and the distribution of digital products.

Educational Byte: Decentralized Escrow—What It Is and Why You Should Use It

\ “Escrow” has been a security measure in traditional finances for a while, long before the appearance of cryptocurrencies and decentralized systems. The point was opposite to decentralization, indeed: escrow implies middlemen. A trusted third party, often a company, mediates between two strangers and keeps the funds involved in their trade safe until it’s complete. That same third party could solve disputes about the trade if they arise.

\ On the other hand, a decentralized escrow involves a platform that allows two parties to securely exchange assets without relying on a third-party intermediary like a bank or lawyer. Instead, it uses smart contracts—self-executing agreements on a distributed network—that hold funds until specific conditions are met. This reduces fraud risk and ensures fair transactions without trusting a central authority.

\ For example, in a peer-to-peer (P2P) sale, a buyer deposits funds into a smart contract. The seller then delivers the agreed product or service. Once the buyer confirms receipt, the smart contract releases payment. If there’s a dispute, an arbitrator (often chosen in advance) can step in, ensuring fairness. This method can be applied, among other uses, to crypto trading, freelance work, and digital goods purchases.

\

Centralized vs. Decentralized Escrow ServicesCentralized escrow services offer convenience and structured dispute resolution but come with notable drawbacks. Since a company manages the funds, users must trust its security measures and policies. These services often charge significant fees (even up to $450,000 per international arbitration), which can be costly for individuals and small businesses. Additionally, they require compliance with their specific rules, which may vary by region. Dispute resolution through arbitration can be expensive and time-consuming, particularly for complex cases, making it an option mostly accessible to larger enterprises.

\

Decentralized escrow removes intermediaries, reducing costs and increasing autonomy. Smart contracts automate transactions, ensuring that funds are only released when agreed-upon conditions are met. An important consideration is that those smart contracts aren’t controlled by a central party. They exist inside a distributed, open network that only takes small transaction fees for every contract. Their code is already done, and it often can’t be changed.

\ This system enhances security by eliminating the risk of an escrow provider mismanaging or freezing funds. Furthermore, decentralized escrow can be accessible worldwide, without restrictions based on location or bureaucracy. In cases where disputes require human intervention, digital arbitration can still be integrated, often at a lower cost than traditional legal services.

\ Now, despite its advantages, decentralized escrow has some challenges. Smart contracts require careful coding to prevent vulnerabilities (it’s important to pick a reputable platform), and not all disputes can be resolved automatically. For cases involving subjective judgment, human arbitrators are still necessary. However, the transparency and efficiency of decentralized systems make them a promising alternative to traditional escrow, particularly for digital transactions and global trade.

