and the distribution of digital products.

State of Tezos Q1 2025

- Tezos activated its 17th protocol upgrade, Quebec, which reduced block times to 8 seconds and introduced refinements to staking incentives and Adaptive Issuance, enhancing overall protocol performance.

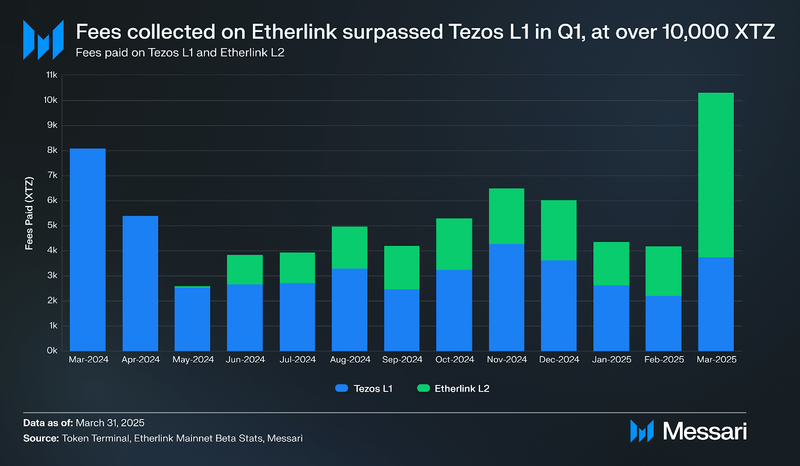

- For the first time, Etherlink generated more transaction fees than Tezos Layer 1, collecting 10,302 XTZ compared to 8,500 XTZ. This milestone highlights Etherlink’s growing contribution as a high-throughput execution environment within the Tezos ecosystem, reinforcing the protocol’s modular vision where Layer 1 provides settlement and governance, while Layer 2 solutions like Etherlink scale application activity.

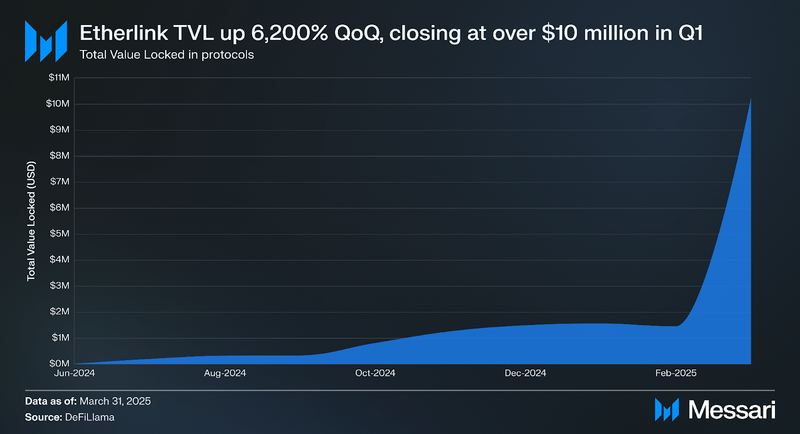

- Total value locked (TVL) on Etherlink rose to $10.8 million, marking a 6,200% increase since Q4, as the Apple Farm rewards program and EVM compatibility drew capital and liquidity from other chains.

- The network ramped up efforts to activate the Data Availability Layer introduced in the Paris upgrade, with community outreach encouraging validator participation to reach the 67% threshold required to bring the feature online.

Tezos (XTZ) is a Liquid Proof-of-Stake (LPoS) blockchain network known for its strong focus on security, upgradeability, and democratic community governance. Its smart contracts on Layer-1 (L1) are implemented using the Michelson language, designed to facilitate formal verification while also offering Ethereum virtual machine (EVM) compatibility through Etherlink, a community-supported Layer-2 (L2). The network features onchain governance and self-amending functionality, enabling stakeholders to adopt protocol upgrades without requiring a network hard fork.

