and the distribution of digital products.

Binance Fees: Complete Guide (For Binance and Binance US)

Binance is the world’s largest cryptocurrency exchange, founded in 2017 by Changpeng Zhao.

They were based in China, but now they have their headquarters in Malta due to the Chinese government’s restrictions.

The platform performs over 1,400,000 transactions per second and has a daily volume of over two billion.

In this article, we will discuss the fees of Binance and Binance US.

Table of contents- Binance Deposit and Withdrawal Fees

- Binance Trading Fees

- Binance Margin Borrow Interest rate

- Binance USDⓈ-M Futures Trading Rate

- Binance Coin-M Futures Trading Rate

- Binance Cross Collateral Interest Rate

- Binance US Deposit and Withdrawal Fees

- Binance US Trading Fees

- Binance Fees: Conclusion

Deposits in Binance are entirely free.

The withdrawal fee and minimum withdrawal is determined upon the blockchain network. Hence, they are not fixed and depend upon network congestion.

For example, To withdraw Bitcoin, you can use any one of the following networks. Each network has a different minimum withdrawal and withdrawal fee.

You can check the complete list here.

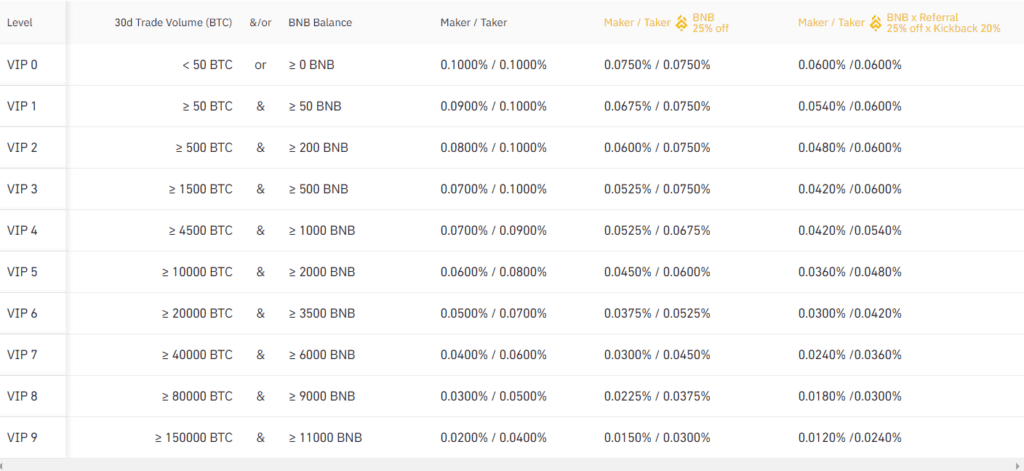

Binance Trading FeesBinance follows a maker-taker model. The fee is divided into eleven levels according to the trading volume over thirty days and BNB Balance. Therefore your trading fee will be decided by your VIP Level.

Every day at 0:00 am UTC, your trading volume (BTC) over thirty days, and BNB Balance is updated. The tier level and maker-taker is fees is updated at around 2:00 UTC

If you have BNB in your account, then by default, trading fees will be deducted from your BNB balance, getting you a 25% discount on your trading fee. Additionally, you will get a 20% discount on referring to your friends.

