and the distribution of digital products.

Moonbeam Q2 2024 Brief

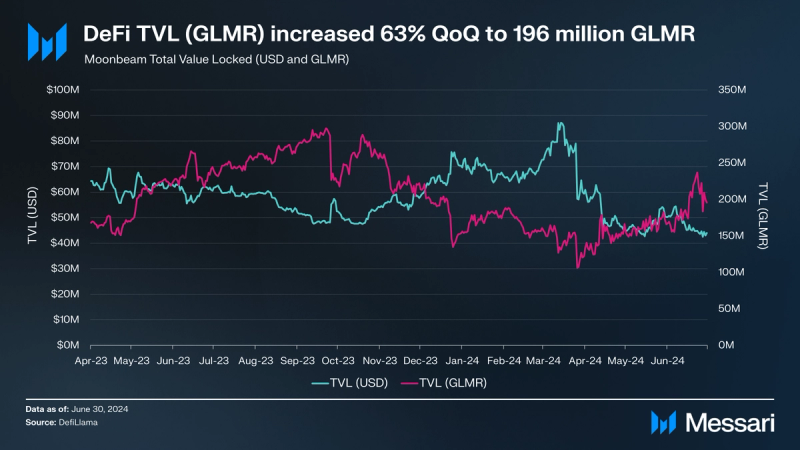

- Moonbeam ended the quarter with a DeFi TVL (GLMR) of 196 million (+63% QoQ). The increase indicates a positive net capital flow into the network.

- Moonbeam revealed its Moonrise initiative. The roadmap is already underway with developments such as reducing block times to six seconds, incorporating Ethereum's Dencun compatibility, and establishing an Ecosystem Fund.

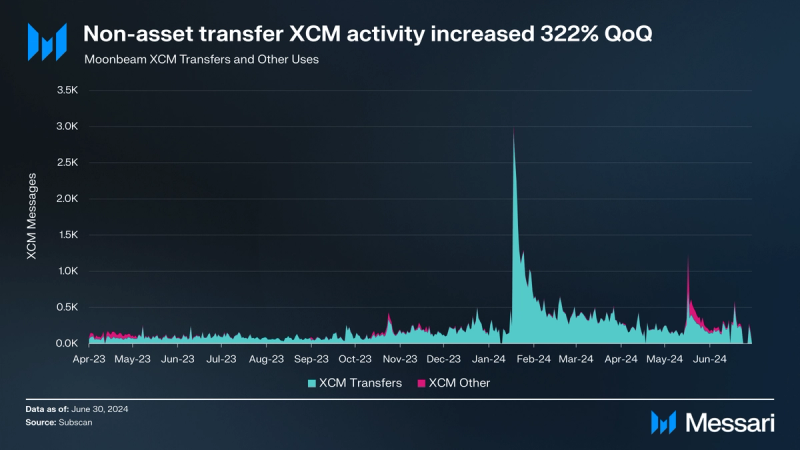

- Non-asset transfer XCM activity increased 322% QoQ. The increase signals XCM is being used more broadly and points to further increases in adoption.

- Moonbeam made several notable announcements in the gaming sector. These included a partnership with Animo Industries, the Lunar Gaming Festival April campaign, and the launch of Heroes Battle Arena.

- Moonbeam partnered with Gauntlet to optimize grant programs, enhance community alignment, and improve funding decisions.

Moonbeam (GLMR) is a Layer-1 parachain on the Polkadot Network, serving as an EVM-compatible smart contract platform. It provides an Ethereum Virtual Machine (EVM) implementation and a Web3 API, enabling straightforward deployment of Solidity contracts and protocol interfaces with minimal modifications. Its primary features include cross-chain integration, staking, and on-chain governance.

The network includes multiple deployments: Moonbeam on Polkadot (December 2021), Moonriver on Kusama (June 2021), and Moonbase Alpha on TestNet (September 2020). This structure ensures safe and rapid updates to Moonbeam's mainnet.

Moonbeam's technology stack, built with Rust and Substrate, provides a robust development environment. It boasts Ethereum compatibility, offering a full EVM implementation and Web3 RPC API, which integrates existing Ethereum tools and applications. As a key player in the Polkadot ecosystem, Moonbeam provides developers with an accessible route to leverage Polkadot's network effects while utilizing Ethereum tooling and compatibility.

