and the distribution of digital products.

DM Television

4 Best Financial Planning Software for Advisors- A Must Read!!

The nature of the financial environment is rapidly changing. The purpose of advisors is no longer just investment management. For clients, it is crucial to have personalized financial plans that exactly follow their purposes and situations. Only with the right software can advisors meet the appropriate level of customer provision. Software helps overcome the logistical nightmare and, at the same time, introduces a new level of client involvement and optimal solutions. This article provides insight into the best financial planning software for advisors; hopefully, it will simplify the life of financial advisors.

What is Financial Planning Software?At its core, financial planning software is the framework of an advisor’s practice, helping them accomplish a multitude of vital duties mentioned above. It includes setting client goals, assessing their risk appetite, analyzing portfolio options, projecting retirement and estate matters, etc. These platforms rely on sophisticated algorithms and data analytics to help the advisor design unique financial plans that meet the client’s goals and risk appetite.

Best Financial Planning Software for AdvisorsHere are some of the best software for financial advisors that will provide the clarity, flexibility, and support you need to confidently build financial plans.

Envestnet MoneyGuideDedicated to their mission of providing quality financial plans to everyone, Envestnet MoneyGuide focuses exclusively on helping advisors use financial planning to more effectively motivate each client to create, implement, and maintain an investment strategy that best meets their lifetime financial goals.

Envestnet provides solutions via four main ways namely Money Guide Pro, Money Guide Elite, Wealth Studios, and MyBlocks. For financial planning, Money Guide Pro and Money Guide Elite are most preferred.

With easy-to-use financial planning tools, Envestnet MoneyGuide, both Pro and Elite, helps advisors of all sizes customize their planning services to meet the unique needs of their clients.

Envestnet MoneyGuide Features

Envestnet MoneyGuide Features

- The key feature of MoneyGuide is its Play Zone. It engages the clients in a more interactive planning process. You can also request a Demo to understand the platform better.

- There is a Client Portal & Aggregation option which provides you with the most recent information and the ability to control your client’s financial activity more efficiently.

- With the sophisticated solutions provided by MoneyGuidePro, you can give advice on detailed healthcare costs, compare current and target allocation recommendations, and give a more detailed and customizable executive summary.

- You can also do estate planning, position risk capacity, as well as customize asset classes, portfolios, and their underlying assumptions.

- MoneyGuideElite provides all the features MoneyGuidePro has. Additionally, you can do dynamic distribution presentations, secure income modeling, have advanced lifetime protection, and do tax planning.

You can try MoneyGuide free for 14 days with a trial. For that, you have three options:

- Individual: This plan is for solo planners who are already doing financial planning but need a more efficient way of providing plan. For Pro, you have to pay $125 per advisor if chosen as a monthly plan or $1400 per advisor for an annual subscription. For Elite, the fee for a monthly subscription is $175 per advisor while $2000 per advisor for a yearly plan.

- Ensemble: If you are a group of 2 to 19 individuals, that provides a diverse list of services to your clients, financial planning is a great value-add. For the ensemble license, you need to contact the MoneyGuide Sales Team at 1-800-841-5312.

- Enterprise: If you are a firm with 20+ employees, you’ll need a customized solution to enhance your technology. To enjoy the flexible enterprise license, know the pricing details by contacting the MoneyGuide Sales Team at 1-800-841-5312.

Having financial services for almost the last 20 years, eMoney ensures delivery of continuous enhancements to their core products while exploring new features and services to keep pace with the evolving planning landscape.

You can use any planning method from the three: eMoney Plus (focused on goals-based financial planning), eMoney Pro(focused on cash-flow-based financial planning), and eMoney Premier(integrates both goals-based and cash-flow-based tools). All these products include client portals, spending and budgeting tools, insights and data, power integration, and many more.

eMoney Features

eMoney Features

- The most attractive feature of eMoney is the Decision Center. It is specifically designed to cater to the requirements of the clients and then provide the best course of action.

- Deliver plans with the help of dynamic tools that visualize the impact of actions and update them in real time.

- Have an exclusive Client Portal to easily view their full financial picture and securely store important documents.

- Compiles an all-encompassing source of financial data for your clients and assures them that you are addressing their comprehensive needs.

- Makes data-driven decisions with the help of Advisor analytics and thereby takes actions and builds strategies with the right information.

- Easily access the financial technology applications your firm relies on most—all from the eMoney platform.

- There is also a Resources section containing past case studies, news, events, blogs, and summits to provide more integrated knowledge about financial planning.

Because eMoney is a scalable, customizable platform, pricing may vary based on the unique needs of your organization. To get an accurate estimate, talk to customer service about your financial planning requirements.

You can start a free trial or call 1-888-362-4612 to learn more about the pricing schedule.

