and the distribution of digital products.

DM Television

Koinly Review – Is It Really a Good Tax Software?

Have you tried to figure out taxes to be paid on your crypto income? Confused while transacting through various exchanges and holding crypto coins in multiple wallets? Koinly resolves all these hassles by automatically consolidating your trades in one place and helps you report your taxes instantly. This article reviews a tax management platform Koinly that can help you with your end-to-end taxes and tracking portfolio changes on a real-time basis.

Summary (TL;DR)- Koinly is a tax management platform started in 2018 helps you file taxes within 20 minutes.

- The platform supports 17000+ cryptocurrencies and 350+ crypto exchanges.

- The platform allows API integrations with multiple exchanges/ wallets to help you auto-sync the datafeeds for automated calculation and import/ upload of CSV files is available.

- Lifetime free account to track your holdings on real time basis. Offers paid plans for downloading detailed tax computations.

- Supports multi-country and multi-currency formats with specialized tax reports in IRS form, Capital Gains, International tax report formats.

- Easy signup process to begin with and an active customer support team.

Koinly is a tax management platform founded in 2018 by Mr. Robin Singh and operates out of Palo Alto, California, under California’s state laws. Retains presence out of the UK, US, Sweden, and Germany. The website acclaims 11,000+ tax reports filed since 2018 and has tracked funds of $250M+ since then.

It competes with other tax compliance service providers like accounting, CryptoTaxCalculator, and TokenTax.

The platform supports tax reporting across the globe, allowing you to import data via APIs, CSV files, x/y/z pub keys, and generate reports that can be downloaded in pdf formats. In addition, it supports various accounting methods like First In First Out (FIFO), Last in First Out (LIFO), Shared pool method and generate International tax reports, Schedule D Reports, and many more, thus facilitating services across multiple countries.

Access LinkedIn Profile of Mr. Robin Singh.

VISIT KOINLY Koinly

Key Features

Koinly

Key Features

- Track portfolio at one place: Platform tracks holdings across wallets and exchanges all in one place and changes in portfolio value on a real-time basis with tax liabilities.

- Distinguish your Income: Helps you track and distinguish income from staking, mining, lending, gifts and other income.

- Hassle-free data import: Auto-sync wallets and exchanges via API keys, import CSV files, use x/y/z/pub keys to update transactions.

- Supports multiple currencies: Choose currency as per your tax reporting country. For example, US Dollar based reporting for reporting taxable income in the USA and pound for reporting taxes in the UK. Generate tax reports as per your state/ country compliance requirements. Koinly supports 20+ country formats, including IRS Forms, UK. Capital Gains, and many more.

- Export/download of tax reports: Generate tax reports from Koinly in 20 mins, download in pdf format multiple times or export to tax filing softwares like TurboTax, TaxAct, H&R, etc.

- AI-based error detection: Koinly uses AI to detect errors and rectify them. It uses a double-entry ledger system to record transactions, highlights missing transactions in your imported data, and skips duplicate transactions for accuracy.

- Lifetime free account: Sign up on the platform for free without adding your credit card to track your holdings and preview tax summary for free. Pay only when you want to download the tax reports.

- Multiple accounting methods: Platform supports FIFO, LIFO, HIFO, and other accounting methods followed globally.

- Pay in any currency: Plans can be purchased using credit/ debit cards or cryptocurrency as well.

Also Read: Best crypto tax software for your money

Get Started with KoinlySign up on the Koinly website to access their services. Follow the below steps:

Step 1: Sign UpSign up using your Coinbase or Google account. Alternatively, fill in your name, email address and set up a password to create your Koinly account. The platform does not require you to add any other proofs to establish your identity. Finally, checkbox if you want to subscribe to crypto taxes-related notifications or any updates on the Koinly platform.