Website / X (Twitter) / Telegram

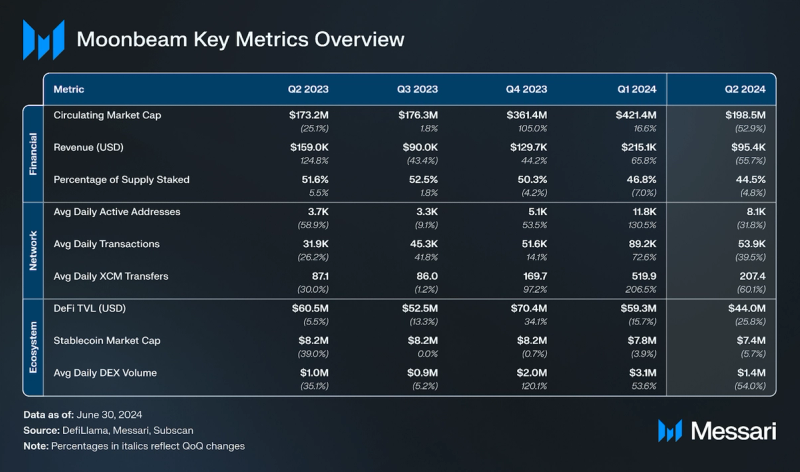

Key Metrics Analysis

Analysis

In Q2 2024, the entire crypto market saw a decline following a strong previous six months. For reference, BTC, ETH, and DOT market cap changes were -12%, -6%, and -34%, respectively.

GLMR's circulating market cap decreased to $199 million (-53% QoQ), and the fully diluted market cap decreased to $253 million (-53% QoQ). GLMR's market cap ranking fell from 225 to 270 among all assets, making it the fifth largest parachain by market cap within the Polkadot ecosystem.

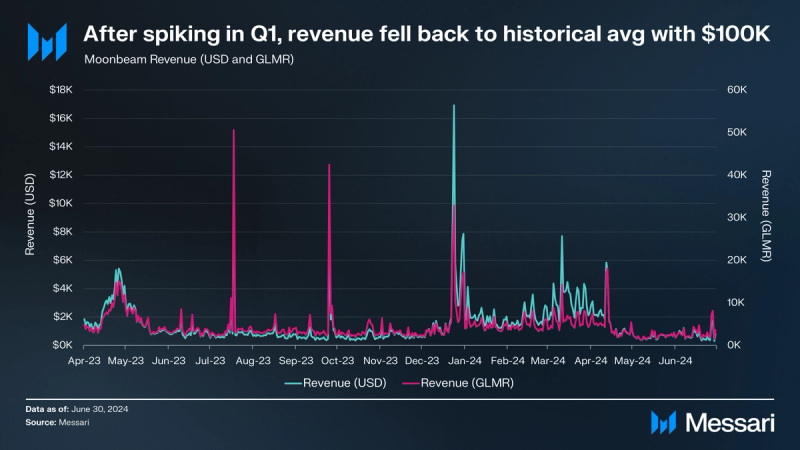

After seeing multiple quarters of revenue growth, Moonbeam's revenue slowed in Q2 2024. Moonbeam revenue (GLMR) was 303,000 (-35% QoQ), while the revenue (USD) saw a larger decrease of -56% QoQ to $95,000.

GLMR is the native token of the Moonbeam network. It serves multiple functions such as rewarding block producers to sustain chain liveliness, enabling on-chain governance, and paying for network transaction fees. The token experiences an annual inflation of 5% with no maximum supply. Of the transaction fees generated on the Moonbeam network, 80% are burned with the remaining 20% directed to the network's Treasury. After rising for several consecutive quarters, the percentage of supply staked decreased to 45%, which was down 5% QoQ.

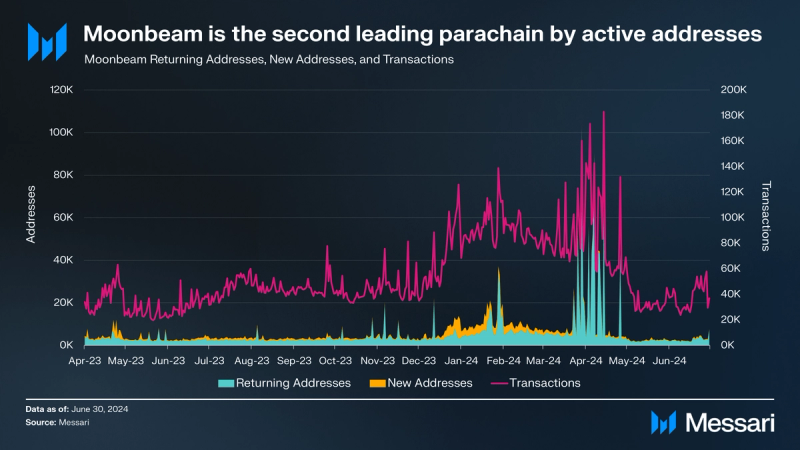

After seeing steady activity growth for most of the last year, Moonbeam network activity had a pullback in Q2 2024. Average daily active addresses decreased to 8,100 (-32% QoQ), average daily new addresses dropped to 600 (-79% QoQ), and average daily returning addresses fell to 570 (-17% QoQ). Average daily transactions also declined to 54,000 (-40% QoQ). Moonbeam fell to second among parachains in active addresses, trailing Nodle. Contributors to the decline include an NFT minting infrastructure partner suspending services in May, and adjustments to the fee model that affected the activity of certain projects.

