and the distribution of digital products.

DM Television

Best Digital Asset Exchange for October 2022: Buy and Sell Bitcoin, Ether, and More

The perception of cryptocurrencies has evolved from a means of evading law agencies to being a secure way of fostering easy cross-border payment. While this new narrative is awesome, the question in the minds of many newbies in the crypto space remains, “How do I get started with the digital asset?’

The answer is simple: crypto exchanges. This article will focus on what they are, examples of exchanges (Redot, Binance), and the important things to note when choosing a crypto exchange. Let’s get started.

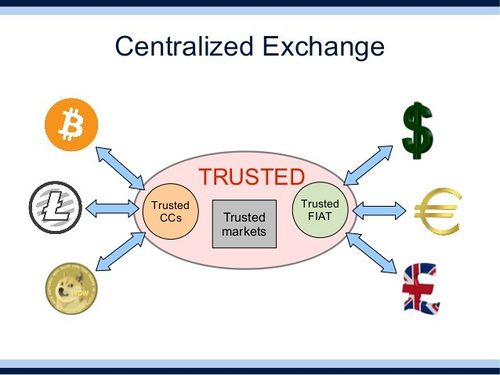

What is a Crypto Asset Exchange?A cryptocurrency exchange is a regulated and legal means where cryptocurrency trades can be facilitated seamlessly. They could either be centralized (owned and actively managed) or decentralized (no intermediary to facilitate transactions).

How Do Crypto Exchanges Work?There are different ways crypto exchanges work. For instance, centralized exchanges allow crypto-fiat swaps and act as the arbitration between buyers and sellers. Decentralized exchanges act a bit differently.

Some crypto exchanges have inbuilt wallets that automatically save a user’s crypto when bought, while others are purely for transacting digital currencies.

Source: Moralis Academy

What are the Different Types of Crypto Exchanges?

Centralized

Source: Moralis Academy

What are the Different Types of Crypto Exchanges?

Centralized

As explained earlier, centralized exchanges act as an intermediary between buyers and sellers.

To avoid scams, most centralized exchanges take users through Know your customer (KYC) and anti-money laundering (AML) procedures to ensure full transparency and zero anonymity.

Centralized exchanges are good for beginner traders or those who want to use cryptocurrencies for light transactions

DecentralizedDecentralized exchanges act differently from their centralized exchanges because instead of an intermediary, they are run by smart contracts.

HybridThese exchanges take advantage of both crypto exchanges and use them as a compliment to the other’s demerit.

For instance, some hybrid exchange allows users to have their private keys but still require KYC processes.

Understanding Digital Assets Exchanges FeesYou will be charged for every transaction you carry out on an exchange. These fees could be paid to the exchange or the crypto network.

- Trading Fees

These are paid when you initiate a transaction. They are of two types: Maker fees and taker fees.

- Deposit Fees

Whenever you buy crypto through fiat, you are charged a deposit fee. This is very common amongst centralized exchanges as you cannot buy crypto with fiat on decentralized exchanges.

- Withdrawal Fees

When you want to send your crypto to your bank account (or anywhere outside the exchange) as fiat, you are charged a withdrawal fee.

- Account Fees

These are fees paid for maintaining a crypto account. Although it is uncommon, some exchanges still have periodic account fees.

- Network Fees

They differ from trading fees because they are primarily on decentralized exchanges. They are the monies paid to miners to confirm transactions.

Best Digital Assets Exchanges and Investing Platforms Binance Advantage- Supports many cryptocurrencies

- High liquidity

- Huge withdrawal fees

- US platform has limited features

- Zero deposit and withdrawal fee

- Low minimum deposit

- Limited cryptocurrencies

- Lack of advanced charting tools

- Redot offers up to 70% commission on referrals

- 1-click Ethereum staking

- Good charting system

- Experienced team

- Institution-grade security

- Relatively new and unavailable around the world

- Good for crypto-fiat swaps

- Strong security

- Bad customer support service

- Shady trading fees

One vital part of your crypto trading journey is the exchange you choose. Several factors will influence your choice of exchange, and thankfully, we have many crypto exchanges with varied features.

Redot Digital Assets Exchange is your best bet if you want to earn some passive income with referrals, and Binance is one of the most popular crypto trading platforms.

BEGIN TRADING ON REDOT Frequently Asked Questions What’s the difference between a crypto exchange and a crypto wallet?An exchange allows you to trade cryptocurrencies, while a wallet is where you save your cryptocurrencies.

What are the risks in buying, trading, and selling crypto?There are various risks you should be aware of when trading cryptocurrencies. First is the volatility risk. Cryptocurrency can be extremely volatile and using leverage unreasonably can be devastating. Many countries are also undecided on how to regulate cryptocurrencies and the regulation threat is bigger than every other risk combined.

What is the best digital asset exchange?The position of the best digital asset exchange is debatable. What we have in the industry is a wide array of exchanges, each focusing on a distinct feature.

Why is crypto down?It is not unnatural for cryptocurrency prices to be down. Corrections and drawdowns are natural thing, and seasoned investors expect and plan for them.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.