and the distribution of digital products.

Marinade Q4 2024 Brief

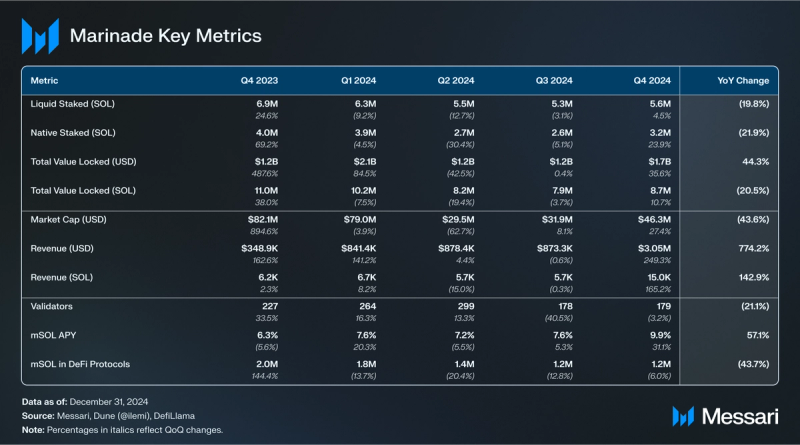

- Marinade’s Total Value Locked (TVL) increased by 35.6% QoQ to $1.7 billion. Native staking now comprises 36.2% of Marinade's TVL.

- Revenue reached $3.05 million in Q4’24, representing a 249.3% QoQ increase in USD and a 165.2% increase in SOL. 98.7% of Marinade’s revenue was generated through the Stake Auction Marketplace (SAM).

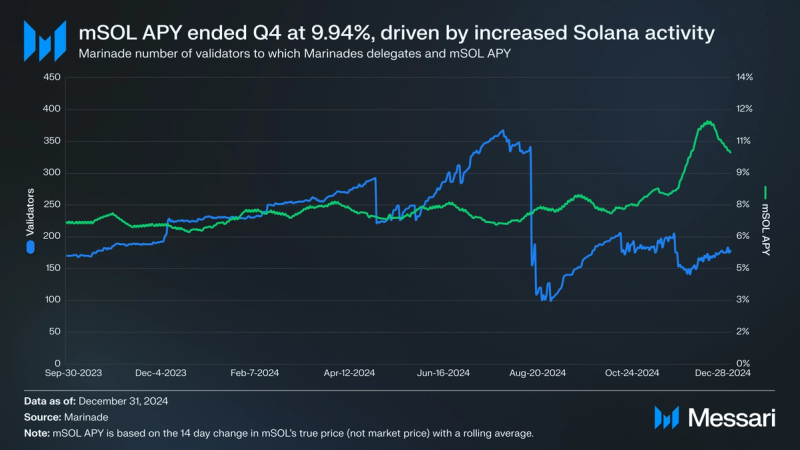

- mSOL APY increased by 31.1% QoQ to 9.9%. mSOL’s APY was supported by Solana’s rising transaction volumes and network activity.

- Three governance proposals (MIP1, MIP2, and MIP3) were passed. These proposals were designed to improve validator participation, staker protection, and MNDE utility.

- Marinade’s native and liquid staking products accounted for 2.2% of all staked SOL. Marinade’s native and liquid staking SOL TVL increased by 23.9% and 4.5%, respectively, QoQ.

Marinade (MNDE) is an automated staking protocol on Solana that provides liquid and native staking solutions. Marinade was founded during the March 2021 Solana x Serum Hackathon and launched on mainnet on August 2, 2021. Marinade’s governance token MNDE was released a few months later, with a retroactive airdrop for Marinade SOL (mSOL) holders. Marinade has not raised venture capital funding or conducted public token sales. Instead, Marinade’s native token MNDE has mainly been distributed via various campaigns to reward users and contributors. Beyond incentives, MNDE is used for governance on Realms. Previously, Marinade delegates staked SOL to validators based on its algorithmic delegation strategy (60%) and MNDE and mSOL directed stake (20% each), where tokenholders can vote for specific validators or the algorithmic set. After Q2, the delegation strategy was updated with a Stake Action Marketplace where validators bid on stakers SOL deposits. For both the algorithmic strategy and directed stake, validators need to meet specific criteria for eligibility, notably a maximum 7% commission. In April 2024, Marinade launched Protected Staking Rewards (PSR), which also requires validators to put up a SOL bond to be eligible for stake on Marinade. PSR enforces an onchain service-level agreement protecting stakers from reduced rewards.

