and the distribution of digital products.

Crypto Tax in India: Are you Supposed to do Your Taxes?

Have you been earning profits and making money on cryptocurrency but unaware of the tax implications? The crypto tax in India is already complicated; adding crypto assets to it makes it extra challenging. The regulators globally are fixing to lay down a framework around legal and tax aspects for digital assets. In the past 1-2 years, there has been a massive surge in the number of investors, traders, miners, and stakers who earn from crypto assets. Thus the requirement of regulations needs to be expedited.

This article will cover legal and tax aspects from the viewpoint of Indian laws on income generated through crypto-assets.

Summary (TL;DR)- The income generated through cryptocurrency is taxable. However, different rules and tax rates apply depending on the source and mode of income.

- In addition, transaction fees you receive from mining are valid for taxation as income from other sources.

- However, the new crypto tokens your receive are not taxable on sale as this self-generated asset has no acquisition cost and does not come under the ambit of current laws.

- Interest payments received in coins on staking are also taxed as interest income under income from other sources.

- Gifts received are also taxable, subject to certain relaxations. For example, the total value of crypto coins received from friends throughout the year is taxable if the same exceeds INR. 50,000.

The question of tax only arises:

- When one realizes gains/ profits on a trade, thus, one is liable to pay taxes only when a sale/ transfer has taken place. Therefore, only buying crypto assets does not bring any tax implications.

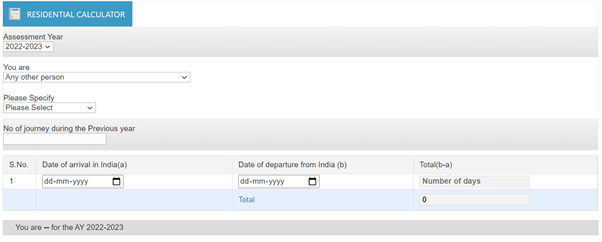

- Moreover, whether tax is applicable on you or not, in India is dependent on your residential status. As per Income Tax laws, if you are an Indian Resident, your gains made through crypto transactions anywhere in the world will be taxable in India. For example, as per the law, you are an Indian resident, and perform crypto transactions on a foreign exchange example in Estonia while sitting in India will also be feasible for tax as per Indian laws only. Therefore, non-resident trading on Indian crypto exchanges is also liable for taxation in India. In contrast, if they trade on an exchange outside India, they are not exposed to taxation in India. Check your residential status here.

Residential status

Residential status

If you fulfil the above two categories, you are liable to pay taxes whether you are an individual, HUF, partnership, or a company dealing in cryptos.

Crypto Tax in India: How to own a Bitcoin?- Mining: A gold miner extracts gold from gold mines. Similarly, crypto miners use computing prowess to solve complex puzzles/ algorithms/ codes/ and record data globally on the blockchain to get rewards with crypto tokens and transaction fees during mining. For example, bitcoin miners receives a new bitcoin as a reward during the mining process and a transaction fee for completing the blockchain and ensuring the authenticity of the transactions recorded.

- Buying: Buying it from crypto exchanges using FIAT and storing it in Hard or Soft wallets in digital form.

- Legal tender: This can be used to consider the sale of goods and services instead of real currency. Currently, in India, RBI does not recognize cryptocurrencies as a legal tender for payments.

- Staking: While staking (similar to lending) your crypto assets, you receive interest payments in the form of additional coins.

- Gift: Receiving cryptocurrencies as a gift from someone.

Indian tax laws are inclusive, i.e., any and every income earned from any source is taxable unless explicitly exempted. By this definition, earnings from crypto are also taxable. Therefore, if crypto earnings are not reported and offered to taxes, it shall be considered non-compliance. This can lead to a levy of penalties, fines, and tax authorities can also issue a search warrant for suspected unreported income through investigative sources. This makes it mandatory for crypto adopters to report and pay taxes on their crypto transactions quickly.

Cryptocurrency for investment basisCrypto assets can be treated as a currency or a capital asset. In India, the central bank, i.e., RBI can grant a legal tender. Currently, cryptocurrency has not been approved as a legal tender; however, the RBI might launch trials for Indian CBDC by the end of December 2021, i.e., to be used as a medium of exchange (the way we use Rs. 10-2000 currency notes). However, that does not mean the cryptocurrency is illegal in India, yet.

