and the distribution of digital products.

DM Television

Crypto Analyst Unveils Shocking Altcoin Season Forecast

In a bold series of posts on X on January 14, prominent crypto analyst Miles Deutscher delivered a shocking forecast concerning the long-debated phenomenon of an altcoin season. His commentary quickly drew attention from crypto analysts, particularly as it appeared to challenge, rather than reinforce, the long-standing hopes of a 2021-style altcoin mania.

RIP Crypto Altcoin Season?Deutscher began his post by acknowledging the renewed conversation within crypto circles on whether an “alt season” could come around again. He distinguished two different interpretations of the term altcoin season. “Will there ever be an ‘alt season’ again? Seeing a lot of discussion about this on the TL,” Deutscher noted. “Firstly, it depends on your definition of ‘alt season’. If you’re referring to the index, then yes, I expect it to spike again at some point this year.”

However, he cautioned that a reoccurrence of the euphoric, multi-month surge experienced in 2021 would be exceedingly unlikely: “If you’re referring to the multi-month up-only mania of 2021, then no. The unique combination of QE/stimulus and V-shaped equities repricing created conditions that are almost impossible to replicate. Expecting that is a recipe for disaster. Key word here: ‘expecting.’”

Deutscher’s overarching advice emphasized flexibility and preparedness rather than relying on extended bullish waves. He advocated for taking profits in what he expects to be comparatively short-lived rotations into altcoins—though he did acknowledge the possibility of a surprise rally: “If a larger ‘alt season’ DOES happen, great. That makes our job a lot easier, and complacency won’t be punished as much. Go in with the mindset of the rotation into alts being short-lived (this will force you to take profits). It may not actually be short-lived, but at least you’re securing profits.”

He stressed that prudent strategies should consider “multiple mini-cycles or pockets of narrative outperformance,” underlining the importance of not hoping for a second coming of the 2021 market conditions. Deutscher’s advice ultimately hinged on portfolio construction and proactive trading: “Instead of holding everything and everything, have a more concentrated basket of high-conviction assets. Juxtapose those holdings with the willingness to trade in profitable playgrounds (i.e. AI) – but treat them as trades, don’t bag hold.”

Deutscher’s comments came in response to a statement from crypto influencer Ansem, who had asserted: “No alt szn ever again. Pockets of extreme outperformance always there, with people moving down the risk curve in cyclical terms but never to the level as before. What’s the real reason BTC.d doesn’t have to go up and to the right for a decade straight?”

While both analysts believe that a 2021-style altcoin season seems highly unlikely, they highlight the still existing opportunities in this bull run. “Specific assets/sectors are going to have crazy runs when conditions allow it. Instead of holding everything and everything, have a more concentrated basket of high-conviction assets,” Deutscher concludes.

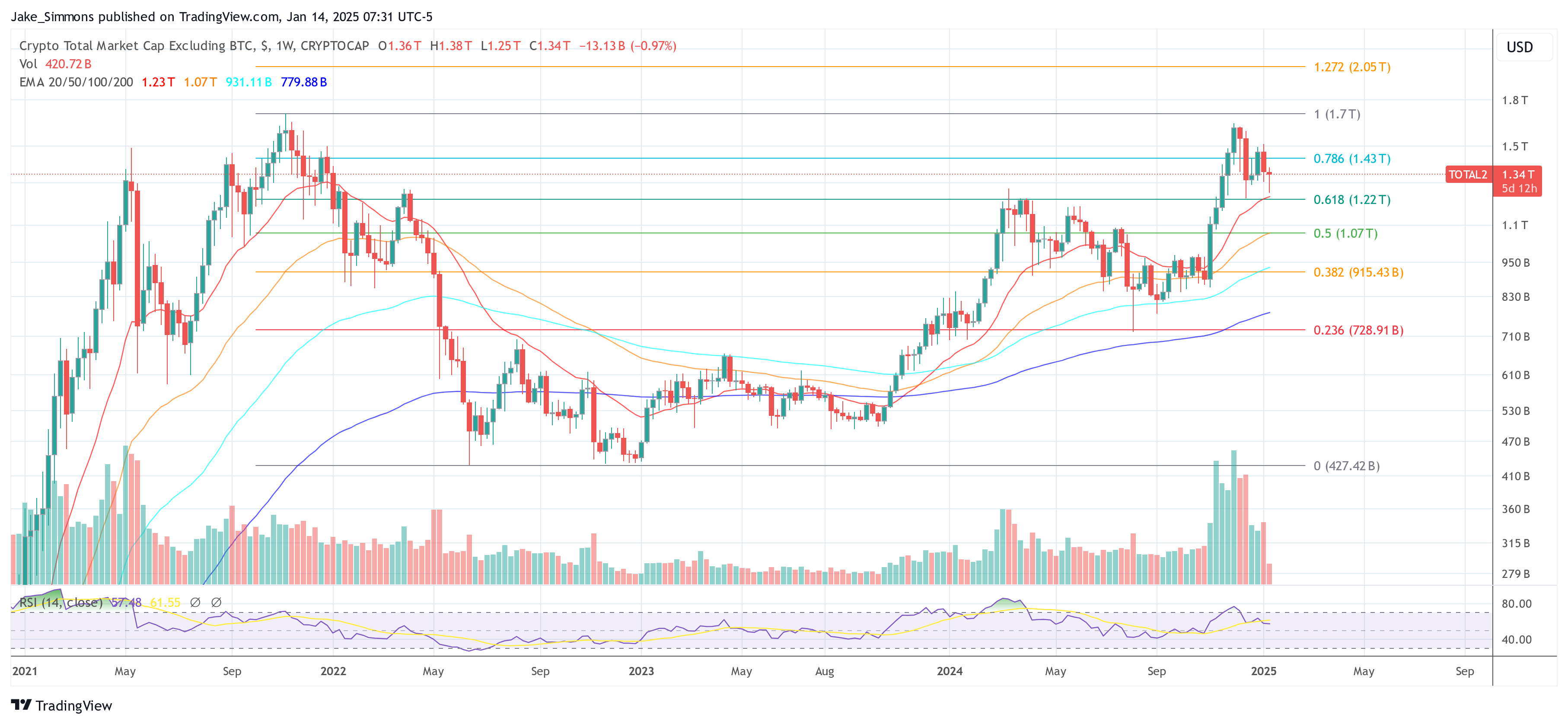

At press time, total crypto market cap excluding Bitcoin (TOTAL2) stood at $1.34 trillion.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright 2025, Central Coast Communications, Inc.