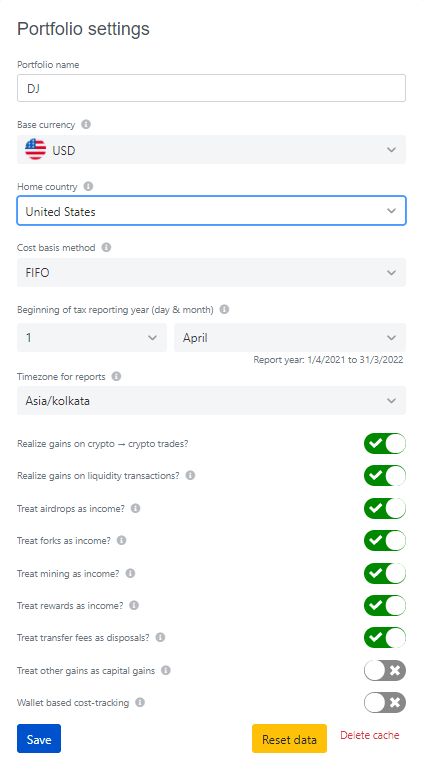

Click on create an account to get started. Then, in the following pop-up, choose the base currency and home country depending on your country of filing taxes.

These settings can be changed by going to the Settings tab on the top panel.

- Portfolio Name

- Base Currency

- Home Country

- Cost basis method

- Beginning of the tax year

- Timezone for reports

Get Started with Koinly

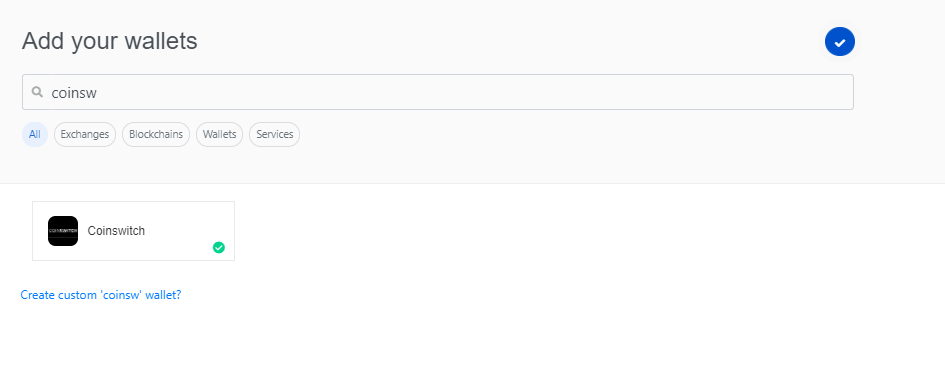

Step 2: Add a Wallet

Get Started with Koinly

Step 2: Add a Wallet

The platform considers all exchanges, wallets, lending services, etc., as a typical wallet only. So, add your exchange, wallets, services to create a wallet and track your transactions in one place. Then, use the search option to add your networks. Koinly supports all the cryptocurrencies tracked on CoinMarketCap, 350+ exchanges where cryptos are traded, 50+ Blockchains to trace your transactions. However, if you cannot find your exchange/wallet on the search option, click on Create custom wallet with the “Your Wallet Name” option.

Add a Wallet

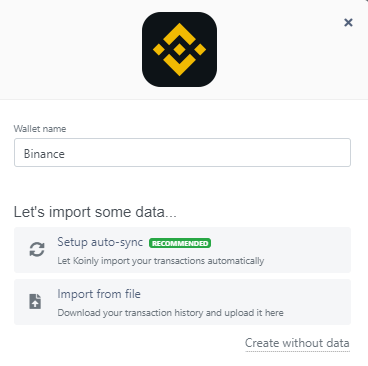

Step 3: Import your data

Add a Wallet

Step 3: Import your data

Once you have added your networks, you will need to import your data using

Import your Data

Import your Data

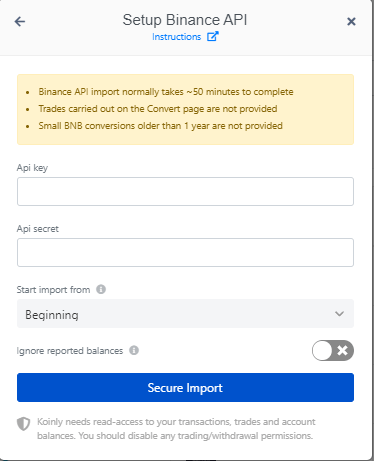

- Setup auto-sync: This will allow the platform to sync transactions on a going basis using the API keys. This will help the platform auto-update the transactions as and when they occur.