Website / X (Twitter) / Discord

Performance AnalysisTVL

Performance AnalysisTVL

Marinade’s TVL increased by 35.6% QoQ to $1.7 billion in Q3. When denominated in SOL, TVL increased by 59.9% to 8.9 million. Total Marinade TVL, typically correlated to Solana TVL, increased by 10.7% QoQ to $8.5 billion.

Marinade operates two separate staking products: liquid and native staking.

Marinade’s liquid staking allows users to stake their SOL for mSOL, which provides all the benefits of native staking yield and allows users to participate in DeFi with their receipt token. In Q4’24, Marinade’s liquid-staked SOL TVL rose by 4.5% QoQ to 5.6 million SOL.

Marinade native staking launched in Q3’23, allowing users to stake SOL directly without losing custody of their keys. This strategy may appeal more to institutional investors, who tend to avoid the smart contract risks associated with liquid staking and the concentration risks tied to relying on a single validator or custodian solution. Native staking comprises 36.2% of Marinade’s total TVL. Marinade Native’s TVL rose 23.9% QoQ to 3.2 million SOL in Q4’24.

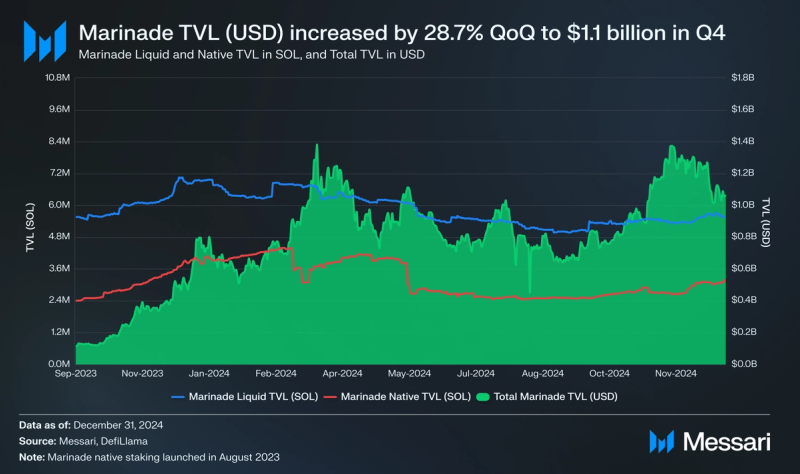

Market Cap and FeesCopilot Insights: How much of Marinade's revenue comes from the Stake Auction Marketplace?Copilot Insights: How much revenue did Marinade generate in Q4 2024?

In Q4’24, Marinade’s market cap increased 27.4% QoQ to $46.3 million. MNDE has a maximum supply of 1 billion tokens, of which 386 million are circulating. 108.0 million MNDE tokens were unlocked from the DAO treasury in Q4’24.

Marinade’s Q4’24 total revenue reached $3.05 million, a 249.3% increase QoQ and a 774.2% increase YoY. The rise in revenue can be attributed to two key factors: the rise in SOL’s price and the establishment of Marinade’s Stake Auction Marketplace (SAM). In Q4’24, SOL’s median price rose from Q3’s median price of $143.85 to $194.48. Furthermore, Marinade’s SAM, launched on Aug. 14, 2024, earned 14,835.11 SOL in Q4’24, accounting for 98.7% of all revenue generated over the quarter.

Marinade’s SAM is an auction marketplace where validators compete in open bidding for stakers’ delegated SOL. Each validator in the Marinade delegation set will only pay as much as the least-yielding validator in the delegation set. Validators with higher amounts of stake will still have the potential to earn greater rewards in addition to perks like priority fees. Marinade automates the distribution of SOL to the highest-performing validators to achieve optimal returns for stakers. Marinade generates revenue from the SAM by charging a variable performance fee on validator bids. This performance fee is dynamically adjusted to target enhanced yields greater than 0% commission validators can provide.