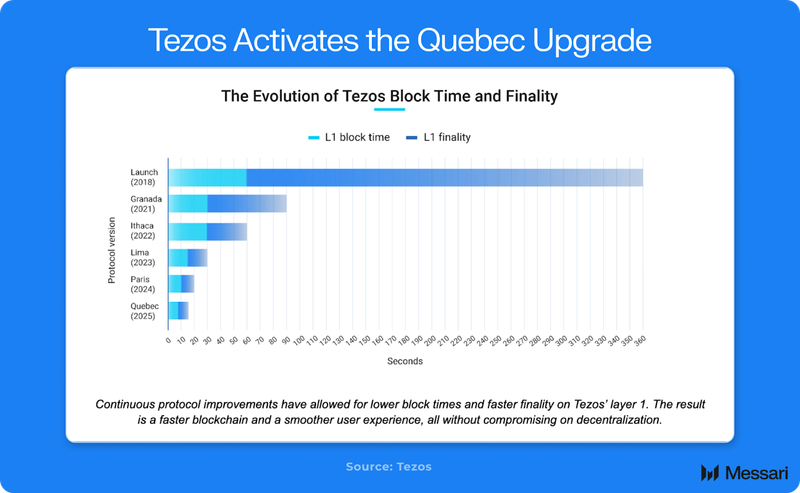

Recent upgrades on Tezos have focused on scalability and performance through Smart Rollups and a Data Availability Layer (DAL). The Mumbai upgrade introduced Smart Rollups, a L2 scaling solution that enables throughput beyond 1 million TPS and customization to adapt to specific use cases, such as implementing new coding environments. The Paris upgrade reduced L1 block time from 15 to 10 seconds, bringing 20-second finality. It also introduced the DAL, a data-availability solution that boosts Smart Rollup scalability and is part of the Tezos protocol. Finally, the Paris upgrade implemented a new staking mechanism and Adaptive Issuance, which adjusts token issuance based on the staked ratio of XTZ. In Q3, developer teams Nomadic Labs, Trilitech, and Functori proposed the Quebec upgrade, aiming to reduce block time to 8 seconds, enhance staking, and adjust Adaptive Issuance to curb inflation. By the end of Q4, this proposal had moved to the final ‘Promotion’ voting phase. Current R&D work focuses on realizing ‘Tezos X,’ a proposed roadmap for boosting the blockchain’s performance, composability, and interoperability, with the goal of delivering a "cloud-like" developer experience. Leveraging Smart Rollup technology and the data-availability layer, it enables developers to build complex, scalable applications using mainstream programming languages, with improved connectivity across the ecosystem.

