and the distribution of digital products.

DM Television

Dell just scored a $9B AI server deal but can it actually profit?

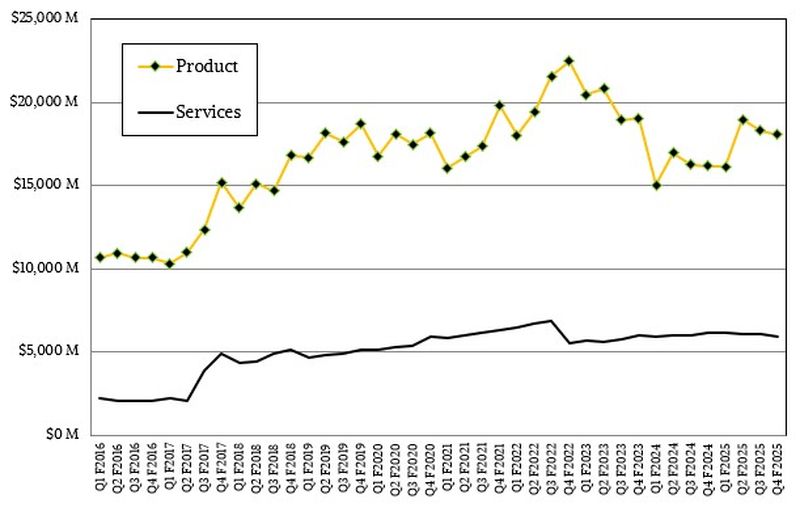

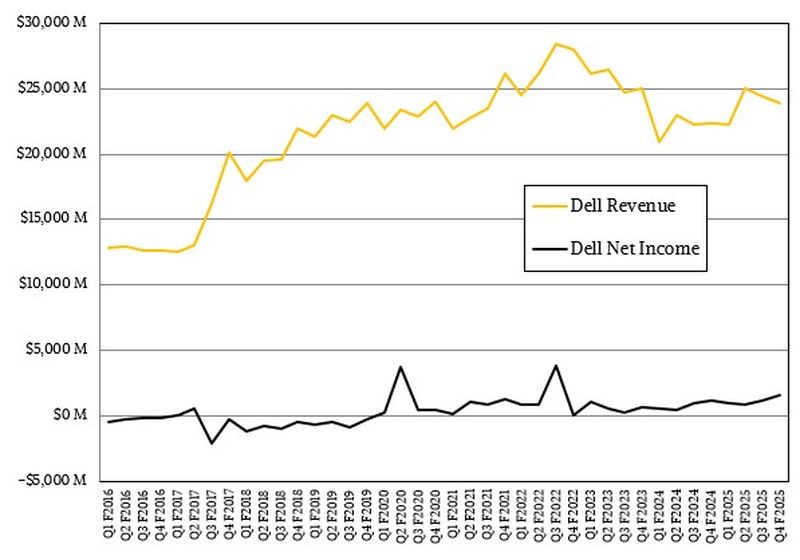

The high-performance computing market remains challenging for server manufacturers like Dell, Hewlett Packard Enterprise (HPE), and Lenovo, especially amid increasing demand for AI servers. Despite growing deal flow, profitability is hampered by thin margins.

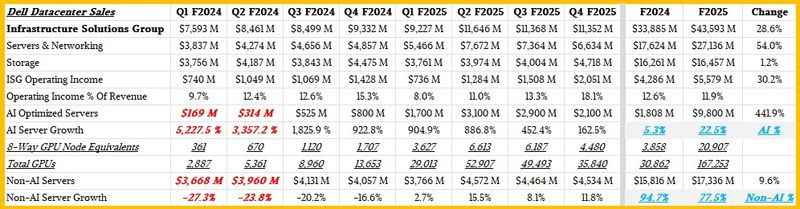

AI servers are flying off the shelves: So why aren’t they paying off?A recent analysis by The Next Platform reveals that while AI server deals boost total revenues, they diminish profitability per dollar earned. Notably, the gross margins for AI servers are around 5%, in contrast to traditional servers, which typically yield margins three times higher. Dell’s CEO stated that their expectations for AI server revenue for fiscal 2026 are at least $15 billion.

In the fourth quarter of fiscal 2025, which ended in January 2025, Dell reported AI server revenue of $2.1 billion, down from $2.9 billion in the previous quarter and significantly lower than Q2’s $3.1 billion. The fluctuation underscores the unpredictable nature of AI hardware sales.

Image: The Next Platform

Image: The Next Platform

Timothy Prickett Morgan of TNP noted that most of the margins from building AI systems are absorbed by Nvidia for GPUs and interconnects. Other companies like AMD and Intel receive minimal revenue shares from the lucrative AI server market. Morgan added that the margins from enterprise servers, which are considered more profitable, are significantly higher.

Microsoft’s 50-year celebration comes with a secret AI surprise

Dell ended Q4 with an AI server backlog of $4.1 billion, which expanded to $9 billion after securing a $4.9 billion deal with xAI. This indicates potential demand as enterprises look to integrate Generative AI workloads into their systems.

Image: The Next Platform

Image: The Next Platform

In terms of overall revenues, Dell aimed for approximately $97 billion in fiscal 2025 but only achieved $95.57 billion. In its Infrastructure Solutions Group (ISG), which manages servers, storage, and networking, Dell posted $11.35 billion in sales, representing a 21.6% year-over-year increase. Amidst this, non-AI servers contributed $4.53 billion, marking a 11.8% rise.

Datacenter storage generated $4.72 billion in sales, despite a modest increase of 5.4%. This storage revenue aids in balancing the lower margins from AI server sales. Dell is also focusing on selling more of its proprietary storage solutions, which typically offer higher margins.

Image: The Next Platform

Image: The Next Platform

Looking back at the performance, Dell’s net income for the January quarter rose to $1.53 billion, representing 6.4% of total revenue, the highest in recent times. As the market for AI servers evolves, Dell’s strategies appear aimed at mitigating profitability challenges while leveraging its position as a leading server manufacturer.

Featured image credit: Dell

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.