Binance Trading Fees

Binance Margin Borrow Interest rate

Binance Trading Fees

Binance Margin Borrow Interest rate

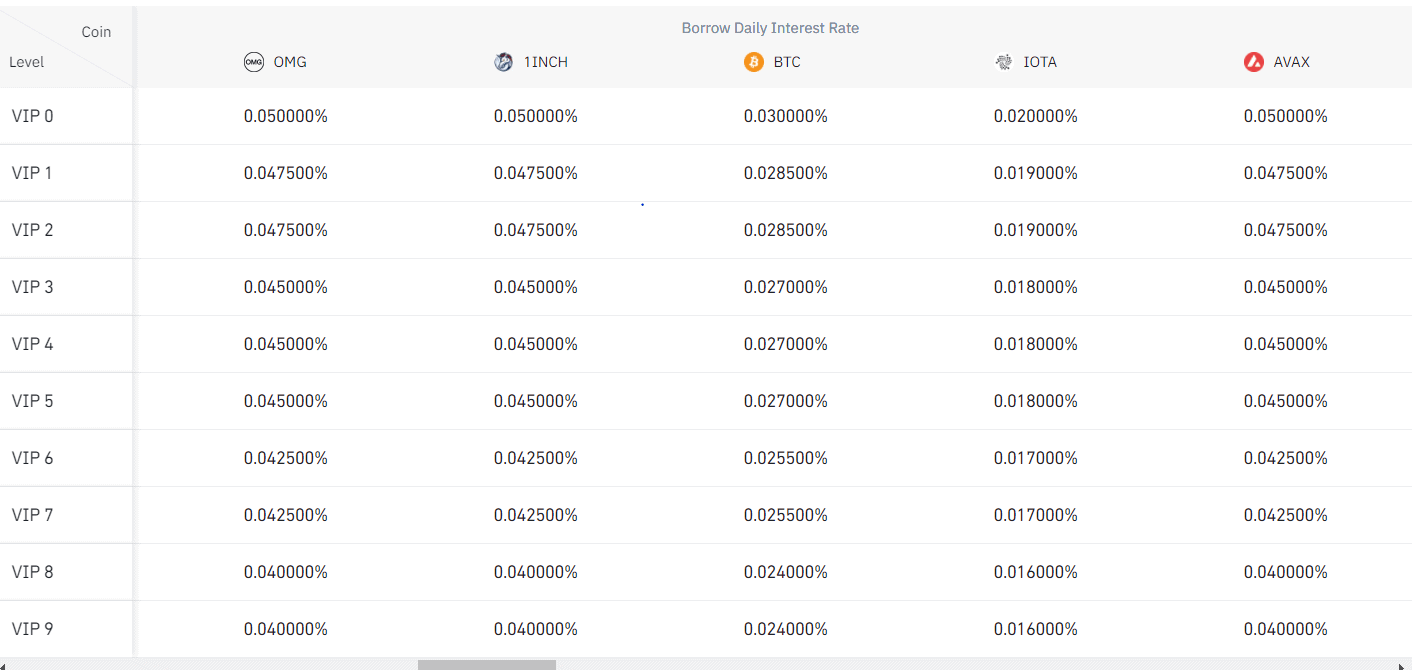

The margin borrows interest rate depends on the VIP level you are. Each cryptocurrency has a different interest rate.

Binance Margin Borrow Interest Rate

Binance Margin Borrow Interest Rate

You can check the entire list here.