Website / X (Twitter) / Discord

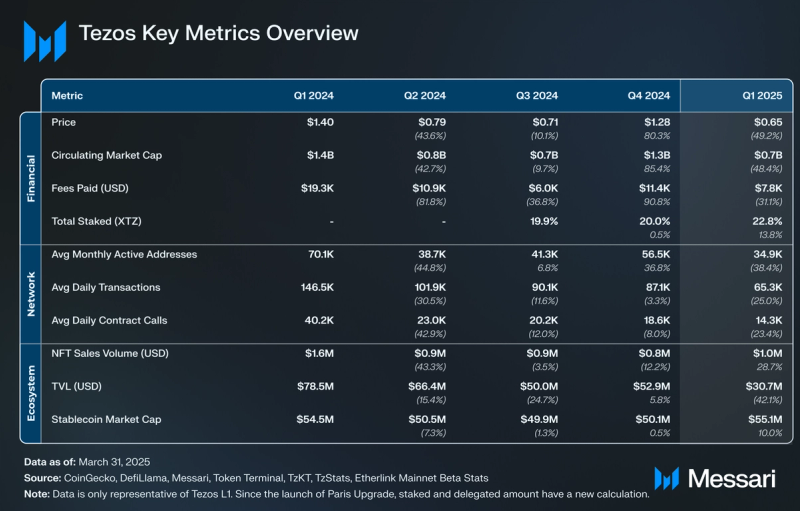

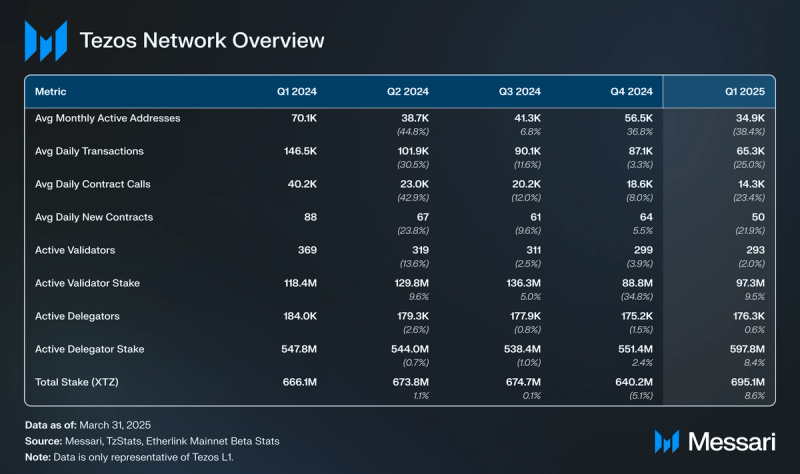

Key Metrics Financial Overview

Financial Overview Revenue

Revenue

In Q1 2025, Tezos L1 transaction fees slipped to 8,500 XTZ, marking a 23.3% QoQ decrease in XTZ terms (31.1% in USD terms due to a decrease in XTZ price). Etherlink, Tezos' first EVM-compatible, non-custodial smart rollup, experienced a significant 54.1% QoQ growth, reaching 10,302 XTZ, surpassing Tezos L1 for the first time. As a cost-efficient L2 solution, Etherlink Mainnet's rapid growth outpacing L1 aligns with expectations for its scalability and cost advantages.

Supply and Market CapitalizationXTZ, the native token of Tezos, is used as a medium of exchange and for staking, delegating, and facilitating governance. As of the end of Q1, the circulating supply was 1.0 billion XTZ. The Paris upgrade that launched in 2024 introduced the Adaptive Issuance mechanism, which is designed to incentivize a secure network while keeping inflation at a minimum. The target for staking is 50% of total XTZ supply, and the mechanism dynamically adjusts staking rewards to achieve this with the least possible XTZ issuance. The aim is to minimize the dilution of XTZ, improve liquidity, reduce inefficiencies, and make XTZ better suited for real-world use cases. In Q1, the annualized real yield for validators was 1.6%, with a QoQ increase of 1.3%.

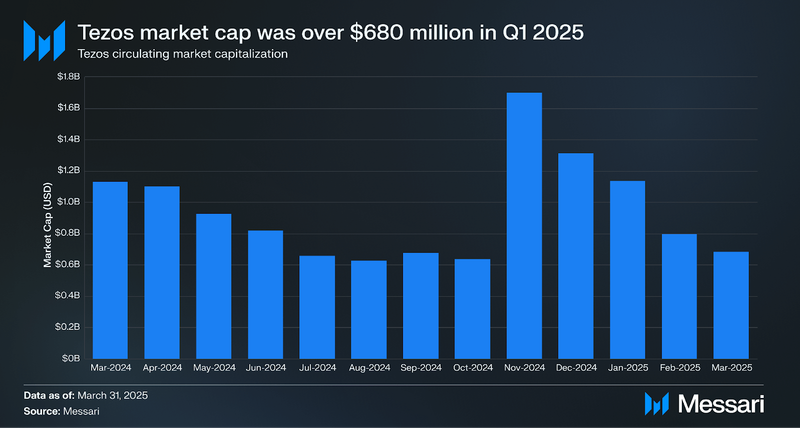

Tezos' market capitalization closed Q1 2025 at over $680 million, down 48.4% QoQ, driven primarily by a 49.2% decline in the price of XTZ. The drop in XTZ mirrored broader weakness in the crypto market during Q1. For reference, Ethereum's market cap was down 45.6% QoQ. Despite the price decline, demand for XTZ remained resilient, as evidenced by fees paid during the quarter.

Network Overview Usage

Usage

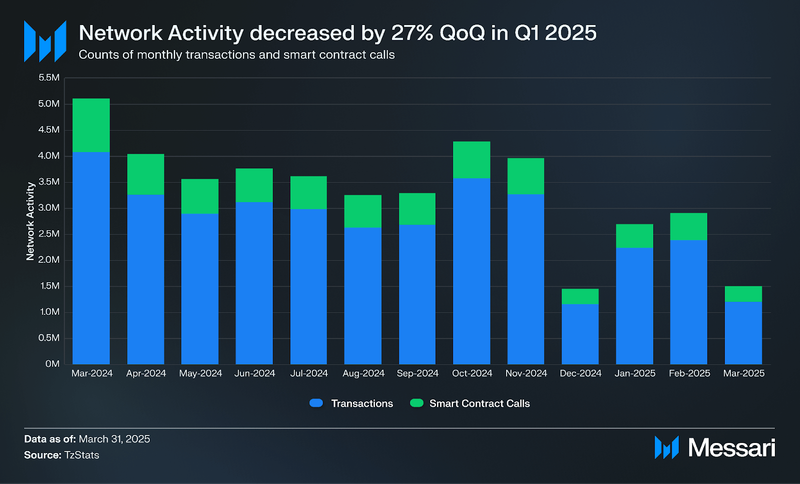

In Q1 2025, overall network activity on the Tezos L1 declined 27.3% QoQ, with average monthly transactions and contract calls totaling 2.4 million. This decline reflects a broader reduction in activity across blockchain networks during the quarter and aligns with expectations as usage gradually shifts to L2 solutions like Etherlink, which offer faster and cheaper transactions in support of Tezos’ scaling roadmap.

