and the distribution of digital products.

DM Television

A Guide to Delta Exchange Futures Trading

Delta Exchange offers futures trading in Bitcoin and 50 other DeFi and altcoins with up to 100x leverage, which has all margin trading features and is generally superior to margin trade.

Even though investing in cryptos could be highly rewarding, the volatility and uncertainty associated with the cryptocurrency markets often dissuade people from directly investing in them. Investors often look for a mechanism or portfolio to help them hedge their investments against the associated risks and volatility. But with thousands of cryptocurrencies floating in the market, an individual investor is sure to get dazed and confused.

That’s where Delta Exchange steps in to solve all such investor worries by allowing them a backdoor entry into the crypto markets via derivatives. Derivatives such as futures, options, swaps, perpetual, etc., are one of the many ways by which traders can speculate on the value of the underlying asset and earn gains.

Delta Exchange Futures TradingDelta Exchange is a crypto derivatives exchange that lets traders trade in innovative products such as futures, options, interest rate swaps, etc., with up to 100x leverage. Futures contracts are one of the most popular derivatives traded on the exchange.

Investopedia defines a futures contract as “a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future.” Crypto futures derivatives are similar to a traditional futures contract. Futures are used to hedge the price movement of an underlying crypto asset to help prevent unforeseen losses from unfavorable price changes. Future contracts facilitate in-built leverage, which acts as a multiplier to your returns.

The price of a futures contract moves broadly in sync with the price of the underlying cryptocurrency. You don’t need to actually buy the underlying crypto asset. You simply speculate on its future value under a futures contract.

VISIT DELTA EXCHANGE Futures Trading with Delta Exchange

Futures Trading with Delta Exchange

Also, read A Guide to Binance Futures Trading

Advantages of Futures TradingTrading futures is an alternative route to buying or selling the underlying crypto. You earn profits in spot trading when you buy low and sell high, but this arrangement is possible only in a bull market. A bear market allows no spot trading. Futures contracts offer several advantages over spot trading:

1. Trading Profits in both bear and bull MarketsWith futures trading, you can profit by going long when the underlying crypto prices are rising and when the prices fall, you can go short and profit from the same. This futures feature helps you navigate profitably through all kinds of market conditions. In spot trading, on the other hand, you can either sell your crypto investment or suffer losses when prices are falling.

2. Hedging Price FluctuationsIn case the prices of the underlying cryptocurrency in a futures contract are falling, the trader can mitigate risks by going short. A short futures position would protect the downfall since the $ value of your portfolio would be effectively locked, and you do not need to sell your cryptocurrencies.

3. Multiplying Gains with LeverageLeverage helps you to open a bigger position than your trading capital. For instance, a 10 times bigger opening position means a 10x leverage. Delta Exchange allows maximum leverage of up to 100x for futures listed on the exchange. While spot trading offers a 1x leverage, margin trading offers 3x-4x leverage, which means futures trading is a lot more capital efficient than any of the two as it provides several-fold higher leverage.

The second thing to note is that in leverage, the trade position opened is higher than the capital deployed, the impact of price movements gets amplified, which in turn means, amplified trading gains.

Also, read Best Futures Trading Signals

Why Trade Futures with Delta Exchange?Delta Exchange offers futures trading in Bitcoin and 100+ other DeFi and altcoins, including BNB, Cardano, Solana, Ripple, Ethereum, ATOM, Stellar, etc. The crypto futures at Delta exchange offer all margin trading features and are generally superior to margin trade.

Delta Exchange offers lower trading fees, tight spreads, and deep order books of the futures contracts that increase the profitability of your trade. It offers improved risk management in the form of TP/SL (Take Profit/Stop Loss) settings with your order. You can also leverage advance order types and other instruments such as options, interest rate swaps for creating more hedging strategies simultaneously. The exchange has professional charts and advanced analysis tools to help you quickly identify trading opportunities.

How to Trade Futures with Delta Exchange?Getting started with your trading journey at Delta Exchange is a matter of a few steps and minutes. If you are already into derivatives trading and understand how to use technical charts and order books to transact orders, you can begin immediately. If you are beginning anew, you can start your practice sessions with Delta Exchange’s Mock trading feature first. Once comfortable, follow these easy steps to start trading in futures:

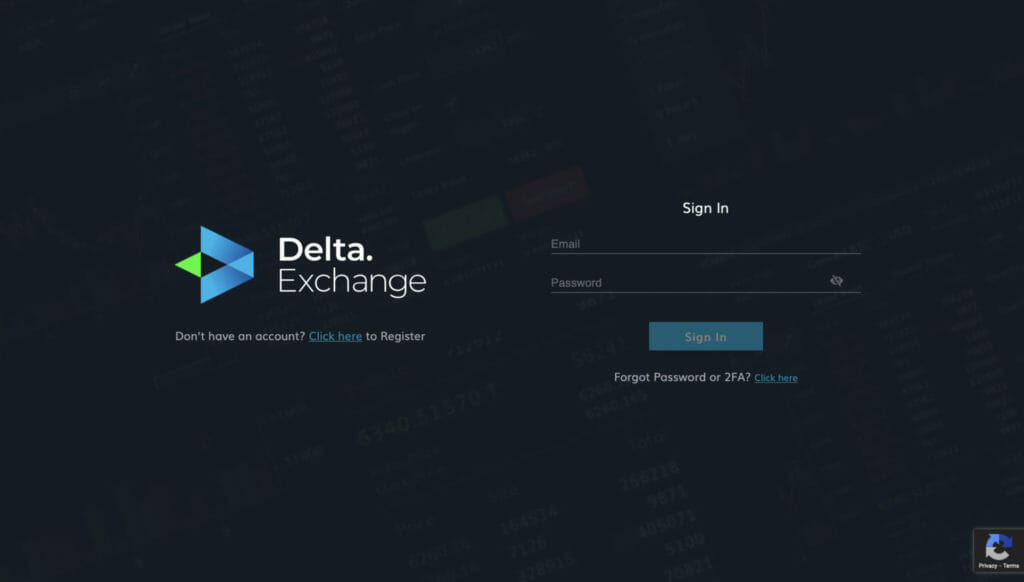

- Log in to your account on the Delta Exchange website. If not registered, sign up on the delta exchange by filling in all the necessary details and clicking on sign up.

Log in at Delta exchange

Log in at Delta exchange

- You will receive a code on your registered email address which you need to enter on the website to complete the sign-up process.

- After completing the sign-up, deposit the initial amount with which you want to start trading in futures on the exchange. You can deposit funds in either BTC, USDT, DETO, or ETH. Copy and paste the address on the platform from where you want to transfer the funds. Conversely, you can scan the QR code displayed on the website to deposit funds. If you need a detailed tutorial on how to deposit or withdraw funds on the exchange, watch this video tutorial by Delta Exchange.

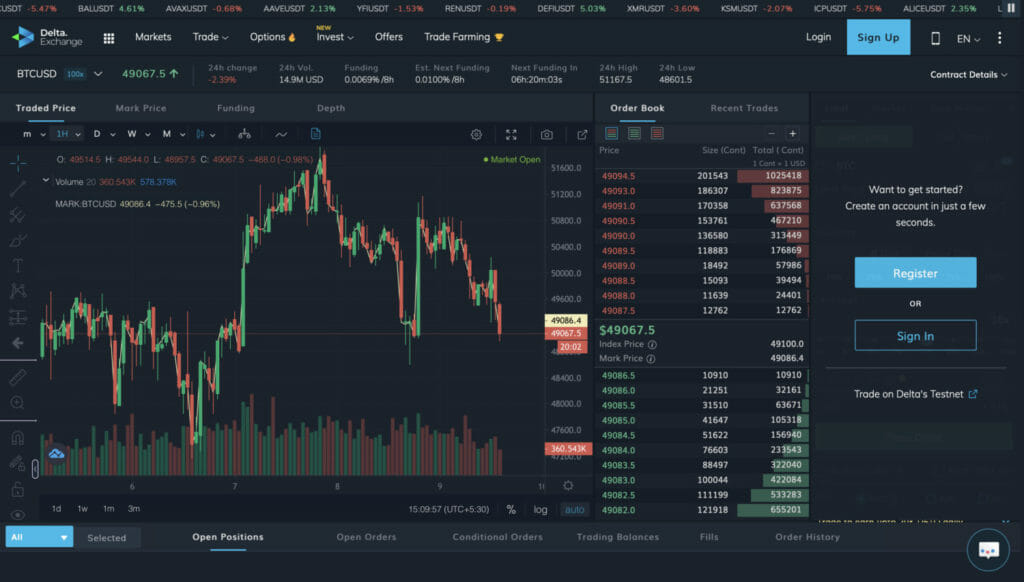

- Once done, click on the ‘Trade’ option in the top taskbar on the website.

- Click on Futures next. You will be directed to the trading dashboard. Choose the type of Future contract you want to trade in.

Click on futures and start trading

Click on futures and start trading

- After studying the price charts and order books, head over to the far left section of the website where you need to enter the details of the contract – whether you want to buy/sell, the limit price, quantity, leverage, etc.

- Click on ‘Place Order’ and voila you are done with placing your first Futures order.

We hope you found this article invigorating and the tutorial educative enough to help you climb your trading ladder on Delta exchange. Hop in at Delta Exchange to know more about Futures and other derivatives and begin your derivatives trading journey most securely with Delta Exchange.

START TRADING WITH DELTA EXCHANGEAlso read,

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.