Marinade also earns revenue from unstaking fees ranging from 0.1-9% based on the total liquidity available in the mSOL/SOL LP and the unstaked amount. In Q4’24, Marinade’s unstaking fees only accounted for 1.35% of its total revenue. Before the launch of the SAM, Marinade also collected a 6% staking fee on Marinade Liquid rewards. Marinade’s staking fee was removed on Aug. 20, 2025.

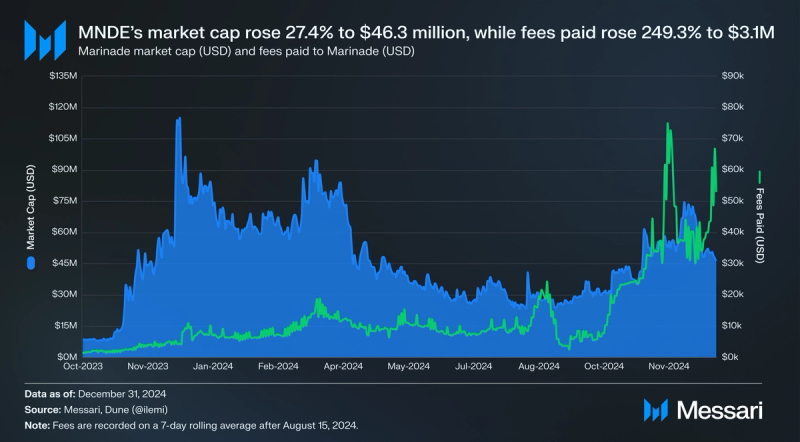

Validators and APYCopilot Insights: How much has mSOL's APY grown?

mSOL APY increased by 31.1% QoQ to 9.9%. Concurrently, network activity on Solana increased across several metrics in Q4’24, including average daily active addresses, average daily transaction fees, and TVL. Validators earn staking rewards based on network performance and activity. When Solana experiences higher transaction volumes, validators process more transactions, which increases the amount of SOL distributed as rewards. The mSOL APY figure is calculated based on mSOL’s “true price,” i.e., SOL in Marinade staking pool / mSOL minted.

Native staking through Marinade typically yields a slightly higher APY because native stakers aren’t paying the same fees as with mSOL. However, with native staking, SOL is locked up and cannot be used in DeFi applications until it is unstaked and goes through the cooldown period.

As of the end of Q4’24, Marinade delegated SOL to 179 validators, a 3.2% QoQ decrease. However, the number of validators Marinade delegates to varies daily. Q3’s decrease in validators corresponds with the launch of Phase 2 of Marinade’s SAM, which began the automatic redistribution of stake among the top-performing validators. Additional information on each validator can be found on Marinade’s network page.

Protected Staking Rewards (PSR) was launched in April 2024, with over 400 validators participating from the outset. PSR enforces an onchain service-level agreement protecting stakers from reduced rewards for validator performance issues or commission rugs. PSR requires validators to put up a bond to be eligible for Marinade stake. This allows Marinade to stake to more validators without sacrificing APY to stakers.

Governance UpdatesCopilot Insights: What were Marinade's governance updates in 2024?Marinade’s governance framework remained central to protocol development in Q4’24, with the community passing three Marinade Improvement Proposals (MIPs):

- MIP 1: Relaxation of SAM Constraints

- MIP 2: Adjustment of Protected Staking Rewards (PSR) Coverage

- MIP 3: Further Adjustment of PSR Coverage

These proposals focused on increasing validator participation, enhancing staker protection, and improving competitiveness across the ecosystem.

MIP 1: Relaxation of SAM ConstraintsOn Oct. 21, 2024, Marinade proposed a relaxation of SAM constraints. The proposal was designed to enhance SAM’s accessibility and competitiveness by increasing Solana’s administrative services organization (ASO) concentration limit from 20% to 30% and removing Marinade-specific ASO and country-based concentration constraints. These adjustments allow more validators to participate in Marinade’s SAM, which increases competition. MIP 1 passed with overwhelming support, with 99.9% of the vote in favor.

MIP 2: Adjustment of Protected Staking Rewards (PSR) CoverageOn Oct. 21, 2024, Marinade created a second proposal designed to adjust the PSR mechanism. The adjustment aimed to incentivize validators to maintain high uptime while improving Marinade’s financial sustainability by making validators responsible for covering 100% of rewards lost due to downtime when their uptime falls between 50% and 99%. While Marinade would only cover the rewards lost in the lower 0% to 50% uptime range. By reducing the strain on Marinade’s treasury, the protocol can reallocate resources toward development, security, and user experience enhancements. MIP 2 passed with 82.8% of the vote in favor.

