketplace activity (requests, bids, lease details, etc.) is stored onchain and payments are settled with Akash’s native token (AKT). For a full primer on Akash, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Key Metrics Usage and Provider AnalysisLeases and Revenue

Usage and Provider AnalysisLeases and RevenueAkash’s marketplace uses a reverse auction, in which users propose a bid that describes the resources they’d like to use for a deployment. When accepted, a lease is opened onchain managing the activity of this relationship.

New leases on Akash Network represent agreements between users and providers for renting computational resources. In Q4 2024, Akash recorded a 274% QoQ increase in new leases, rising from 16,000 in Q3 to 61,000 in Q4, and a 317% YoY growth compared to 15,000 in Q4 2023. This growth reflects the impact of key developments in Q3 and Q4 2024.

A key driver was NVIDIA’s acquisition of Brev.dev in Q3, which enhanced Akash’s GPU ecosystem and attracted enterprise users focused on AI and high-performance computing. In Q4, Akash’s expansion to three countries in Latin America supported regional adoption. The beta release of Akash Console 2.0 introduced fiat payments and free trials, reducing barriers for non-crypto-native users. Additionally, reduced take rates for uAKT (1%) and axlUSDC (2%) made leasing more affordable, while the launch of permissionless AI access to advanced models broadened Akash’s appeal to developers and researchers, further driving adoption.

Active leases on Akash represent ongoing agreements where users utilize and manage computational resources on the network. Leases remain active as long as they are in use and cease once closed. In Q4 2024, Akash Network’s average daily active leases increased 26% QoQ and 74% YoY, rising from 693 in Q3 to 875 in Q4. This growth was driven by strategic integrations, enhanced accessibility, and broader adoption across diverse workloads. Key partnerships, such as those with Sentinel Scout and Passage, introduced scalable and recurring use cases, including AI workflows and immersive virtual events, which contributed to sustained lease activity.

Revenue increased more significantly than active leases, with Q4 lease revenue growing 144% QoQ and 565% YoY to $742,000. The disproportionate revenue growth was attributed to higher-value workloads, such as AI and machine learning, facilitated by the availability of advanced GPUs like NVIDIA H100 and A100. These workloads generated higher revenue per lease compared to standard compute tasks. Deployment cost adjustments and new payment options, including credit card support and free trials, further broadened user adoption and encouraged larger deployments.

On December 7, 2024, Akash achieved its highest daily revenue of $12,500, driven by 1,058 active leases and 956 new leases created on that day alone.

All Resource Compute

In Q4 2024, Akash Network demonstrated notable growth across its core resource metrics, reflecting increased adoption of its decentralized compute platform. GPU usage grew 42% QoQ to 363 units, a 428% YoY increase, while capacity expanded 37% QoQ to 577 units, marking a 269% YoY rise. Initiatives like the Incentives Pilot 2 program and partnerships with NVIDIA (via Brev.dev) and Venice.ai played a key role in expanding capacity and attracting enterprise users with resource-intensive applications. The sustained increase in GPU usage reflects both new user adoption and ongoing utilization by existing users.

CPU usage declined 18% QoQ to 4,500 units, though it increased 123% YoY. Capacity grew 27% QoQ to 21,000k units, a 274% YoY increase, ensuring the platform remained prepared for diverse computational needs despite shifting user preferences toward GPU-driven workloads.

Storage capacity increased 28% QoQ to 869 TB, a 253% YoY rise, while usage fell 4% QoQ to 37 TB but remained 62% higher YoY. This suggests users prioritized compute-intensive tasks over storage-heavy applications. RAM usage grew 27% QoQ to 14 TB, a 214% YoY increase, with capacity expanding 38% QoQ to 117 TB, a 287% YoY rise, reflecting the growing complexity and memory demands of deployed workloads.

Overall, the data highlights a shift in resource usage patterns, with GPUs and RAM seeing the strongest growth. These trends reflect Akash’s ability to adapt to evolving user demands while continuing to expand its infrastructure for high-performance computing.

GPU Compute

In Q4 2024, Akash’s GPU capacity reached 577 units, marking a 269% YoY increase and a 37% QoQ growth from 420 units in Q3. GPU usage grew even more sharply, increasing 428% YoY to 363 units, with a 42% QoQ rise from 255 units in Q3. These metrics highlight Akash’s continued efforts to scale GPU availability and meet the growing demand for decentralized compute power, particularly for AI and machine learning workloads.