\

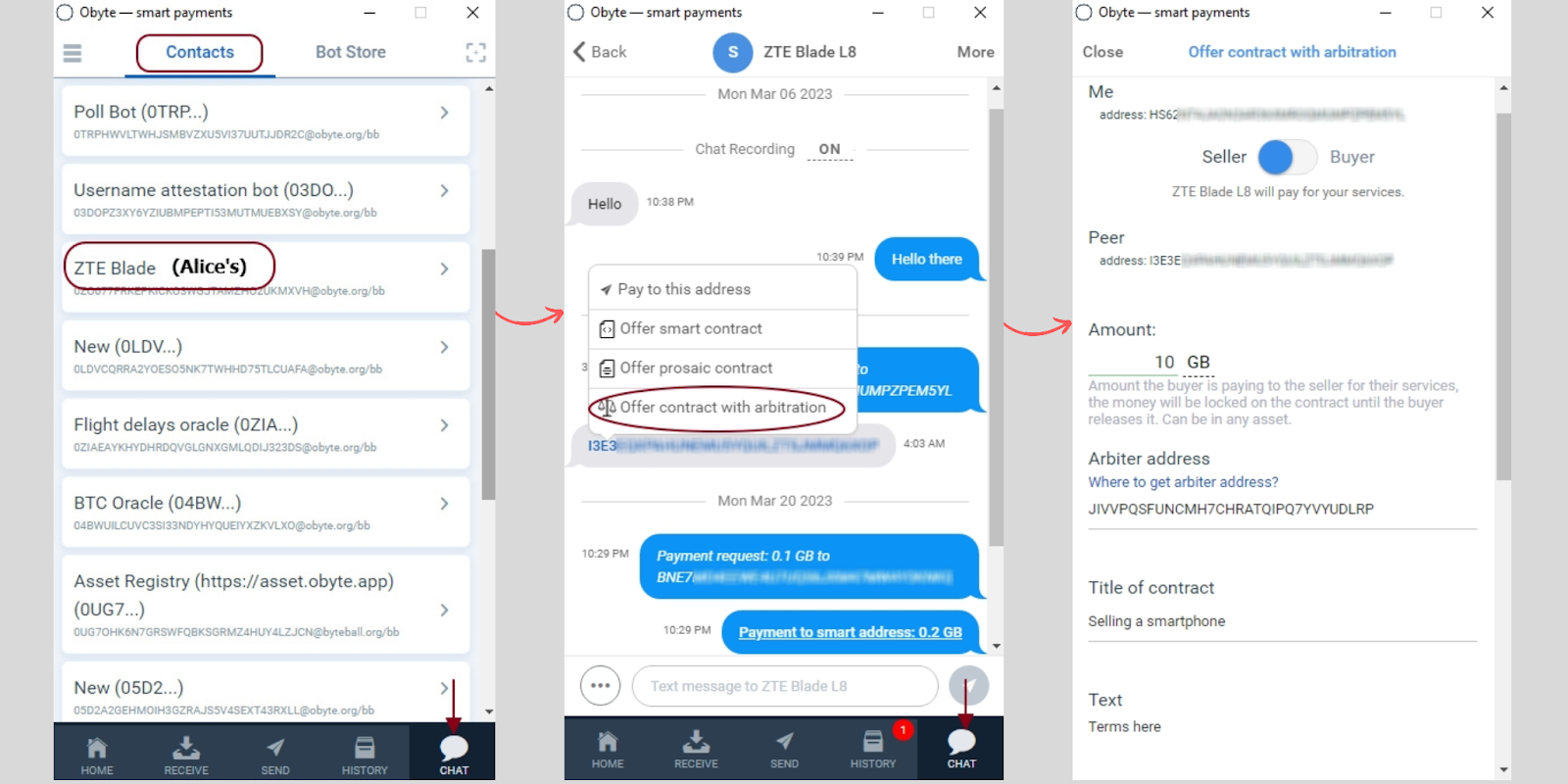

Create a Contract with ArbitrationObyte offers a fully decentralized way to handle secure transactions through its contract with an arbitration system. Unlike traditional smart contracts that rely on public data or oracles, these contracts allow users to set personalized terms and involve a human arbiter in case of disputes. Funds are locked within the contract and only released when both parties agree that the terms have been met.

\

\ If a dispute arises, an arbiter steps in to review the evidence and make a final decision. This system ensures that transactions are safe, efficient, and not dependent on centralized authorities. The ArbStore platform serves as a marketplace for professional arbiters who can be chosen to oversee contracts. These arbiters are real individuals with verified identities and expertise in areas like law, business, and technology.

\ Users can browse arbiter profiles, check their experience and fees, and select one before finalizing a contract. Fees for arbiters typically range from 2% to 5% and are only charged if a dispute occurs. Additionally, a small fixed fee of 0.75% applies to all contracts with arbitration. If an arbiter makes an unfair decision, users can report them to ArbStore moderators for further review.

\

Using Obyte’s wallet, setting up a decentralized escrow with ArbStore is simple. Users first discuss and draft their contract within the wallet’s encrypted chat. Once both parties agree, the contract locks the funds and includes the selected arbiter’s address. If everything proceeds smoothly, the buyer releases the payment. If a dispute arises, the arbiter evaluates the case and resolves it. This system eliminates reliance on expensive intermediaries, ensuring a trustless, cost-effective, and censorship-resistant way to conduct transactions securely.

\ \ \

:::info Featured Vector Image by stockgiu / Freepik

:::

\n

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.