Also Read ➤ ➤ 6 Best Financial Modeling Software – Important Read!!

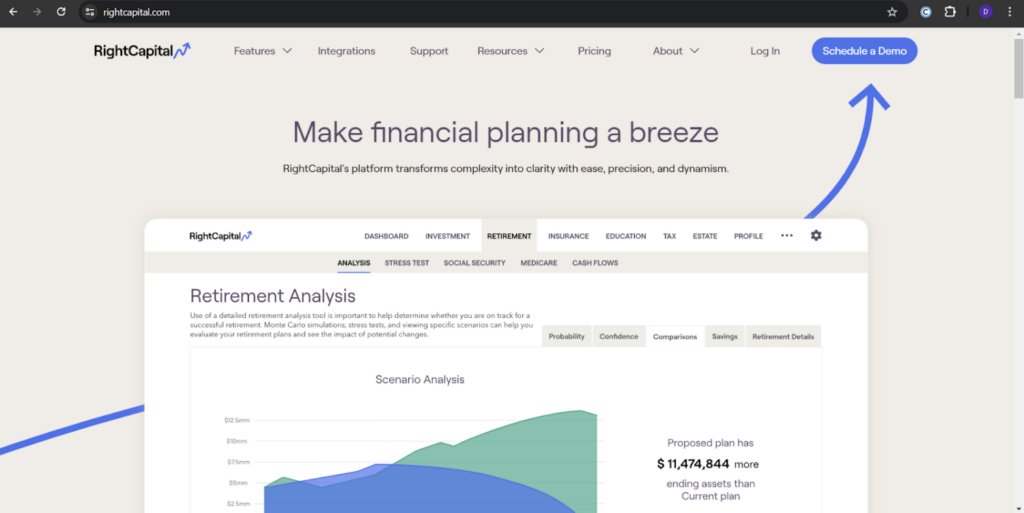

RightCapitalFounded in 2015, RightCapital is rated as the fastest-growing financial planning software with the highest user satisfaction by The Kitces Report. With its modern features, RightCapital illustrates interactive retirement plans, efficient tax distribution as well as insurance needs reviews.

You can use Snapshots to create personalized plan summaries with charts and notes to share with clients. For an organized household net worth, goals, and income, use Blueprint while to help the client understand the cash flow, use Cash Flow Map.

RightCapital Features

RightCapital Features

- You can show clients how to maximize their Social Security income by optimizing their social security.

- You can have a 20-minute one-to-one virtual demo and a 14-day free trial.

- Provides a place for clients to manage all their credit card and bank accounts, track spending in various categories, and see how they are doing against monthly budget goals.

- Have a student loan management feature that illustrates different scenarios so your client can reduce payments.

- Help clients learn the flow of assets at the end of life, including any possible estate tax ramifications.

You will have three pricing options to choose from based on our needs:

- Basic: It will have all the features with a monthly subscription of $139.95 per advisor.

- Premium: Includes all Basic features and some additional add-ons like account aggregation, and budgeting tools. To access these features, you have to pay $179.95 per advisor per month.

- Platinum: It will have all the features mentioned in Premium with enhanced investment return parameters, custom asset classes, and many more. To access this account, you need to call RightCapital at (888)982-9596.

Orion is completely oriented around the advisors and the enterprises that serve them. With its powerful technology paired with a wide range of solutions and services in wealth management, Orion builds portfolios that help your clients meet their unique vision of success.

Orion is all on one powerful, easy-to-use platform that delivers holistic advice, connects progress toward goals with investment performance, and collaborates on goals-based or cash flow planning.

Orion Features

Orion Features

- It has one integrated UX called Orion Advantage which provides clients with a comprehensive view of their full financial picture by including their Financial Planning output with Orion’s reports for an integrated, engaging presentation.

- With the feature of Advisor Tech, you can fuel your firm with the technology you need to streamline your operations, or strategically outsource to supercharge growth with a tech-enabled TAMP.

- You can request a demo to see how to access the financial planning tools needed to strengthen the advisor-client relationship and how to increase your growth potential.

- It also has a free resource Whitepaper which helps in effective marketing to lead to successful financial planning.

For the pricing schedule, you need to contact the sales team of Advisor Tech or call (402)496-3513.

Best Financial Planning Software for Advisors: ConclusionWith the rapidly changing and complex financial environment, the importance of financial software cannot be understated. Advisors who wish to deliver top-quality services and value to their clients can only accelerate success by leveraging the best-in-class solutions summarized in this article to simplify their operations and information submission, increase client interaction, and, in the end, achieve the best possible financial outcomes. Technology will always be a vital aspect of an advisor’s enrichment as new and improved trends emerge, and using cutting-edge technologies is essential to the advisor’s success in an industry that is continually evolving.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.