The growth in GPU capacity was driven by the Provider Incentives Pilot 2 program, initiated earlier in 2024 with a $5 million allocation approved by the Akash community to incentivize GPU providers. This program played a key role in expanding GPU capacity from 470 units in Q3 to 577 units in Q4, enabling Akash to support increasingly resource-intensive AI deployments.

Active Providers

Akash’s permissionless network allows resource providers to join from anywhere in the world, creating a geographically diverse and resilient infrastructure. This global distribution enhances the network’s ability to withstand regional disruptions, such as natural disasters, power outages, or political instability. It also improves performance by enabling tasks to be processed closer to end users, reducing latency and optimizing data transfer efficiency.

In Q4 2024, the number of active providers on Akash’s network grew from 62 in Q3 to 67, reflecting an 11% QoQ increase and a 34% YoY growth. This steady expansion highlights the increasing appeal of Akash’s decentralized compute marketplace, driven by growing demand for resources, enhanced provider incentives, and the platform’s expanding infrastructure.

A significant factor in this growth was the rise in revenue opportunities for providers. Akash achieved a record-breaking lease revenue of $742,000 in Q4, a 144% QoQ increase, signaling strong demand for computational resources. With a 274% QoQ increase in new leases and rising utilization of high-performance resources like GPUs (up 42% QoQ), providers recognized Akash as a thriving ecosystem offering substantial returns.

The Provider Incentives Pilot 2 program further fueled network growth by incentivizing the onboarding of advanced GPUs, such as NVIDIA’s H100 and A100. This initiative enabled providers to meet increasing demand for compute-intensive workloads while making participation in the network more lucrative. By expanding the supply of high-performance resources, the program contributed to both the growth of active providers and the overall scalability of Akash’s network.

Token AnalysisMarket Cap

AKT's market capitalization rose 1% QoQ from $685M in Q3 2024 to $692M in Q4 2024 and grew 26% YoY from $549M in Q4 2023. The price of AKT increased 1% QoQ from $2.77 to $2.80 and 14% YoY from $2.46 to $2.80.

The 26% YoY market cap growth, outpacing the 14% price increase, reflects a 2.5% rise in circulating supply, from 242M tokens in Q3 to 248M in Q4. This expansion is likely tied to staking rewards, token vesting, or emissions. Despite the higher supply, the consistent 1% QoQ increase in both market cap and price suggests that demand for AKT grew proportionally, maintaining price stability and demonstrating strong market fundamentals.

Staking

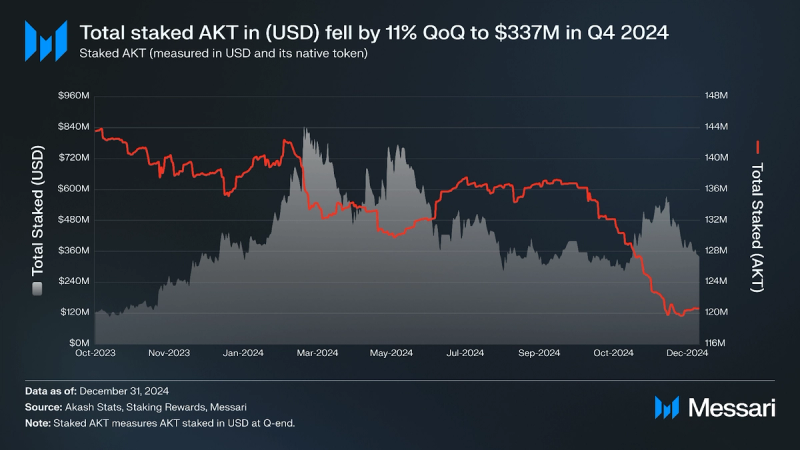

The value of staked AKT in USD decreased 10.6% QoQ, from $377M in Q3 2024 to $337M in Q4 2024. The total staked AKT also declined 11.0% QoQ, from 136M to 121M tokens, while the staking ratio dropped from 55% to 47% of the circulating supply, a 12% reduction. The AKT price remained stable at approximately $2.80 during this period, indicating that the decline in staked value was driven by reduced staking participation rather than price changes.

The 11% reduction in staked AKT did not significantly impact staking yields, as a 2% increase in the network’s inflation rate maintained relatively stable rewards QoQ. The decline in staking participation may reflect changes in network incentives, adjustments to tokenomics, or strategic reallocation of assets by validators and delegators. These shifts suggest evolving sentiment among network participants, influenced by factors such as operational costs, yield dynamics, or broader market conditions.