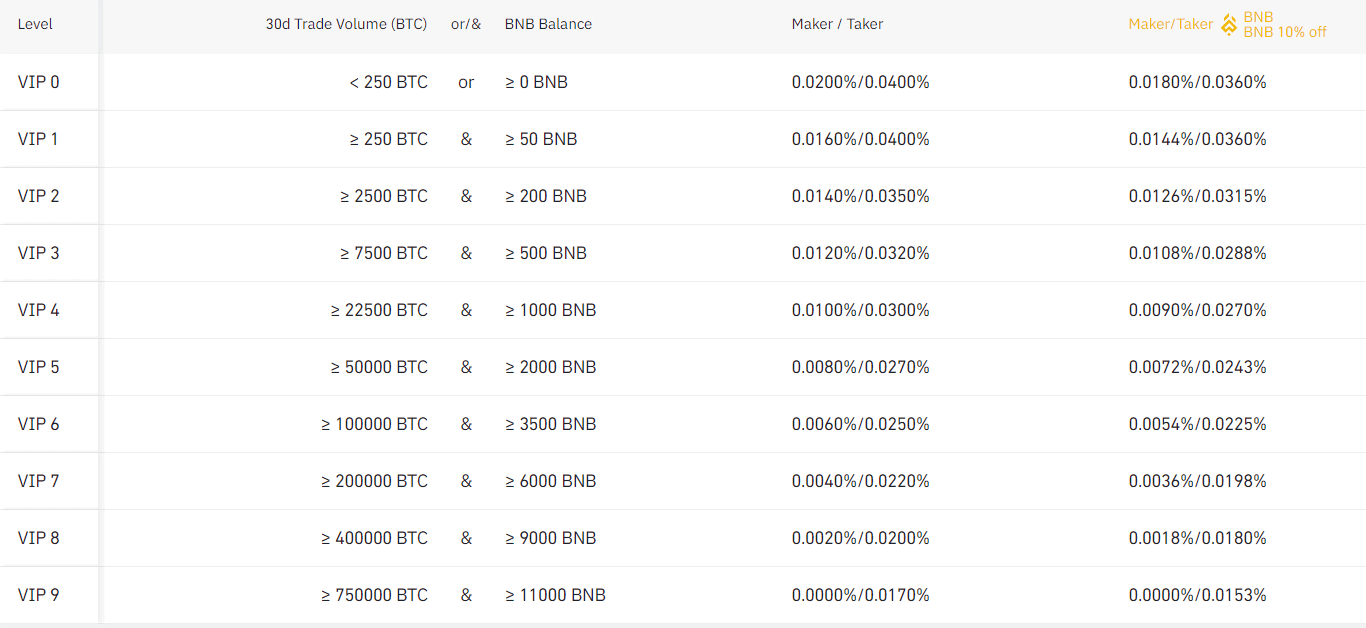

Binance USDⓈ-M Futures Trading RateThe USDⓈ-M Futures Trading Rates offers trading perpetually and quarterly with leverage up to 125x. Additionally, you will get a 10% discount on using BNB.

Binance USD-M Futures Trading Rate

Binance Coin-M Futures Trading Rate

Binance USD-M Futures Trading Rate

Binance Coin-M Futures Trading Rate

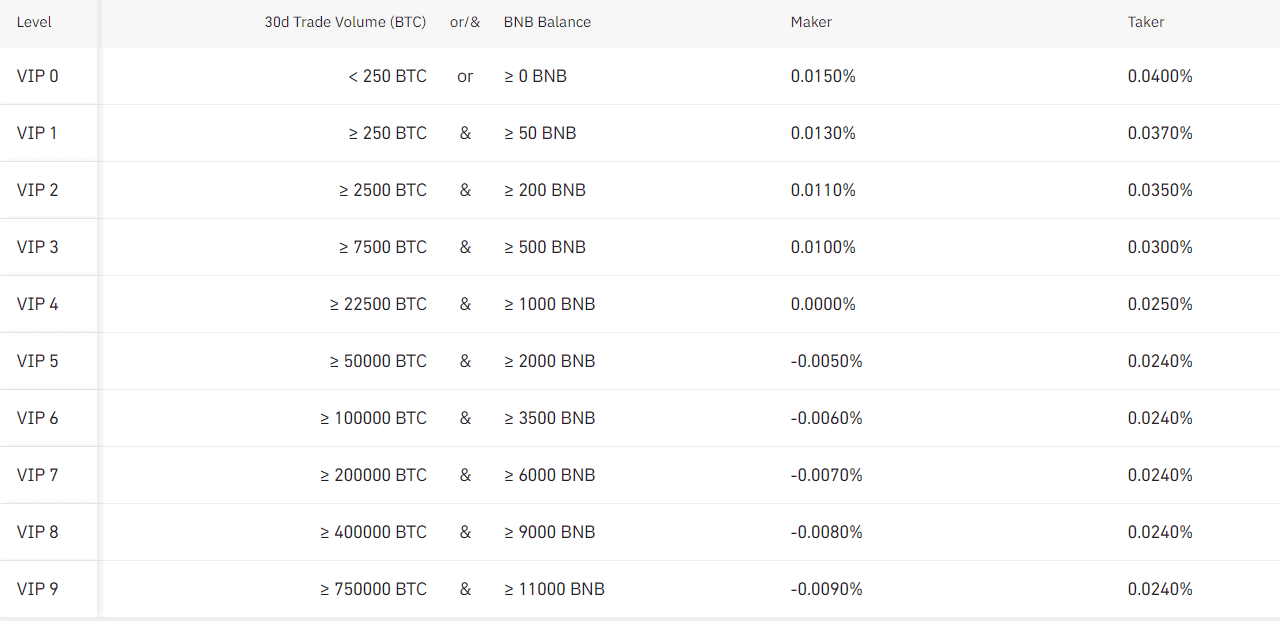

Coin-M Futures allow you to trade perpetually and quarterly with leverage up to 125x. The trading rates for Coin-M futures are mentioned below.

