and the distribution of digital products.

How to Identify the Best Copy Traders on BYDFI?

There are good traders to copy trades on almost all crypto copy trading platforms. However, some of these might be beginners with bad management skills and high-risk profiles, but some are excellent at their jobs.

This article will help you identify the best copy traders on BYDFI and give you an in-depth analysis when searching for the best copy trader to follow.

Summary (TL;DR)- Copy trading enables individuals in the crypto market to automatically copy all the positions opened and managed by the trader they are following.

- BYDFI trading and crypto trading also provide a copy trading option.

- One of the easiest ways to identify good copy traders is by investigating how much followers rely on them, and if they have fewer followers, then it is a bad sign.

- Before following a trader, always go through their profile and trading history.

- Look for all the negative returns and the profit they have made over time.

- Moreover, see the time they are holding the trade and get to know their trading style. Their style should always match your style of trading.

Copy trading helps you copy all the positions of professional traders with a single click. More specifically, whenever that expert opens or closes a trade, your account is also allowed to do the same.

However, this also means that if the expert’s account loses, your copied account will also lose. Hence, please be wary of reckless traders on various copy trading platforms.

To learn more, read, 7 Top Copy Trading Platforms [Important Read]

What is BYDFI Copy trading?BYDFI is a trading exchange platform that also offers copy trading options for traders. Through “BYDFI Copy Trading,” the exchange has screened some traders on top of the best records.

This is done weekly and provides accurate data for high-performing traders to help them gain more followers on the platform. Moreover, you can also be a part of the list as long as you are tactical, professional, and strategic.

How to choose the best copy trader?

How to choose the best copy trader?

There are a lot of parameters that one should keep in mind while opting for a copy trader, some of which are noted below.

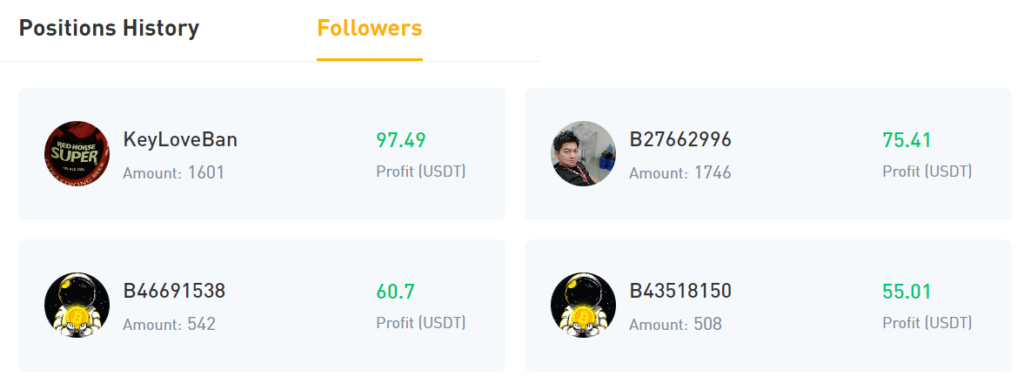

Trusted TradersOne of the quick ways by which you can identify a great copy trader is by investigating how much other followers trust them. You need to check out the amount of money other traders have invested.

Moreover, it would be best and will help if you also consider the profit that those followers are getting by following and investing in that signal provider. All this relevant information is there on their profile page.

Generally, if a trader you consider for copying trades has very few followers and copiers, it is considered a bad sign. However, the most copied trades also don’t mean they are definitely good traders.

VISIT BYDFI Followers

Trade Returns

Followers

Trade Returns

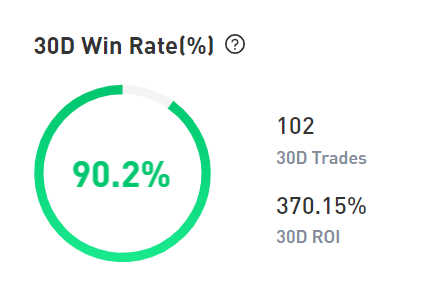

Negative returns are not a good sign. One should always look at the returns that the trader is making.

Very high returns may seem appealing but remember that annual returns of around 70% or more are not usual and are most likely down to high risk or luck. Moreover, before copying a trader, always look for the monthly returns to better understand the performance.

Always check the trader’s profit chart because you would want to go with a trader who has consistently risen in profit for a while.

All this should be evident through a steady, smooth rise in profits. If there is an irregular graphical representation, the trader might probably be gambling around, which would explain the alternating periods of huge losses and high profits.

Therefore, be extremely cautious of the traders who get unbelievably high winning ratios.

Trade Returns

Number of Trades

Trade Returns

Number of Trades

Another factor that should be pondered upon while evaluating the best copy trader to follow is the number of traders the copied trader undertakes.

It is a good indicator if the number of closed trades exceeds 100. Moreover, the number of trades made by a trader helps assess that the trader is an expert in the crypto market and his success is not just down to luck. Although, this also depends on the trader’s strategy.

Further, long-term traders tend to hold their positions for a long time, thus, fewer trades can be justified.

ConsistencyZoom in on the trader’s consistency besides just pondering on the number of closed trades. If a copy trader has several successive months and minimal losses in between will make an ideal trader copy trade.

Also, ensure that the trader is in the game for a while and deeply invested in trading.