According to the Electric Capital 2023 Developer Report, Moonbeam had 545 monthly active developers, including 173 full-time and 298 part-time. Moonbeam emphasizes its developer community and has made several significant funding announcements and partnerships in Q2 2024:

- Announced $13 million in ecosystem funding, including the $10 million Moonbeam Innovation Fund and $3 million in ecosystem grants, supporting gaming, real-world assets, and the Moonriver network.

- Made the first investment in N3MUS which is building a gaming ecosystem on Moonbeam.

- Allocated 4.5 million GLMR in incentives for the DeFi ecosystem.

- Uniswap incentives of $250,000 from Uniswap and $100,000 from Moonbeam.

- Partnered with Gauntlet to optimize grant programs, enhance community alignment, and improve funding decisions.

Moonbeam's Cross-Consensus Messaging (XCM) activity saw an abnormal spike in Q1 2024 due to Manta launching their L2 and using Moonbeam to move assets between their Parachain and L2. In Q2, the numbers fell in line with historical averages. Average daily XCM transfers decreased to 207 (-60% QoQ), and average daily XCM messages fell to 244 (-54% QoQ). However, the average daily XCM other increased significantly to 36 (+322% QoQ), indicating that XCM is being used more beyond asset transfers.

In Q2 2024, all leading protocols on Moonbeam saw a decrease in TVL. The DeFi TVL on Moonbeam was $44 million (-26% QoQ), while the DeFi TVL (GLMR) was 196 million (+63% QoQ). The TVL GLMR increase indicated that there was a positive net capital flow into the network.

The leading protocols by TVL on Moonbeam are:

- Moonwell (Lending): $27 million (-33%)

- StellaSwap (Lending): $5 million (-55%)

- Frax Swap (DEX): $1 million (-50%)

- Prime (DEX): $850,000 (-79%)

- Beam (DEX): $620,000 (-69%)

The average daily DEX volume was $1.4 million (-54% QoQ). StellaSwap led with an average of $1 million in daily volume, while Beam averaged $280,000 in daily volume.

Additionally, Moonbeam made a notable push into the gaming sector in Q1 2024 with several key initiatives. A partnership with Animo Industries, the Web3 game developer behind the third-person mech-shooter “Stars Arena ''. Polkadot announced an active Games Bounty for solo game developers and studios, funded with 100,000 DOT. The Lunar Gaming Festival announced an April campaign, a community initiative run by Collators and Games in the Moonbeam & Moonriver ecosystem. Furthermore, Heroes Battle Arena, a multichain strategy battle game, was launched on Moonbeam.

Moonbeam's stablecoin market cap slightly decreased to $7.3 million, but has been extremely stable the past year. Frax continues to dominate the ecosystem's stablecoin market with a 72% share. Moonbeam’s stablecoin market ranking was approximately 48th. In Q1 2024, Binance and Kucoin announced support for the Polkadot ecosystem by enabling native USDC and USDT deposits and withdrawals directly to the Polkadot AssetHub.

Additional key developments and community initiatives included:

- Secret Integration: Secret's Confidential Computing Layer is now integrated with Moonbeam. This integration will provide the network with decentralized confidential computing (DeCC) tooling, documentation, and support.

- Runtime 3000: This release brings several significant updates, including halving the block time to 6 seconds to enable async-backing and reducing the target block fullness to 35% across Moonbeam, Moonriver, and Moonbase Alpha. Additionally, it introduces Cancun compatibility, enables the pallet-xcm precompile, updates pallet weights, removes the localAssets lazy migration, eliminates the Moonbase migration, and upgrades Rust to version 1.77.0.

In Q1 2024, Moonbeam revealed strategic areas of focus for 2024 including cross-chain interoperability, gaming, real-world asset integration, and expansion into new regions.

In Q2 2024, Moonbeam unveiled its Moonrise initiative, which is already in motion with key developments such as reducing block times to six seconds, incorporating Ethereum's Dencun compatibility, and establishing an Ecosystem Fund. Future plans for Moonrise include core protocol enhancements designed to increase throughput by 8x and further integrations with Glacis and Tanssi to enhance cross-chain functionality. Additionally, new developer tools such as zkAuth for Web2 authentication and streamlined stablecoin flows are set to improve user experience.

Q2 2024 was also a significant period for Moonriver. Moonriver is set to be supported by Axelar to improve crosschain bridge capabilities.

Closing SummaryIn Q2 2024, Moonbeam faced various challenges and opportunities as it continued to develop its ecosystem. Network activity experienced a pullback due to poor market conditions, with average daily active addresses decreasing to 8,100 and average daily transactions declining to 53,900. Despite these challenges, Moonbeam remains a top two parachain by activity. Meanwhile, TVL GLMR increased to 196 million (+63% QoQ), indicating a net positive capital flow into the network.

The Moonrise roadmap was revealed in Q2 2024. This roadmap is already underway with significant developments such as reducing block times to six seconds, incorporating Ethereum's Dencun compatibility, and establishing an Ecosystem Fund. Future plans include core protocol enhancements designed to increase throughput, enhance crosschain functionality, and add new developer tools.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.