and the distribution of digital products.

Livepeer Q2 2024 Brief

- While video transcoding usage decreased 22% QoQ, the Livepeer community continued to optimize the transcoding price paid by users. The price per minute transcoded dropped 21% QoQ from $0.0021/min in Q1’24 to $0.0017/min in Q2’24.

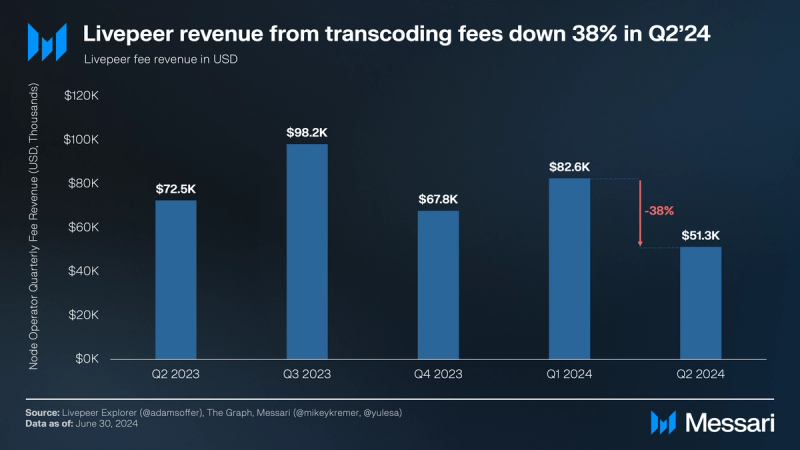

- As a result, Livepeer demand-side revenue from transcoding dropped 38% QoQ.

- Simultaneously, staking rewards grew 64% QoQ in USD terms as the LPT issuance grew 12% QoQ and reached its highest level since the Arbitrum migration in Q1’22.

- The Livepeer team introduced an AI subnet for text-to-image, text-to-video, and image-to-video capabilities used across entertainment, social media, and gaming.

- In an attempt to address video deepfakes, Livepeer joined the Coalition for Content Provenance and Authenticity (C2PA) to help trace the provenance of video content.

Building decentralized video apps like Twitch or TikTok requires infrastructure for live and on-demand video streaming. Based on a user’s bandwidth and device, video content needs to be processed — i.e., transcoded — into viewable formats. While cloud providers like AWS, Google, or Microsoft are commonplace solutions for video transcoding, they incur high costs.

The Livepeer network offers an open and permissionless video infrastructure marketplace for live and on-demand streaming. Livepeer’s transcoding marketplace allows anyone to contribute compute resources (e.g., GPUs) and to compete on price. The network is designed to reduce transcoding costs for end users by up to 10x.

Within Livepeer’s decentralized transcoding network, there are three key participants:

- Node operators — called "Orchestrators" — route transcoding jobs. The amount of work a node operator can perform is proportional to how many Livepeer native tokens (LPT) it stakes. Node operators earn ETH fees and newly minted LPT rewards.

- Service nodes — called "Transcoders" — provide compute resources for node operators and deliver video transcoding. In return, they earn ETH fees. Typically, Orchestrators and Transcoders run within the same machine (combined setup).

- Delegators stake LPT towards effective node operators to help secure the Livepeer network. Staking is rewarded with a portion of both ETH fees and LPT rewards.

Beyond transcoding, Livepeer introduced an AI subnet for video generation capabilities (text-to-image, text-to-video, and image-to-video) used across entertainment, social media, and gaming. The LPT token has recently been included in the Grayscale Decentralized AI Fund consisting of native tokens of decentralized AI protocols.

Website / X (Twitter) / Discord

Key Metrics Performance Analysis

Performance AnalysisDemand for Livepeer services comes from apps and developers in need of video transcoding and live-streaming capabilities. For example, decentralized social media (DeSoc) apps, traditional Web2 apps (like TikTok or Twitch), or music streaming apps (like Spotify or SoundCloud) require streaming infrastructure to broadcast video content.

NetworkLivepeer’s network usage can be gauged by estimating the number of minutes of video transcoded. In September 2023, Livepeer announced a change in the methodology for estimating its usage. This change addressed some of the challenges in estimating the number of transcoded minutes, given that this metric is not directly observable onchain.

While the previous methodology relied on transcoding fees earned by node operators as a proxy for usage, the updated methodology accounts for changes in usage patterns, such as the introduction of video on demand (VOD) transcoding and varying price points. As the usage metric is acknowledged as imperfect but valuable, the previous data is retained until September 2023, when the change was implemented.

The usage of the Livepeer transcoding network decreased 22% QoQ. Nearly 31 million minutes of video were transcoded in Q2’24, down from the all-time high of 39 million in Q1’24, but on par with the 30 million mark set in Q4’23.