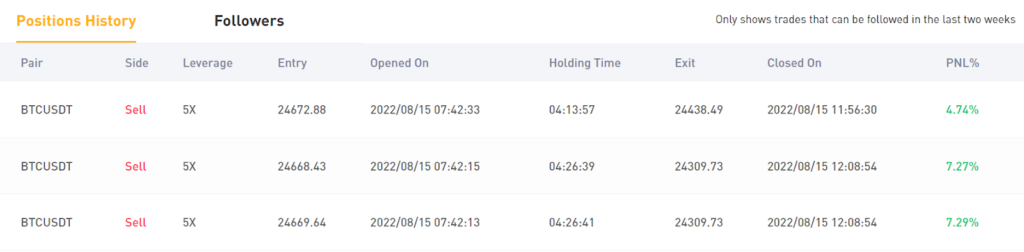

VISIT BYDFI Positions HistoryThe position history should not be neglected when looking for a profile to copy. Investigate all the positions that are currently open, and they should be available in the copy trader’s profile when you open the BYDFI trading platform.

This will give you information like which pair they have invested in, the leverage, the entry amount, which dates it opened on, holding time, exit amount, closed date, and the profit & loss ratio.

Moreover, if the trader whose position history you are looking into has many “reds,” i.e., the loss ratio is more than the profit ratio, this can be a bad sign. However, sometimes all this can be due to a market condition or a long-term investing strategy.

Postions History

Cumulative ROI

Postions History

Cumulative ROI

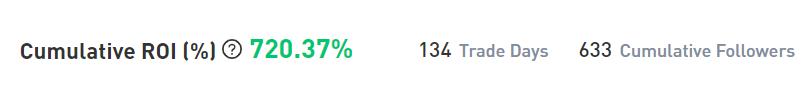

Cumulative ROI, or Cumulative Rate of Interest, is the total return on investment. This means that it is the aggregate amount that the trader has gained or lost over time, independent of the amount of time involved.

This cumulative return is expressed as a percentage, and the formula that is used to calculate this is Cumulative profit in history/ the maximum margin for a single order in history * 100%.

This percentage will tell the exact condition and profit earning of the trader you are willing to follow to copy trades.

VISIT BYDFI Cumulative ROI

Trading Styles

Cumulative ROI

Trading Styles

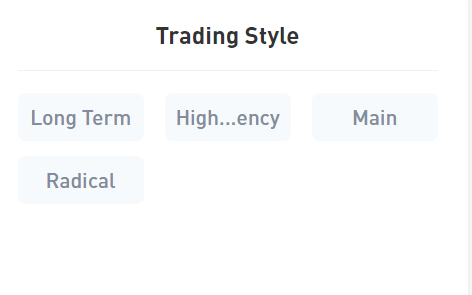

Look for the trading styles the trader follows: high frequency, low frequency, short term, long term, main, light trade, heavy trade, radical, steady, and mid-term.

If you are willing to invest according to their trading style, then you are all good to go. The trading style is present there in the trader’s profile. Moreover, you can also filter out the traders according to the trading style they follow.

Trading Style

Understanding the strategy and behavior

Trading Style

Understanding the strategy and behavior

Make sure that you read the profile description of the trader correctly before following them and also understand their trading style because it may or may not fit yours. Always try to assess all the closed operations to understand their strategy better.

Knowing your copy trader’s strategies and behavior is crucial for risk management, especially if you are following various traders to try and spread out the risk.

Moreover, be sure to compare their strategies alongside their trading history. Remember, if you are following two traders employing the same strategy, your risks are not well spread.

One of the great ways to understand your trader is by analyzing their profile properly.

In addition, examine how they behave after a bad run and whether they panic and then begin to change their way of doing things. Most professional traders try to stick to their tried and tested way of trading even after incurring a loss.

ConclusionWhen you decide to copy a trader, just think that the past performance is not always indicative of future results, which is why there are no guarantees while investing. Moreover, before going ahead with copying traders, it is essential to know the basics of copy trading for beginner traders.

Hope with this article, you are all set to start searching for your ideal copy trader to follow. However, if you are still not that sure, don’t hesitate to ask the trader about their trading activity and come to a conclusion.

VISIT BYDFI Frequently Asked Questions Is copy trading legal?Yes, copy trading is completely legal in most parts of the world, provided that the trading platform itself is properly regulated. Investing in the crypto market using a regulated broker simultaneously legalizes your account and all the other traders.

How does copy trading work?Copy trading usually starts to work when a trader opens a trade. The copier then copies the trade of the trader that he/she is following.

This usually happens automatically, without the requirement for any manual interventions. Further, you may make a profit or loss respective to the trader you have copied.

So, if they will make a profit, you will also make a profit, but if they incur a loss, you will also.

How to choose the best copy trading platform?Opting for the best copy trading platform is not as easy as you may think. It would be best if you considered a lot of factors while selecting your perfect platform. Below mentioned are some essential factors that should be kept in mind:

The platform should be properly regulated, and the security standards should also be high to make sure that all your investments are in a safe platform.

One of the most important factors is the number and quality of traders to copy. Traders should be good enough to copy trades from, and the platform should always provide you with a range of good traders.

Transparency is also one of those things that you should go behind. In general, you should be able to analyze, assess the strategy, understand the trading style, and track all the records of the trader you are willing to follow.

Check for the ROI and the number of days from which they are trading.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.