and the distribution of digital products.

DM Television

The Future of DeFi: Perpetual Constant Maturity Options (PCMOs)

\ Since the introduction of Decentralized Exchanges (DEX) with EtherDelta in 2017, Decentralized Finance (DeFi) is reshaping financial markets, providing new alternatives to traditional financial systems. However, as DeFi matures and integrates with traditional finance (TradFi), critical challenges remain, most notably, the absence of a standardized interest rate mechanism for crypto assets. Unlike traditional financial markets, where interest rates influence asset pricing and risk assessment, crypto markets lack a natural cost-of-carry framework.

\ This article explores the evolving DeFi landscape, examining how existing trading solutions—ranging from centralized exchanges (CEXs) and Automated Market Makers (AMMs) to perpetual futures—attempt to address these structural gaps. It then explains how Perpetual Constant Maturity Options (PCMOs), already introduced by some initiatives like 1xMM, present a potential breakthrough in bridging DeFi with traditional financial frameworks.

The DeFi landscape: a continuously evolving ecosystem disrupting traditional financeAs DeFi continues to mature towards the integration of TradFI, the industry faces a persistent challenge: achieving an optimal balance between decentralization, efficiency, and user protection. The decentralized finance (DeFi) ecosystem has evolved into a diverse landscape of trading solutions, each presenting its own advantages and challenges. Centralized exchanges (CEXs), such as Binance and Deribit, offer high liquidity and ease of use but introduce counterparty risks, elevated fees, and centralized asset control. On the other hand, Automated Market Makers (AMMs), like Uniswap and Curve, facilitate permissionless trading yet struggle with issues such as impermanent loss and liquidity fragmentation, which Layer 2 solutions (like dYdX) aim to address.

\ Yield farming platforms like Aave and Compound provide opportunities for passive income but often lack full transparency and necessitate over-collateralization, reducing capital efficiency. Meanwhile, decentralized perpetual futures platforms, including GMX and PERP, enable leveraged trading but expose users to significant volatility and short-term contract limitations

Interest Rates: a major challenge for crypto assetsCryptocurrencies occupy a unique position in financial markets. While often perceived as “digital” currencies, their price behavior resembles that of commodities. They function as a hybrid between fiat currencies and precious metals — serving as a store of value akin to digital gold while also being a medium of exchange like fiat currencies. However, a key distinction sets them apart: the absence of intrinsic interest rates.

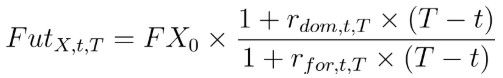

In traditional finance, the cost of carrying an asset is typically assessed through interest rates, which also influence the pricing of futures contracts. For instance, in foreign exchange (FX) markets, the price of an FX futures contract incorporates interest rate differentials:

\

\ However, when applied to cryptocurrencies, this model breaks down:

\

- Futures prices in crypto markets exhibit extreme volatility, frequently oscillating between positive and negative funding rates within seconds — akin to “volatile” commodities rather than fiat currencies

\

- Unlike traditional assets, cryptocurrencies do not have a natural risk-free interest rate, making it difficult to establish a standardized cost of carry. In most situations, Futures prices lead to significantly negative interest rates, if we apply the usual FX futures formula

\ This absence of interest rates presents a fundamental challenge: there is no inherent mechanism to determine the cost of holding crypto assets over time. This gap complicates risk assessment and financial planning for individuals and institutions holding digital assets.

Perpetual Futures: a proxy for opportunity cost that come with structural limitationsPerpetual futures contracts provide continuous exposure to short-term futures prices while incorporating funding rates designed to approximate the cost of holding a position. The perpetual funding rate is determined by the difference between the theoretical weighted order book price of an asset and its spot market price (or an index representing its average spot price). This mechanism aims to balance market forces by incentivizing traders to take positions that align with market trends.