Simultaneously, the Livepeer network aims to capitalize on AI video compute capabilities, such as text-to-image, text-to-video, and image-to-video capabilities used across entertainment, social media, and gaming. To this end, the Livepeer team introduced an AI subnet for decentralized AI media processing marketplaces and tools. Usage is expected to increase with the mainnet launch scheduled during Token2049 in September.

FinancialsRevenue from Transcoding FeesDemand-side revenue comprises ETH fees accrued from services on the Livepeer network. Transcoding fees are accrued by node operators and further distributed to transcoders and delegators. Node operators with larger amounts of stake are more likely to receive more transcoding work, subsequently earning more transcoding fees.

Livepeer demand-side revenue from transcoding fees decreased 38% QoQ in USD terms. As usage of the Livepeer transcoding network decreased 22% QoQ, the price per minute transcoded dropped 21% QoQ from an average of $0.0021/min in Q1’24 to an average of $0.0017/min in Q2’24.

The reduction in the price per minute transcoded comes as a result of Livepeer lowering the costs of transcoding. For context, the Livepeer team is focused on enabling businesses to use Livepeer’s streaming and multistreaming (i.e., live streaming to multiple platforms simultaneously) in a cost-efficient manner. By helping node operators competitively price their transcoding, Livepeer aims to attract more transcoding work on the network.

With this in mind, node operators have actively been discussing how to optimize the price per pixel for video transcoding. With the current 20% YoY growth of the live-streaming market, Livepeer aims to continue reducing the cost of streaming solutions for end users by up to 10x.

In addition to transcoding, Livepeer supports AI video generation using the network’s compute power (e.g., GPUs), as per Messari’s recent report. Node operators recently started to accrue ETH fees for performing AI video generation, following the introduction of an AI subnet for AI video generation capabilities such as text-to-image, text-to-video, and image-to-video capabilities. The initiative has plenty of potential, as the use cases span across entertainment, social media, and gaming.

Once launched on mainnet, the Livepeer AI subnet will likely drive further demand channels for the network's compute resources while introducing additional revenue streams. This represents a major step as the network introduces its first job types beyond transcoding, on its path to addressing the entire video and media compute infrastructure market.

Staking RewardsThe Livepeer network distributes staking rewards in LPT to node operators and delegators. To provide transcoding services on the Livepeer network, node operators must stake LPT. A node operator’s stake weight comprises their own tokens and those delegated towards them.

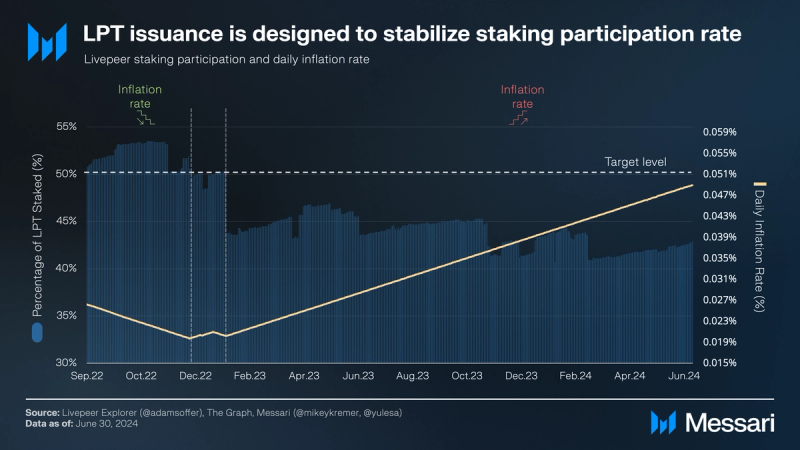

Staking rewards grew 64% QoQ in USD terms, as the LPT issuance grew 12% QoQ and reached its highest level since the Arbitrum migration in Q1’22. This increase in LPT issuance corresponded to the staking participation staying below the 50% equilibrium threshold. The high level of staking rewards relative to fees earned via transcoding indicates that the Livepeer node operators rely heavily on staking rewards to sustain their day-to-day operations and offer competitive transcoding prices.

Staking ParticipationThe LPT token follows the Stake-for-Access (SFA) model, also known as a work token model. That is, Livepeer requires its node operators to stake LPT to perform work on the network. The past six quarters saw Livepeer staking participation — the percentage of the circulating LPT supply that is staked — stay below the 50% target level. Simultaneously, delegators on the Livepeer network decreased to 3,500 Q2’24, down from over 4,300 in Q1’23.