MIP 3: Enhancing MNDE Utility by Integrating with the Stake Auction MarketplaceOn Oct. 22, 2024, Marinade introduced a proposal to integrate the MNDE-directed stake mechanism with Marinade’s SAM. Marinade’s directed stake product enabled MNDE holders to choose the validator they wanted to support. However, MIP 3 removes the standalone MNDE-directed stake system and implements a system where a proportion of MNDE tokens directed towards a validator increases their maximum potential stake from the SAM, which will distribute 100% of Marinade’s TVL. By consolidating stake distribution within the SAM, MIP 3 simplifies the staking process, eliminates inefficiencies, and gives MNDE holders direct influence over validator stake caps. MIP 3 passed with 75.9% of the vote in favor.

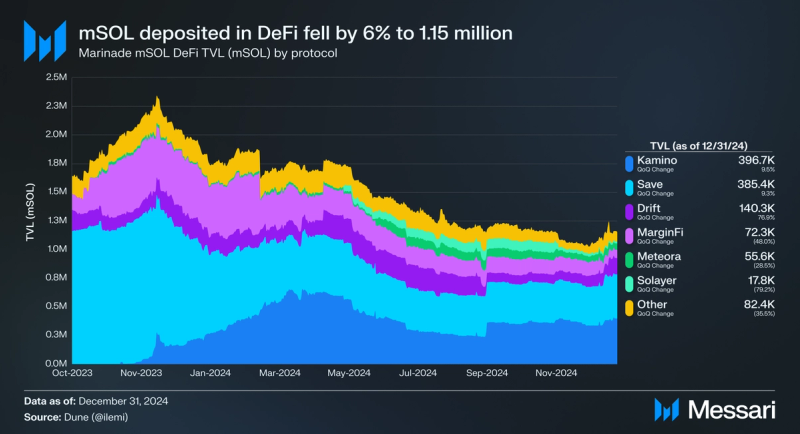

mSOL in DeFiCopilot Insights: How can I earn additional yield on my mSOL?

mSOL deposited in DeFi protocols decreased by 6.0% QoQ to 1.15 million, potentially driven by updates and changes within each protocol:

- Kamino maintained its majority share of mSOL in DeFi for the fourth quarter in a row. Kamino leads mSOL TVL on Solana. Kamino’s mSOL TVL grew 9.5% QoQ to 396,700 mSOL.

- Drift, the 9th largest protocol on Solana by TVL, ended Q4’24 with 143,200 mSOL, a 76.9% increase QoQ. Comparatively, JitoSOL fell 6% QoQ to 619,000 tokens, while DSOL (Drift Staked SOL) increased 152% QoQ to 391,900 tokens.

- Save, formerly Solend, initially captured the majority share of mSOL in DeFi, but Kamino surpassed it in Q1’24. In Q4’24, Solend’s mSOL supply increased by 9.3% QoQ to 385,400 mSOL.

- Solayer, a restaking network on Solana, launched at the end of May 2024. Solayer’s mSOL supply fell 79.2% QoQ to 55,600 mSOL in Q4’24.

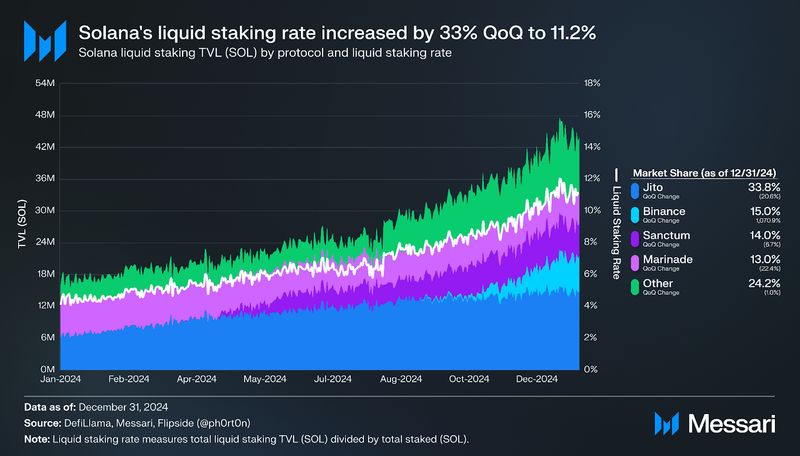

Solana’s liquid staking rate (the percent of liquid-staked SOL) increased by 7.9% QoQ to 11.2%. With 65% of eligible SOL supply staked, an increase in the liquid staking rate is necessary to maintain an ecosystem focused on yield-bearing SOL.