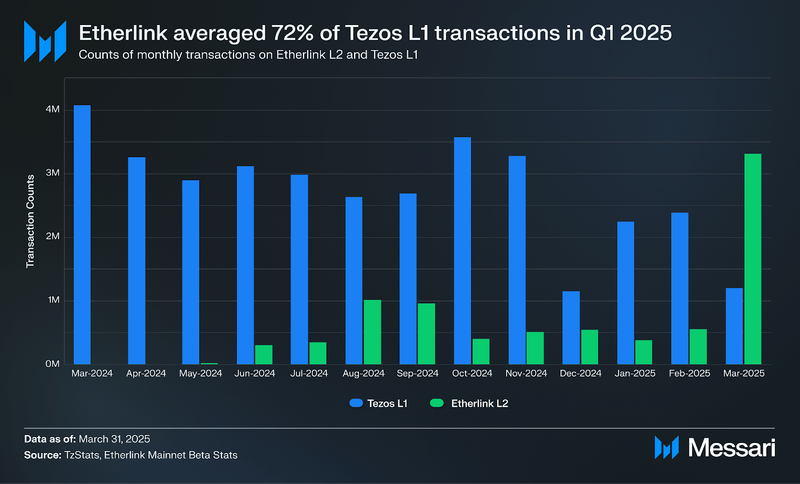

In Q1 2025, network activity on Etherlink averaged over 1.4 million monthly transactions, up 189.2% QoQ and representing 72.2% of Tezos L1's transaction counts. This highlights the rapid adoption of Etherlink within just six months of its launch, showcasing its growing role as a scalable L2 solution within the Tezos ecosystem.

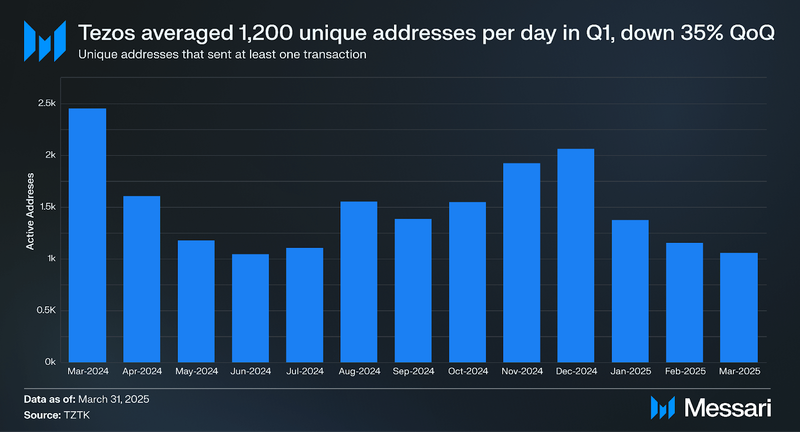

In Q1 2025, daily active addresses (DAA) on Tezos L1 fell 35.4% QoQ, averaging 1,200 unique addresses per day. As a globally integrated network, Tezos remains subject to broader market dynamics.

Network UpgradesQuebec Protocol ActivationFollowing prior updates on the Quebec proposal in earlier quarters, Tezos officially activated the Quebec protocol upgrade on Jan. 20, 2025. This marks the network’s 17th protocol upgrade, continuing its regular cadence of self-amendment through decentralized governance. Developed collaboratively by Nomadic Labs, TriliTech, and Functori the upgrade introduces performance enhancements and refinements to Tezos’ economic model.

Key Enhancements Introduced

- Faster Block Times: Block production time was reduced from 10 seconds to 8 seconds, decreasing transaction finality to 16 seconds. These improvements were achieved without increasing hardware requirements, ensuring continued accessibility for community bakers operating low-end infrastructure.

- Expanded Staking Capacity: Bakers can now accept up to 9x their own stake from external delegators, up from the previous 5x limit. This change supports increased staking demand while maintaining decentralization by preventing excessive concentration of stake.

- Revised Staking Incentives: The reward differential between staking and delegation was adjusted from 2:1 to 3:1, further incentivizing direct participation in consensus over passive delegation.