Sync up

Sync up

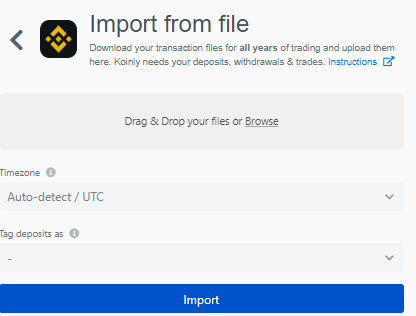

- Import from File:

- Import CSV file: Download transaction history from the exchanges/wallets you transact in CSV format and upload it here.

- No API keys/ No CSV File: Create a custom file and follow the steps below:

- Click Format1 / Format2 to direct to a google sheet format

- Click on File- make a copy- delete the existing sample data and fill in transaction data

- Go to File tab- download- common separated values.

- Once downloaded, upload the File using the import file option on Koinly.

Import from file

Import from file

Watch this video if you are not able to create a custom file and import it on Koinly.

We need to note that we cannot import multiple files at once. Thus, be patient enough to drop a single file and let the import be completed before dropping it in another file. If you find out the imported File has incomplete transactions, add the correct File again, and Koinly will recognize and exclude duplicate transactions.

However, note that you should only use either the auto-sync option via API keys or the import file option and not both of them. The platform will not distinguish the duplicate transactions if both methods are used. Your values will be incorrect; however, if you need to mix CSV and API, import CSV files first and set up the API only to import newer transactions.

Also Read: Crypto Tax in India: Are you Supposed to do Your Taxes?

Step 4: Wait for gains to update and review data.Once the transactions are imported, the platform fetches market prices and matches transfers between your wallets before previewing the tax summary. Once this process is completed, review your data for completeness.

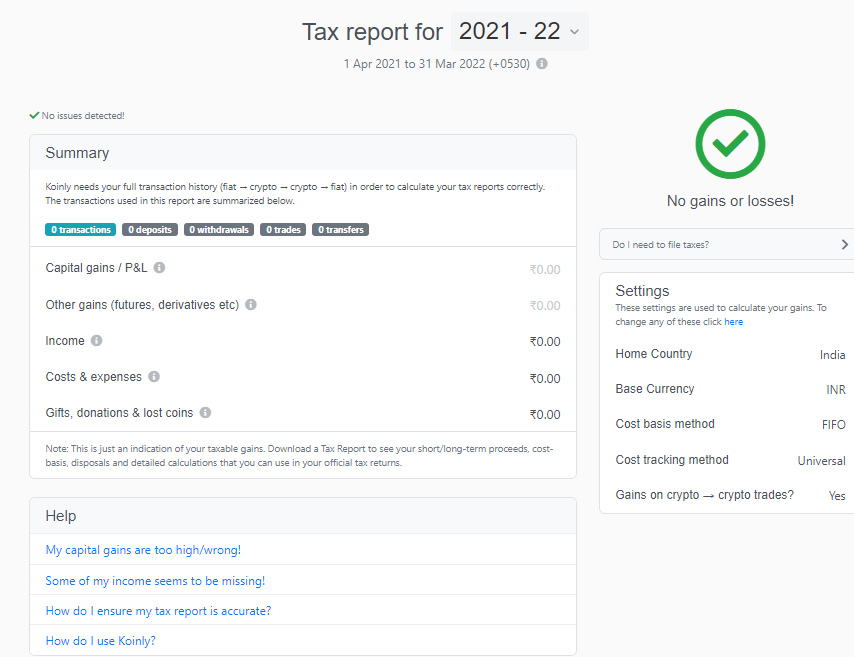

Step 5: Download your tax reportsClick on the Tax Reports page to summarise capital gains and income for your selected tax year. You can download the tax reports for a specific year in your required format. The reports can be downloaded in CSV, excel, pdf formats multiple times.

