and the distribution of digital products.

Ravencoin To Fork For ASIC Resistance

Another altcoin network is pivoting to a new algorithm to prevent mining centralization. . Ravencoin, a network for asset tokenization, is expected to implement a hard fork tomorrow over fears that nearly 50% of the network is controlled by ASIC miners.

How Ravencoin Flies From ASICsDesigned with the little guy in mind, Ravencoin was conceived from the start as a cryptocurrency that would keep mining power in the hands of as many people as possible.

RVN developers presented an elegant solution to the problem of ASIC domination. By rotating through a series of algorithms rather than relying on a single solution, ASIC developers would be foiled in their efforts to take over the network. Since ASICs require a great deal of time, research, and money to produce, it would theoretically be too costly to design a machine that could adjust to a constantly changing algorithm.

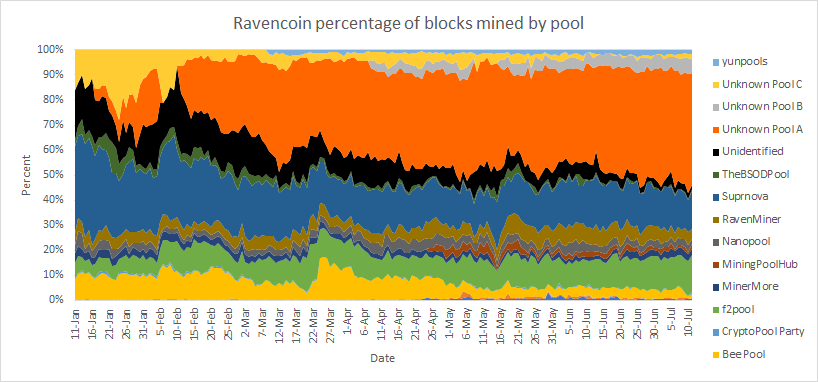

But it looks like ASICs have managed to make their way into the network anyway. An article posted this summer revealed dramatic evidence that ASICs were already mining on the Ravencoin network, using a new machine that adapts to the varying patterns of the X16R algorithm.

Earlier in the year, a single miner appeared to have gathered an enormous quantity of RVN and sold it in bulk quantities. This single user was mining as much as 45% of all Ravencoin blocks in July.

source: standarderror

source: standarderror

This vulnerability prompted the move to a new version of the X16R algorithm, which will keep the network in the hands of GPU and FGPA miners.

Fork ImprovementsVersion two of X16R, which will be implemented on October 1, is designed to put an end to mining centralization. As described on 2miners.com, the key feature of the fork is “banning ASICs from the network, so block mining and the network operation will be ensured by GPU owners.” This increases the number of miners and reduces the influence of any individual or pool.

The blog explains that this will be a “huge benefit for GPU owners,” who may see a return to profitability and even “make a quick buck” before the network balances out over time. Those interested in mining the new algorithm can check out the “Definitive Guide” provided on the blog.

Upgrading And YouRavencoin users should update their software to 2.5.1, which can be found at this link. RVN Miners can follow the steps provided for upgrading their mining software by following the steps provided here.

Binance, one of the most popular platforms for trading RVN, has announced support for the upgrade, handling all the technical requirements for asset holders on the exchange. The exchange will suspend deposits and withdrawals of RVN during the transition, resuming activity once the newly upgraded network is deemed stable.

Trading of RVN will not be affected by the fork, Binance states, since the network is not expected to split. The fork should merely act as an upgrade.

Or will it?

Time For Ravencoin Classic?A small contingent of Ravencoin enthusiasts seem to have planned a minor coup to maintain the original blockchain. If these miners continue mining the old algorithm, they could conceivably split the chain, with a “Ravencoin Classic” alongside the new ASIC-resistant network.

Such a split is unlikely, but cautious users may want to store away their Ravencoins off the exchanges and on a dedicated wallet. A relatively obscure Twitter account appears to be leading the minority contingent, but has since announced the cancellation of forking plans.

source: Twitter

source: Twitter

Binance advises users to follow the detailed advice provided in Tron Black’s posted article, “Ravencoin — Upgrade and Protect Yourselves before Oct 1!” Black recommends users store RVN on-chain in upgraded software, with the latest version available here.

He also suggests removing RVN from custodial accounts such as Binance, Bittrex, and other exchanges, “at least until this upgrade is complete and everyone is on the same page.” Importantly, Black warns to not transfer RVN during the forking period, at least until a few days after October 1. Lastly, he suggests not buying or selling RVN until after the network has stabilized and “everyone knows where everything stands.”

Market ResponseDespite the bearish market doldrums, the RVN fork has created some positive buzz, with prices rising against BTC and USD. Nearing 400 satoshis at a value around 3 cents USD, trading on RVN has been more active as the fork approaches. Daily volumes have also increased, at the time of writing.

source: CoinMarketCap

source: CoinMarketCap

Judging from recent Twitter activity and daily sentiment trends gathered from theTIE.io, traders are feeling positive about future market prospects for RVN.

theTIE.io

theTIE.io

Ravencoin is not the first project to deal with the ASIC dilemma. Monero regularly uses hard forks to keep a step ahead of hardware developers, as Crypto Briefing has previously reported. However, there is also a security trade-off in ASIC resistance: GPU-mined networks are also more susceptible to attacks from rented hashpower.

The post Ravencoin To Fork For ASIC Resistance appeared first on Crypto Briefing.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.