- Adaptive Issuance Refinement: First introduced in the Paris upgrade, the Adaptive Issuance mechanism was further refined to ensure issuance remains strictly aligned with security needs. The update tightens issuance dynamics when staking levels approach the network’s 50% participation target, helping to minimize inflation without compromising security.

Governance and Protocol Evolution

The Quebec upgrade was ratified through Tezos’ onchain governance process and follows comprehensive community consultation on staking economics. It reinforces the long-term trajectory outlined in the Tezos X roadmap, which prioritizes scalability, performance, and economic resilience.

Initial community discussions on the next protocol upgrade, codenamed “R”, also began during the quarter, signaling continued momentum in protocol development and governance participation.

Octez Software Updates

Octez Software UpdatesIn Q1 2025, Tezos released multiple updates to its core Octez Software, addressing stability, protocol compatibility, and peer-to-peer networking improvements. The updates primarily supported the smooth integration of the Quebec protocol upgrade and included refinements to RPC (Remote Procedure Call) infrastructure and consensus behavior.

- Octez v21.2, released on January 15, addressed an issue on Ghostnet caused by the reduction of the consensus_rights_delay parameter from 3 to 2, a change introduced with the Quebec upgrade. This parameter determines the number of blocks a baker must wait before being eligible to produce a block after endorsing. The update resolved inconsistencies that arose from this change, stabilizing testnet behavior under the new consensus settings.

- Octez v21.4, released on February 25, introduced improvements to peer-to-peer connectivity and diagnostics. The release fixed the logic governing when nodes attempt to reconnect to peers and added new RPC endpoints: GET /p2p/gossipsub/mesh/, GET /p2p/gossipsub/fanout/, and GET /p2p/gossipsub/reconnection_delays. These additions enhance visibility into the Gossipsub message propagation layer, making it easier to monitor and debug peer network activity.

In Q1 2025, the Tezos ecosystem began a coordinated push toward activating the Data Availability Layer (DAL): a major infrastructure component introduced in the Paris protocol upgrade. The DAL is designed to significantly increase the bandwidth available for rollups, playing a central role in scaling Tezos as outlined in the Tezos X roadmap.

The DAL decouples data availability from L1 block space, allowing rollups to publish data through a dedicated pathway while still retaining Layer 1-level security guarantees. This results in an immediate 20x increase in throughput for rollup-based applications and sets the stage for a long-term goal of reaching 100MB/s which is a 4000x improvement over current capacity.

The technology is already integrated with Etherlink, Tezos’ Smart Rollup-based EVM environment, which is expected to benefit from reduced transaction publishing costs once DAL activation is complete. However, activating the DAL requires at least 67% of the Tezos stake to run DAL nodes. As such, efforts during the quarter focused on mobilizing the community and encouraging bakers to begin operating DAL nodes. While the activation threshold had not yet been reached by the end of Q1, outreach initiatives and ecosystem coordination efforts were underway.

Development

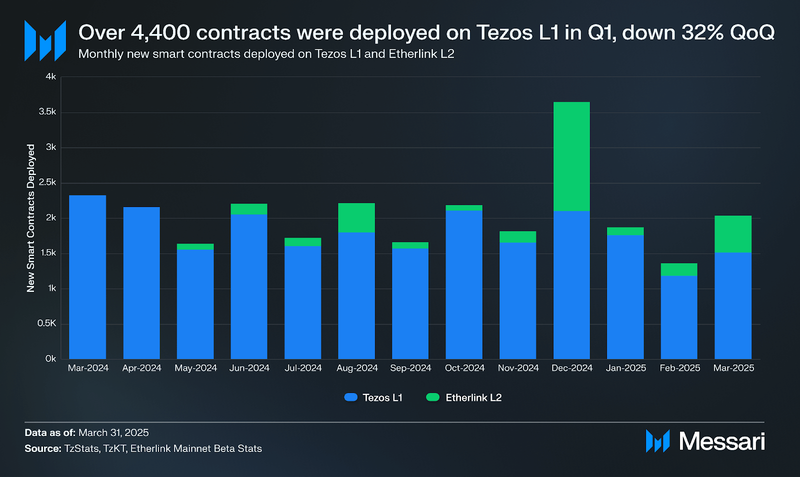

In Q1 2025, over 4,400 contracts were deployed on Tezos L1, marking a 32.1% QoQ decline. Etherlink also saw a slowdown, with over 800 new contracts deployed a 55.2% decrease QoQ. However, development activity picked up meaningfully in March, with more than 500 contracts deployed, making it the second-highest month in the past year and suggesting near-term momentum.