Daily LPT issuance steadily increased from 0.020% in January 2023 to above 0.049% by the end of June 2024, in line with the staking participation rate staying below the 50% equilibrium threshold. For context, the dynamic LPT issuance in absolute terms follows the staking participation rate as below:

- When the participation rate falls below 50%, LPT issuance increases by 0.00005%.

- Conversely, when the participation rate passes 50%, LPT issuance drops by 0.00005%.

An explanation for the staking participation staying below the 50% threshold is the incentive decoupling between staking and transcoding. Previous research found that the top five node operators by LPT staked earned roughly 40-50% of staking rewards but only ~20% of all transcoding fees. Given that smaller node operators perform ~80% of the transcoding work, staking participation could be increased by making smaller node operators more attractive for delegation. Simultaneously, several forum entries (here and here) are discussing the option of moving the equilibrium level to account for the changing supply dynamics of the network.

Qualitative AnalysisKey DevelopmentsLivepeer AI SubnetThe Livepeer team introduced a subnet for decentralized AI media processing marketplaces and tools. The first use cases include video generation capabilities (text-to-image, text-to-video, and image-to-video) used across entertainment, social media, and gaming.

The subnet aims to onboard node operators and enable them to earn revenue in ETH and LPT by deploying their GPU resources for AI media processing tasks. During the subnet optimization phase, the team aims to enhance the network supply by expanding the range of compatible GPUs. Once the optimization phase is complete, the mainnet is scheduled to launch in September.

Go Livepeer ReleasesGo Livepeer is a Go implementation of the Livepeer protocol which powers the public transcoding network. Released in May, V0.7.5 fixed the transcoding layer for WebRTC streams.

GovernanceLivepeer AI Video SPEThe Livepeer AI Video SPE requested funding from the treasury for a special-purpose entity (SPE) focused on developing Livepeer's AI-based video compute capabilities. Following a successful first-stage proposal in Q1’24, the AI Video SPE successfully requested a second round of funding, namely:

- 25,000 LPT from the onchain treasury, as well as

- 6,980 LPT and 12,495 USDC from the first round to be rolled over to the second round.

The proposal aims to enhance AI Subnet performance and service quality, in preparation for the projected mainnet launch on August 1, 2024.

To accelerate the second stage of Livepeer's AI Subnet journey, Livepeer plans to run the following programs:

- Bounty Program: focused on testing harnesses, payments and subnet observability, and supporting additional pipelines.

- Startup Program: each startup will receive a grant plus up to $20,000 of infrastructure credits to use on the AI subnet.

- Hackathon: after the mainnet launch, the SPE and Ecosystem team will run a hackathon to test how developers can build on the subnet and attract new builders.

Realtime Interactive Video SPE

This successful proposal requested 11,000 LPT to launch the Realtime Interactive Video SPE, which focuses on real-time interactive videos. The funds will be used to:

- Cover development and enhancement by SPE’s technical team;

- Establish and maintain an open-source repository;

- Implement security auditing, infrastructure setup, testing, and deployment by the DevOps team;

- Cover collaboration costs with Livepeer Studio for technical solutioning;

- Improve design and community engagement, including UI.

This successful proposal requested 20,000 LPT to launch Aquareum, with a focus on building out a decentralized video indexing layer, app, and development platform, consisting of:

- Aquareum Primitives: An API that provides verifiable video content.

- Aquareum Indexer: An app that indexes video content into a distributed database.

- Aquareum App: An app to display a library of video content.

- Aquareum Node: A node to bundle the Indexer, the app, and the full software stack into a single executable.

The proposal explains that the requested funding will go toward compensating the Aquareum team and renting the server infrastructure for prototyping video distribution.

Coalition for Content Provenance and AuthenticityIn an attempt to fight deep fakes, Livepeer joined the Coalition for Content Provenance and Authenticity (C2PA) to help trace the provenance of video content. C2PA is an open technical standard that enables origin tracing of different types of media. Members of C2PA include companies like TikTok, Adobe, Google, Sony, Intel, BBC, Microsoft, and OpenAI.

Closing SummaryWhile the usage of Livepeer’s transcoding network decreased 22% QoQ, the Livepeer community continued to optimize transcoding costs for the user. The price per minute transcoded decreased 21% QoQ from $0.0021/min in Q1’24 to $0.0017/min in Q2’24. As a result, Livepeer demand-side revenue from transcoding dropped 38% QoQ. Simultaneously, staking rewards grew 64% QoQ in USD terms as LPT issuance grew 12% QoQ and reached its highest level since the Arbitrum migration in Q1’22.

Beyond transcoding, the Livepeer team introduced an AI subnet for text-to-image, text-to-video, and image-to-video capabilities used across entertainment, social media, and gaming. Usage is expected to increase with the mainnet launch scheduled for September 2024.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.