GET STARTED WITH KOINLY NOW! Download your tax report

Countries and Accounting methods supported by Koinly

Download your tax report

Countries and Accounting methods supported by Koinly

The platform supports nearly 100+ countries, and the most common ones are listed on their website. However, even if your specific country isn’t exclusively supported, the platform can be used if the taxation laws of your country follow accounting methods supported by Koinly. E.g., if your country follows the First in First Out cost method, which Koinly supports, then your tax report can be generated. In addition, the platform supports the following cost basis method.

- First in First Out (FIFO)

- Last in First Out (LIFO)

- Highest in First Out (HIFO)

- Average Cost

- Share Pooling

The platform supports all cryptocurrencies listed on CoinMarketCap and all forms of Ethereum/BSC/Polygon tokens. Furthermore, as and when new cryptocurrencies are introduced, they get auto-updated on the platform.

The platform supports more than 354 exchanges such as Coinbase, Binance, Coinspot, Crypto.com, and many more. Check whether your exchange is supported or not, as the platform has API integrations with these exchanges. Once you add these exchanges, it auto-updates the transactions making it a manual-free job for users. However, if the platform does not support your exchange, you can upload a transaction report on Koinly in their specified format, as we discussed above, and they will generate a tax report.

VISIT KOINLY Wallets supported by KoinlyThe platform supports 74+ wallets, and they are constantly developing and syncing with others regularly to establish API integrations. One can add multiple wallets on Koinly through public keys. The platform imports transactions and AI to detect faulty transactions, transfers within wallets and matches with the exchange transaction history to prepare tax reports accurately.

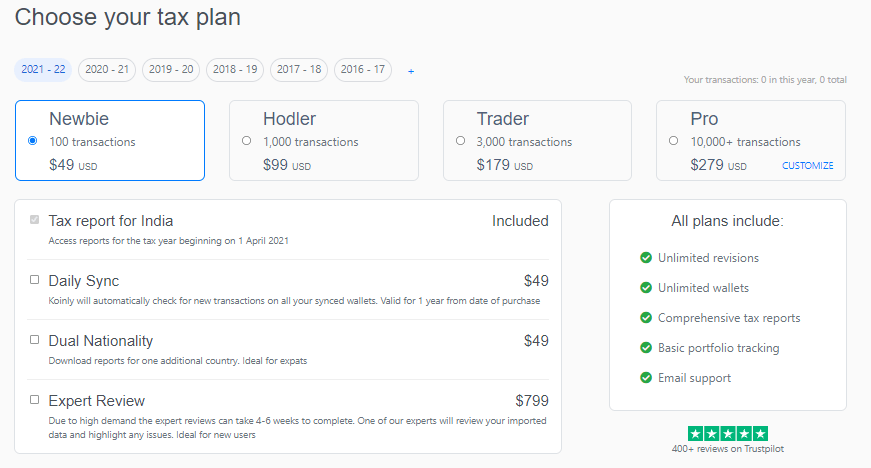

PricingKoinly offers competitive pricing as compared to other tax management platforms. It provides a lifetime free trial period without the need of adding your credit cards. You can preview tax summary up to 10,000 transactions free of cost and only pay when you want to download tax reports. They offer various plans depending on the user requirement with customizable options on request.

Visit Koinly Koinly Plans- Free Plan – Track and view tax liabilities up to 10,000 transactions for free. Pay only when you want to download specific tax reports like Form 8949, Schedule D, International tax reports.

- Newbie- Suitable for beginners having up to 100 transactions with downloadable tax reports. Pay $49 per tax year for this plan.