Qualitative AnalysisPartnerships and DevelopmentsIntegration with Witness Chain: Akash partnered with Witness Chain to improve the scalability and efficiency of decentralized validation for real-world attributes such as location, connectivity, and compute. Witness Chain employs an observation layer powered by protocols like Proof of Location (PoL), which uses cryptographic techniques to authenticate physical attributes with high accuracy. The integration with Akash enables Witness Chain to deploy its Watchtower nodes—key components in its validation process—on a distributed and cost-effective infrastructure. Akash’s dynamic scaling enables real-time adjustment of deployments based on demand, optimizing resource usage and performance. Additionally, Akash’s competitive pricing reduces operational costs, making large-scale deployment financially feasible. This collaboration enhances Witness Chain’s data validation process while allowing Akash to explore applications like Proof of Location (PoL) for verifying its network’s geographic distribution.

Expansion in Latin America: Akash added three new compute providers in Latin America, including two in Buenos Aires and one in Bogotá. This expansion strengthens Akash’s global network and caters to the increasing demand for decentralized cloud services.

Integration with Sentinel Scout: Akash Supercloud has partnered with Sentinel Scout, the first user-facing AI Data Layer platform in the Web3 ecosystem, to enhance decentralized AI applications. Sentinel Scout allows developers to access a network of decentralized data miners for tasks such as data retrieval, validation, and storage. By integrating Akash’s decentralized compute capabilities and Chat API, Sentinel Scout enhances its Intelligent URL Recommendation Engine, enabling efficient identification and retrieval of relevant data sources.

The integration is pivotal for AI developers who rely on Sentinel Scout to streamline workflows in decentralized environments. Akash’s infrastructure also supports data cleaning and embedding processes, ensuring scalability and efficiency in managing data.

Integration with Passage: Passage, a platform for hosting immersive virtual events, has integrated Akash Supercloud to reduce GPU compute costs while maintaining performance. The platform, which enables users to access virtual experiences via browser without downloads or hardware requirements, has historically relied on traditional cloud providers. By leveraging Akash’s decentralized GPU marketplace, Passage achieved average cost reductions of 50%, with savings reaching up to 70% in certain scenarios. During Cosmoverse, Passage demonstrated the practical implications of this integration by driving Akash’s GPU utilization to 85%.

INTELLECT-1 AI Initiative: Prime Intellect, in partnership with Akash, HuggingFace, SemiAnalysis, and others, successfully trained INTELLECT-1, a 10-billion-parameter model, using decentralized compute resources. This effort represents the first decentralized training of a model at this scale.

AkashGen Launch: Akash has introduced AkashGen, an open-source image-generation tool powered by NVIDIA GPUs on the Akash Supercloud. Currently, it runs Stable Diffusion 3.5 Large, a leading generative image model by StabilityAI, with plans to add more models in the future.

Akash Console Beta: The Akash Console upgraded to support credit card payments, simplifying access to compute resources on the Akash Supercloud. Previously limited to AKT or USDC transactions via non-custodial wallets, the addition of fiat payments through Stripe addresses the needs of users unfamiliar with cryptocurrency. Part of the beta release, this update also includes free trials to enhance accessibility.

While USDC remains a key payment method, accounting for 38% of transactions, the introduction of credit card payments offers greater flexibility for developers and enterprises preferring traditional payment options. Users can now fund accounts, manage deployments, and track spending directly within the console.

Notable highlights

- Sponsorship of NVIDIA GTC 2025: Akash sponsored NVIDIA’s GPU Technology Conference, further establishing its presence in the AI and machine learning sectors.

- Recognition for Leadership: Akash CEO Greg Osuri was featured on CoinDesk's "Most Influential 2024" list for his contributions to decentralized computing.

- 2025 Roadmap Release: Akash unveiled its 2025 roadmap on January 14, 2025.

Core development on Akash is approved through token-weighted governance and goes through a structured proposal process. The community can also simply create tools that anyone can use to access Akash. Below are highlights from the Q4 2024 governance initiatives:

Community Support Funding: The Q4 2024 Community Support Proposal allocated 21,902.45 AKT (approximately $72,000) to continue supporting critical community programs. This funding was directed towards the Insiders & Vanguards Program, which incentivizes volunteers to contribute actively to the ecosystem, and structured bounties, now increased to $10,000 per month (up from $5,000). The enhanced bounties aim to encourage greater participation and contributions across Akash’s projects, which are tracked transparently on a public board. This allocation is part of the annual community support budget of $228,000, designed to sustain long-term engagement and drive ecosystem growth.