\ While perpetual funding rates serve as a proxy for opportunity cost, they come with notable limitations:

\

- The order book is not a guaranteed predictor of future price movements, leading to scenarios where funding rates favor traders with profitable positions rather than offsetting their losses

- The funding rate does not always reflect actual market price changes; it can remain at zero even during periods of high volatility

- Investors in leveraged positions are exposed to substantial capital gains or losses, which can far exceed any compensation received from funding rate payments

\ These limitations highlight the need for a more refined mechanism that accounts for long-term cost structures and asset volatility while maintaining the flexibility of perpetual instruments.

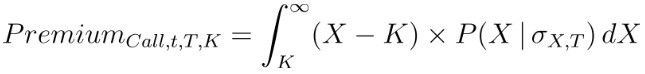

Perpetual Options: the first faltering steps for advanced rate mechanismsTraditional finance relies heavily on vanilla options (calls and puts), which provide traders with valuable exposure at a fraction of the underlying asset's value. Options pricing incorporates the potential future movements of an asset through implied volatility, as seen in the Black-Scholes model:

\

- Options allow investors to gain exposure by paying only the premium rather than the full asset value.

- The option premium reflects the expected future returns of an asset beyond the strike price, making options an effective tool for measuring the cost of carrying an asset. e.g.

\

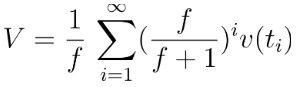

\ However, standard vanilla options come with an inherent limitation: a fixed maturity date. To address this, FTX introduced the concept of perpetual options — an innovation designed to eliminate expiration constraints by maintaining a rolling basket of vanilla options with a fixed strike price and infinite duration:

\

\ Where:

\

\ Despite its potential, the FTX perpetual options model faced sustainability issues. Once an option moved in-the-money, the seller was indefinitely obligated to pay the funding cost, regardless of future market movements. This structure led to a convergence where the perpetual option functioned more like a direct investment in the underlying asset rather than a viable derivatives instrument.

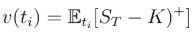

Perpetual Constant Maturity Options: bringing Perpetual Options to the next levelA more robust alternative to Perpetual Options is the Perpetual Constant Maturity Options (PCMO): vanilla options with constant maturity, perpetually rolled over and regularly strike-adjusted.

\

\ Where:

- Xt is the cryptocurrency spot price

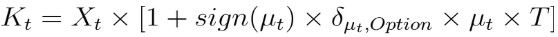

- Kt is computed such as:

\

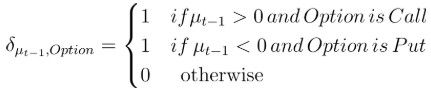

\ And mu(t) is the drift of the asset and delta function is defined as:

\

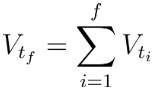

\ These instruments maintain a rolling structure while incorporating variable strike prices, which are re-evaluated at fixed intervals (f - the fixing period). An investor holding a PCMO from t1 to tf gets:

\

\ By doing so, PCMOs offer several advantages:

\

- The contract remains perpetual but avoids the pitfalls of fixed-strike perpetual options

- The dynamic strike adjustment ensures that both buyers and sellers can benefit from market fluctuations

- The structure is designed to counterbalance the directional biases observed in the futures markets

\ PCMOs provide a new approach to the absence of interest rates in crypto markets. By continually resetting strike prices and maintaining constant maturity, they offer a mechanism that better represents the cost of carrying an asset while preserving the flexibility and liquidity benefits of perpetual instruments.

Conclusion: PCMO as the future of DeFiAs DeFi evolves, the need for robust financial instruments that account for asset carry costs becomes increasingly obvious. The absence of natural interest rates in the crypto market creates challenges for risk management and valuation. While perpetual futures have provided a partial solution, their reliance on order book dynamics and funding rates introduces inefficiencies.

\ Perpetual Constant Maturity Options offer a promising innovation that enhances market stability while maintaining the advantages of perpetual contracts. By dynamically adjusting strike prices and continuously rolling over maturities, PCMOs offer a more sustainable method for representing opportunity costs in the DeFi ecosystem. As these instruments gain adoption, they have the potential to bridge gaps in crypto financial ecosystems, shaping a more sophisticated and efficient DeFi landscape.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.