- Hodler- Suitable for ones having up to 1,000 transactions and wants to download tax reports. Get this plan for $99 per tax year.

- Trader- Buy this plan for $179 per tax year for up to 3000 transactions and $279 per tax year for 10,000+ transactions. Suitable for all time traders using multiple exchanges and wallets and making income from staking, mining and lending.

- They also offer customizable plans where you can request a quote.

Algo traders have used Koinly with 500K+ transactions; thus platform offers stable services across user types.

One needs to purchase a plan only when he wants to download various reports, thus ensuring you have a complete view of their offerings before deciding to go for it or not.

How to pay? They accept payments via Credit/ Debit Cards and cryptocurrencies (BTC, ETH, DAI, USDC).

You can view the tax report summary in the free plan and pay as per the plan to download the entire report. In a paid plan, one can download reports multiple times and is allowed to upgrade. However, the plans are valid for a specific tax year only. For example, if you pay for the 2019-2020 tax year, the plan is valid only for 2019-2020. To access reports for the new year, you need to purchase a new plan.

VIEW KOINLY PLANS Koinly Plans

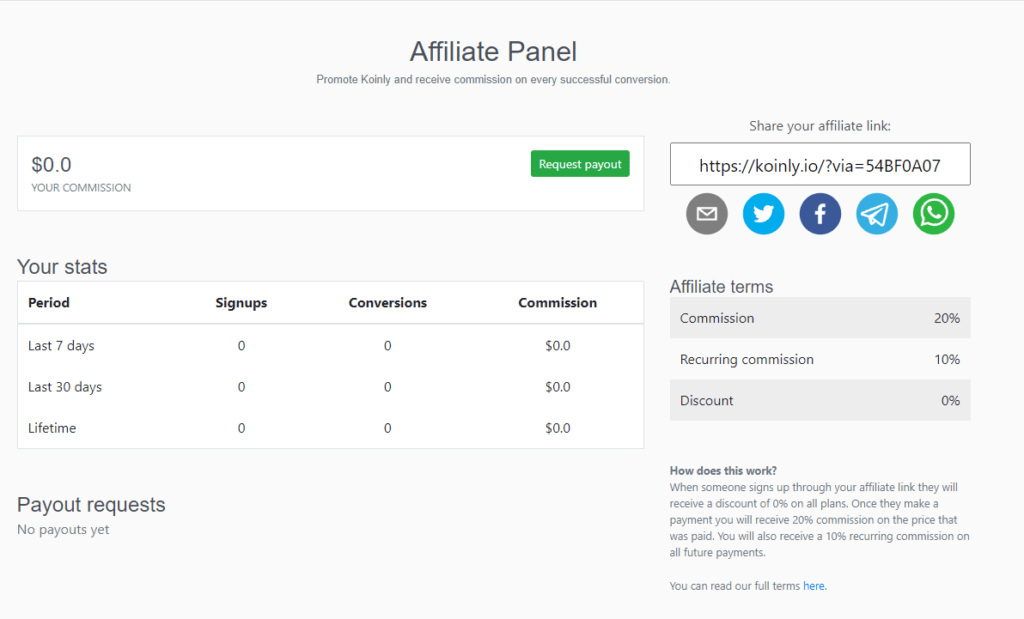

Referral Bonus/ Affiliates

Koinly Plans

Referral Bonus/ Affiliates

Koinly provides a lucrative referral structure to earn commissions up to 40%.

Features of Referral Scheme:

- Lifetime commissions through repeat sales as these plans are valid for a particular tax year the repeat ratio of users is high and thus gives a chance to make a regular income.

- Choose to get payouts in a Paypal account or Bitcoin/ETH.

- Payouts can be requested within 30 days through the affiliate panel.

- Spamming websites or emails with affiliate links is not allowed.

Referral Fee Structure- Payouts depend upon the number of paid users. One can aim for 40% payouts on 500+ referrals.