Events Resourcing Proposal: The Q4 2024 Events Resourcing Proposal allocated 309,547.68 AKT (approximately $690,291.33) to fund Akash’s participation in prominent industry events, including Cosmoverse, NeurIPS, Ray Summit, and DevCon 7. The budget breakdown includes $161,417.09 for Tier 1 sponsorships, $48,261.53 for Tier 2 engagements, and an adjustment of -$109,517 to address shortfalls from previous quarters caused by AKT price volatility and unforeseen costs. These events aim to enhance Akash’s visibility in the AI, blockchain, and cloud computing industries, facilitating networking opportunities, brand building, and strategic collaborations.

MetaMask Integration Final Payment: This proposal finalized the payment of $30,000 worth of AKT tokens for the integration of MetaMask with Akash Network, completing all milestones outlined in the original proposal. Deliverables included the addition of multi-signature wallet support, in-wallet notifications, and the deployment of an alternative wallet UI hosted on Akash servers. This integration enables seamless access for MetaMask’s 30 million active users to Akash’s decentralized cloud computing services, while also bridging Cosmos and Ethereum ecosystems. The initiative aims to increase accessibility, drive adoption, and expand Akash’s marketplace reach to Ethereum-based users.

Provider Incentives Pilot 2: The continuation of the Provider Incentives Program allocated $10 million USD (equivalent to approximately 5,966,667 AKT) to expand Akash’s GPU resources. The program builds on the success of the first pilot by engaging professional and community providers to supply high-quality GPU models, such as H100 and A100-80, to meet rising demand. Up to 10% of the budget is reserved for community providers that meet stringent requirements for reliability, quality, and compliance. A volatility buffer of 43.20% was incorporated to address fluctuations in AKT prices, ensuring the program’s stability. Transparent fund management and reporting are core aspects of this initiative, which aims to strengthen Akash’s capacity for AI and compute-intensive applications.

Developer Onboarding Initiative (Zealy Phase 3): The Developer Onboarding Program allocated 6,500 AKT ($19,500) over three months to support the next phase of its incentive-driven campaign through Zealy. The program introduces a streamlined "user journey," guiding participants from onboarding to active contribution through missions like deploying on Akash, contributing to GitHub, and participating in bounties. This phase reduces costs by 10% compared to earlier campaigns while maintaining effectiveness in developer engagement. Managed by experienced community members, the program builds on earlier successes that saw a 400% increase in participant engagement, aiming to grow the Akash ecosystem by attracting and retaining active contributors.

Akash Console 2.0 Payment Feature Development: This proposal allocated $313,126.55 (29% of the total project cost) to develop and implement new payment features for Akash Console 2.0, including Frictionless Free Trial and Fiat Payment options. These features aim to enhance the user experience by simplifying payment processes, reducing onboarding friction, and making Akash more accessible to new users. Overclock Labs continues to fund the majority of development costs, while the community contributes to accelerating these critical updates. The funds are managed transparently, ensuring accountability and minimizing potential market disruptions, with all milestones aligned to Akash’s broader ecosystem roadmap.

Closing SummaryIn Q4 2024, Akash Network recorded $742,000 in revenue (+144% QoQ), with new leases increasing by 274% QoQ to 61,000. This growth was driven by increased adoption of GPU-based AI workloads, supported by an expansion in average daily GPU capacity to 577 units (+37% QoQ). The active provider count rose by 11% QoQ to 67, reflecting greater engagement from resource suppliers.

Strategic updates included the beta release of Akash Console 2.0, enabling fiat payments and free trials to improve accessibility. Key partnerships with Sentinel Scout, Passage, and Witness Chain introduced new use cases such as AI workflows, virtual events, and data validation. The Provider Incentives Pilot 2 program allocated $10 million to scale GPU capacity, supporting high-performance workloads.

Governance activities focused on community funding, developer incentives, and event sponsorships. The network also finalized the MetaMask integration, improving access for Ethereum-based users.

Looking ahead, Akash aims to expand its decentralized compute capacity and infrastructure to meet increasing demand for AI and compute-intensive workloads.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.