The top competitors for Marinade liquid staking include Jito, Sanctum, Binance staked SOL, and Jupiter. Marinade’s liquid staking market share fell 22.4% QoQ to 13%, with Jito’s market share remaining stable at 42%. However, including Marinade Native staking, which contributed 3.16 million staked SOL to Marinade’s TVL in Q4’24, Marinade’s total liquid plus native staking market share reached 18.9%.

Jito’s jitoSOL remained Solana’s LST leader. The JitoSOL supply grew 6.28% QoQ to nearly 14.7 million SOL, giving it a 34% market share. In Q4’24, Jito expanded its restaking offering by launching Phase 1 and expanding the deposit cap to $50m.

Sanctum LSTs ended Q4’24 with nearly 6.1 million SOL, a 24.8% increase QoQ. The Sanctum Infinity Pool, a multi-LST liquidity pool containing 82 LSTs at the end of Q4’24, saw a 29.9% decrease QoQ with 879,000 SOL in TVL. The pool prices LSTs by its “floor price” relative to SOL, allowing any LST in the pool to tap into any other’s liquidity. For example, if a user wants to sell xSOL for USDC, but no xSOL/USDC pool exists, xSOL could be swapped to ySOL and sold to USDC using the ySOL/USDC pool. The top Sanctum LST is Jupiter’s JupSOL, which ended Q4’24 with a supply of 3.8 million SOL, an 18.7% increase QoQ. Other popular Sanctum LSTs include Helius’ hSOL and Drift’s dSOL.

While Sanctum benefits Marinade by increasing liquidity for mSOL, it may also disadvantage Marinade as one of the market leaders. Sanctum products lower the barriers to launching LSTs, enabling experimentation and expanding the design space of LST functionality. However, Marinade’s PSR and SAM features help provide a defensible moat against new entrants. These features help protect stakers from downtime and use the open market to determine competitive yields. This enabled Marinade’s yield to reach as high as 11.4% APY in Q4’24.

Marinade Native Staking’s top competitors include Galaxy, Binance, and Coinbase, each accounting for over 11.2 million staked SOL. While these three organizations have a higher distribution and access to idle Solana capital, they do not provide non-custodial staking or diversification across multiple validators. Helius is also a leading native staking competitor, accounting for over 12.9 million staked SOL. Ultimately, Marinade’s competitive edge lies in its prioritization of security without sacrificing yield through PSM and its implementation of the SAM to deliver optimal yields determined by the open market.

Closing SummaryMarinade’s Q4’24 performance was marked by strong growth and governance-driven advancements. Total Value Locked (TVL) increased 35.6% QoQ to $1.7 billion, while mSOL APY climbed to 9.9% amid increased Solana network activity. Marinade’s revenue also grew significantly during the quarter, accruing 15,000 SOL, a 165.2% QoQ. Revenue growth was driven by the Stake Auction Marketplace (SAM), which accounted for 98.65% of total revenue after the protocol shifted away from staking fees in August. By the end of the quarter, Marinade’s liquid and native staking products represented 2.2% of all staked SOL. This growth reflects the success of Marinade’s SAM in providing optimal yields for users, competitively positioning Marinade as a leader in the Solana ecosystem.

Q4’s key developments were shaped by governance proposals aimed at strengthening Marinade’s staking ecosystem. MIP 1 relaxed the SAM constraints to improve validator accessibility and competition. MIP 2 restructured Protected Staking Rewards (PSR) to balance downtime-related losses more equitably between validators and Marinade, reducing strain on the protocol’s treasury. MIP 3 integrated MNDE Directed Stake with SAM, simplifying stake distribution and enhancing MNDE utility by allowing token holders to influence validator stake caps. These initiatives improved validator engagement, increased staker protection, and positioned Marinade to adapt to growing competition in Solana’s liquid staking market.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.