The Supreme Court of India, in their 2020 judgment, noted that cryptocurrency could be capable of being accepted as valid payment for the purchase of goods and services, and the RBI can regulate payment systems thus, awaiting framework from regulatory authorities.

Similarly, the finance ministry is proposing a bill on the cryptocurrency framework. Also, note if the government bans the asset class in the future, there will be a grace period to settle your transactions and not a spot ban like demonetization of Rs. 500-1000 notes which happened overnight.

Countries like the US and UK have offered some clarifications on considering crypto assets as property. Thus, their taxation will be in line with how other properties/ assets are charged to tax in these countries.

Thus with the current Indian laws, crypto-assets are classified as capital assets. Accordingly, users also purchase cryptos to hold for investment purposes, and such gains are valid for taxation in line with the tax on capital gains.

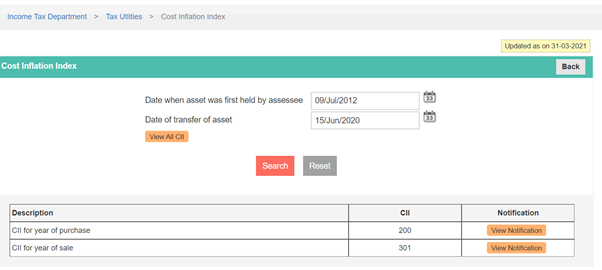

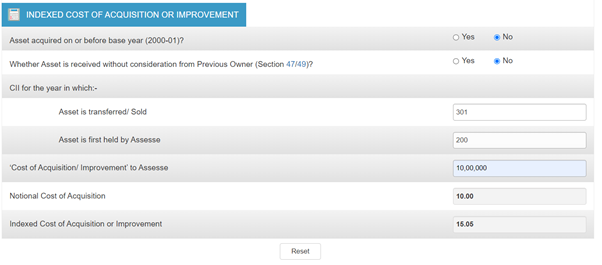

Therefore, for any crypto asset sold within 36 months (<=36) of buying/ receiving it, the gains shall be taxed as Short Term Capital Gains, taxed per slabs. If the same is sold after a holding period of more than 36 months (>36), it will be charged as Long Term Capital Gains and taxed at a flat 20% with the benefit of indexation. Indexation allows purchase/acquisition cost to be adjusted with the inflation rate, thus increasing the purchase/acquisition cost and reducing the absolute gains.

ExampleShort-term capital gains: Cryptocurrencies sold in less than 36 months of purchase/ receipt, i.e., with no indexation benefit on gains.

Long-term capital gains: Cryptocurrencies transferred/sold after 36 months, i.e., with indexation benefit.

*The inflation index value is available on the income tax website. Click here to know the inflation index value.

Inflation Index Value

Inflation Index Value

To calculate the indexation adjusted cost of acquisition, click here.

Indexation Adjusted Cost

What taxes are applicable for short term trades?

Indexation Adjusted Cost

What taxes are applicable for short term trades?

If frequently traded with an intent to benefit from the quick move-in prices, i.e., benefit from the volatility, it cannot be considered for investment purposes and is construed as trading. The gains from trading are liable to taxes as business income and not capital gains. Moreover, tax is also applicable to the business profits as per slabs at different income levels.

The computation of business profits allows deduction of expenses incurred to earn that income. Operating expenses such as brokerage, internet, hardware, and software can be deducted if the income is earned through trading or speculation. However, doing the taxes when you make over a hundred trades in a day can get really tiresome at once. Therefore, we recommend you use a crypto tax tool such as TokenTax or CoinTracking.

Mining of crypto assetsMining is an integral part of the entire decentralized clearinghouse where transactions are validated and cleared. Mining rewards the miner in two forms:

- New coin

- Transaction fees

Currently, the given trend, users prefer mining to get rewards by free crypto tokens.

The implication of GST Laws on CryptoMoreover, unless specifically exempted, any business activity about cryptocurrencies or crypto assets is also liable for GST if total turnover exceeds the specified limit.

In the current context, Indian crypto exchanges are already levying GST on their users. This is present in the trading fee that exchanges add to the buying price of the cryptocurrency. Furthermore, the exchanges pay the GST to the government as part of their general tax payments.

Recently, the Central Board for Indirect Taxes and Customs (CBIC) has received a proposal from the Central Economic Intelligence Bureau (CEIB) to bring cryptocurrency exchanges and platforms under the GST purview. It suggests treating mining as a supply of service as it generates cryptocurrency and charges transaction fees. Hence, such cryptocurrency will classify as an intangible asset and attract a GST of 18 per cent.