Binance Coin-M Futures Trading Rate

Binance Cross Collateral Interest Rate

Binance Coin-M Futures Trading Rate

Binance Cross Collateral Interest Rate

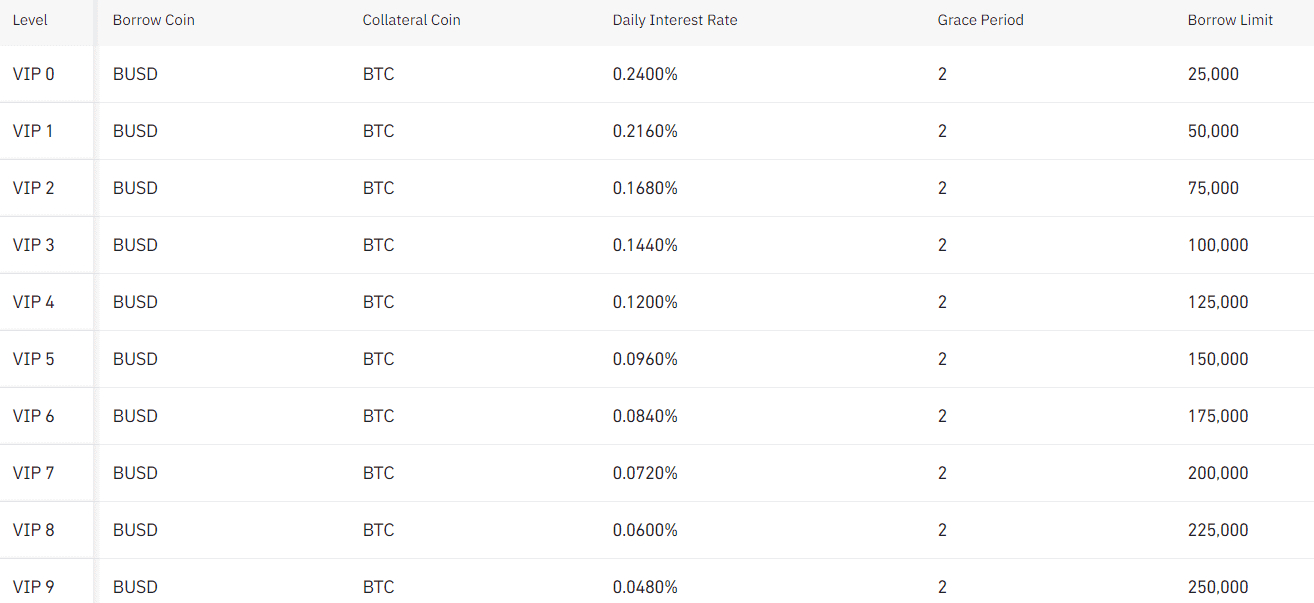

Binance supports four collateral coins BTC, ETH, EUR, and BUSD. The daily interest rate, grace period, and borrow limit differs according to the VIP levels and borrow a coin.

The cross collateral interest rates for BTC when borrow coin is BUSD is mentioned below. You can check the rates for the remaining three here.

Binance Cross Collateral Interest Rate

Binance US Deposit and Withdrawal Fees

Binance Cross Collateral Interest Rate

Binance US Deposit and Withdrawal Fees

Deposits in Binance US are also entirely free.

The withdrawal limit depends upon the level of verification you have completed.

For USD, the fee depends upon the method you choose to complete your payment.

The withdrawal fee and the withdrawal limit vary according to the cryptocurrency you choose. The table below shows the fee and limits of some of the popular cryptocurrencies.

You can check the complete list here.

Binance US Trading FeesBinance US also follows a maker-taker model. The fee is divided into eleven levels according to the trading volume over thirty days and BNB Balance. Therefore your trading fee will be decided by your VIP Level.

Every day at 0:00 am EST, your trading volume (USD) over thirty days, and BNB Balance is updated. The tier level and maker-taker fees is updated at around 1:00 AM EST.

If you have BNB in your account, then trading fees will be deducted from your BNB balance by default. Additionally, you get a 25% discount on your trading fee if you pay using BNB.

By default, you are level VIP 0.

Binance US Trading Fees

Binance US Trading Fees

You can check the trade limit for all the cryptocurrency pairs here.

Binance Fees: ConclusionBinance offers competitive rates. The pricing structure for different types of transactions is divided into levels according to your thirty-day trading volume and BNB balance. Additionally, they offer discounts if you use BNB.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.