How to become eligible for referral payouts?Login to your Koinly account > Click on the account option on the top panel extreme right > Click on Refer Friends.

On the next page, you will see a unique link that you can share with potential referrals. Any referral using your link to join Koinly and purchase a plan gets you commissions.

Click on the Join Affiliate Program and acknowledge their T&Cs. Payouts are processed one time every 30 days and with a minimum payout of $100. One can choose his mode of payout.

EARN WITH KOINLY Referral payouts from Koinly

Types of Reports

Referral payouts from Koinly

Types of Reports

The platform provides detailed reports for users.

- Capital Gains/ P&L: This report will show long/short term capital gains accrued on your crypto transactions. Also displays profits/losses at every transaction.

- Other Gains: Gains made from future and options are treated as Business Income or Other Income and reflected in this report

- Income: Income earned from staking, lending, mining and other miscellaneous income are computed here

- Cost & Expenses Report: Koinly uses AI to detect costs incurred for realizing the gains. For example, charges levied on fiat transfer, brokerage on buying and selling, and transfers in and out of wallet are highlighted here.

- Gifts, donations & lost coins: Any form of free cryptos received or spent get accounted for in this report.

- Complete Tax report: This report shall give an end to end breakup on types of income and tax liability on such income. This report can be used for tax filing or export to other tax filing softwares like TurboTax, H&R, etc. In addition, the platform allows you to download various formats like Schedule D, IRS Form, International Tax reports depending on your country format.

Also Read: Cryptocurrency Tax – 5 Questions You Need To Be Asking [Bitcoin Tax]

Is Koinly Safe?Yes, Koinly is safe as it adheres to best practices ensuring the security of data at all points in time.

- The majority of platform services are hosted on AWS facilities which they are trying to bring 100% of their services under AWS now. Active data and data at rest both are in an encrypted format. Their API and application endpoints are TLS/SSL guarded with an “A+” rating on SSL Lab tests. This means they use strong cypher suites and have fully enabled features such as HSTS and Perfect Forward Secrecy.

- The audit trail over the Koinly infrastructure and Intercom application uses Graylog, AWS Cloudtrail and StreamAlert. Auditing allows them to do ad-hoc security analysis, track changes made to their setup and audit access to every stack layer.

- Most important, Koinly doesn’t store any payments related processes, i.e. does not store your card related details. Instead, all the payment processing is done via Intercom go through their partner, Stripe. Details about their security setup and PCI compliance can be found on Stripe’s security page.

Koinly can be used by beginners to traders for their tax-related compliances. It is a hassle-free platform for those users whose reports formats are available on the platform. However, if the report is not supported by your country then one needs to know about the relevant tax laws applicable in that country, accordingly change the settings to get accurate details. Thus it is more of a Do-It-Yourself platform with automated data entry to save your time. They also provide reviewers to review your portfolio and advise on critical tax-related issues.

VISIT KOINLY Frequently Asked QuestionsNo, the platform does not share any report with tax authorities. Think of Koinly as an intelligent excel spreadsheet that speeds up your calculating taxable gains and losses. In addition, Koinly does not even collect your KYC; you need only to share an email address to sign up. Thus, Koinly does not report data to anyone unless you choose to do so.

It accepts BTC, ETH, DAI, and USDC to purchase their plans.

Koinly adheres to best security practices and does not monetize your data by any means. It provides the best features compared to other software and has an easy-to-use interface needed by a DIY user.

You only need a valid email address to sign up; Koinly provides you with an auto-sync option using public keys and does not ask for any of your private keys. Alternatively, you can also import CSV files.

It is advisable to add all your exchanges and wallets for the accuracy of data. For example, if you have transferred coins from 1 wallet to another, it is not a transfer and does not attract any taxes. But if you have only added one wallet and not the other, the platform will not detect and show incorrect tax liability. Or continuing the same example, one coin was transferred to another wallet and then was exchanged for another coin is a taxable transaction. Thus it is recommended to add all of your exchanges and wallets for an accurate report.

Also read,

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.