CBIC

CBIC

If the same applies, cryptocurrency miners will also have to register under GST if their annual revenue exceeds INR 20 Lakhs. GST will be calculated on the total transaction fee and the reward, i.e., the free crypto-token, where the value of currency mined will be as per the ongoing market value when the cryptocurrency was received.

The implication of Income Tax LawsIn the current construct, in the absence of clear laws by the government, the mining income, i.e., transaction fees, will be taxed as income from other sources.

However, for newly generated coins, i.e., tokens received as rewards, the taxability will only arise when sold/ transferred; however, we would require the cost of acquisition/ purchase to compute the capital gains.

The cost of acquiring this self-generated coin cannot be established as per the provisions of Section 55 of the Income-tax Act, 1961.

Therefore, the capital gains computation mechanism fails following the Supreme Court decision in the case of BC. Srinivasa Shetty. Hence, no capital gains tax would arise on the mining of bitcoins.

However, alternatively, in the foreseeable future, the regulators can make the free coin taxable under income from other sources at the coin’s fair market value when it was mined.

To summarise, at present, the coins earned through crypto mining are NOT TAXABLE.

Income from staking coinsBefore we understand income from staking, let us know the difference between staking and mining, i.e., the concept of Proof of Stake & Proof of Work concept. The reward system for bitcoin mining is also called Proof of Work and involves increasing the amount of computing power needed to mine in the blockchain. However, the proof of work comes with its drawback, the foremost one being mass energy consumption as the blockchain network expands. Furthermore, the bitcoin blockchain network is hard to be hacked because the hackers need to control 51% of the total computing power, which is difficult for bitcoin, but the same is not valid for smaller blockchains that can be prone to hacking.

The Proof of Stake concept was established to overcome this drawback.

You can also read about How Bitcoin Mining Work?| How Ethereum Mining Works

In the proof of stake, the person needs to hold the coin for an indefinite period. After that, the coins stored in your wallet will disappear, and you earn interest on the value of the coins. This is similar to how a savings bank account operates. The longer you hold the coins, the higher the interest you receive as a reward. The moment you remove the coins from the wallet, the staking process stops, and so does your passive income. Thus, the yield depends on the holding value of the coins. Moreover, the yield generated is paid out in the form of coins only.

Thus the coin received for interest from staking is charged as interest income under income from other sources where the value of the coin received is charged to tax.

Cryptocurrency received as a giftWith the innovative gifting options, many crypto exchanges allow you to gift crypto coins to others. However, when you give someone as a gift, the same could be taxable as a transfer under capital gains unless expressly excluded by section 47 of the Income Tax Act, i.e., transfer to a relative, by will, under succession will not be considered as a transfer of capital asset.

The gift received is taxable if the total value of the crypto received exceeds INR 50,000. Moreover, suppose it is obtained from your relative, the occasion of marriage, succession is not taxable even if the total value of crypto assets received throughout the year exceeds INR. 50,000.

Examples- Receiving bitcoin from a friend for free, i.e., a gift is taxable if the total value of coins received exceeds INR. 50,000.

- Cryptos received on occasions like marriage or inheritance shall not be taxable even if received from a friend.

- Coins received from relatives (definition as per Income Tax Act) are not taxable even if the total value throughout the year exceeds INR. 50,000.

For a detailed understanding of the taxability of gifts, refer to our detailed article here.

Crypto Tax in India: ConclusionAt present, there are no clear regulations defined for cryptocurrency transactions. Therefore, the above views are expressed solely from an extended reading of the current laws on 16th August 2021. If there are any specific laws defined for tax and legality of cryptocurrencies, the above views will change. However, until further amendments to the regulations, these views can be considered while filing your tax returns to be in a compliant status and not under-reporting any of realized income.

Frequently Asked Questions (FAQ) Is cryptocurrency taxable in India?In India, cryptocurrency may be subject to taxation, but the laws are currently unclear because the Reserve Bank of India has not yet accorded this asset class legal tender status. The Indian Supreme Court, on the other hand, allowed banks to handle cryptocurrency transactions from merchants and exchanges in March 2020.

Is Bitcoin legal in India 2021?Bitcoin and other cryptocurrencies are currently not banned in India, although they are unregulated. However, the government intends to introduce the “Cryptocurrency and Regulation of Official Digital Currency Bill, 2021,” which is expected to definitively clarify the government’s position.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.