As of November 2024, Tezos has over 167 monthly active developers across over 3,600 repos. From September 2024 to November 2024, average monthly new developers grew from ~38 to 54, further supporting the near-term momentum of development.

Security

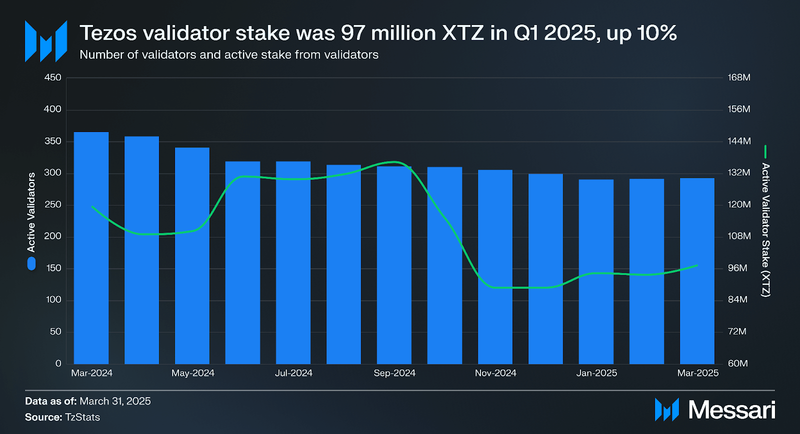

Tezos uses a Liquid Proof-of-Stake (LPoS)mechanism, which requires validators (known as “bakers” in the Tezos ecosystem) and delegators to stake XTZ as collateral to secure the network. Rewards and fees collected from transactions are paid to validators and delegators to maintain the network. Active validators and active validator stake have remained consistent over the last three quarters. In Q1, active validators saw a 2.0% decrease. However, validator stake increased by 9.5%, QoQ reaching 97 million XTZ.

Delegators stake XTZ on active validators and receive a portion of fees and rewards collected. In Q1, active delegators increased by 0.6%, however stake from delegators increased by 8.4% QoQ.

Adaptive Issuance dynamically adjusts the issuance of XTZ based on the proportion of staked tokens to the total supply. At the end of each blockchain cycle, the issuance rate is modified to target a protocol-defined staking level, currently set at 50%. This mechanism incentivizes staking to provide stable security for the network.

The Tezos network has shown consistent year-over-year stability in the number of validators and delegators, as well as in staked XTZ. This stability is crucial for secure and scalable L2 growth. Validators in the ecosystem are also decentralized geographically and by host service providers, further ensuring the network's resilience and security.

GovernanceTezos utilizes a (LPoS) mechanism, enabling staked XTZ to be used for both network security and governance. The network's self-amending blockchain reduces the need for hard forks by employing onchain governance for protocol upgrades. Users delegate their XTZ to validators who participate in stake-weighted voting. The governance process is divided into five periods, spanning approximately 2 months and 10 days.

To complement protocol governance, Tezos Commons established the Tezos Ecosystem DAO, which manages and allocates XTZ for community projects. The DAO’s initial funding came from NFT sales on Objkt and donations from ecosystem participants.

Etherlink follows an onchain governance model similar to Tezos L1, ensuring fairness and transparency. Governance for Etherlink is self-amending (meaning no hard fork), controlled by L1 bakers, and pilots both upgrades and the sequencer operator. The governance process fully happens on Tezos L1 through dedicated smart contracts, and consists of five stages: Proposal Period, Exploration Vote Period, Cooldown Period, Promotion Vote Period, and Adoption Period.. The Etherlink governance periods are synchronized with L1 governance periods.

Ecosystem Overview Etherlink Adoption, Gaming, and NFTs

Etherlink Adoption, Gaming, and NFTsIn Q1 2025, Etherlink continued to play a pivotal role in supporting the expansion of the Tezos ecosystem, facilitating growth across DeFi, gaming, and NFTs. As an EVM compatible Layer 2 built on Tezos' Smart Rollup technology, Etherlink delivers subsecond finality and low fees, while remaining anchored to Tezos' secure and decentralized Layer 1 for settlement and governance. This quarter saw a surge in new activity, including incentive programs, infrastructure enhancements, and strategic partnerships. Together, these developments reinforced Etherlink’s role as a scalable execution layer that complements Tezos’ vision for a modular and layered blockchain architecture.

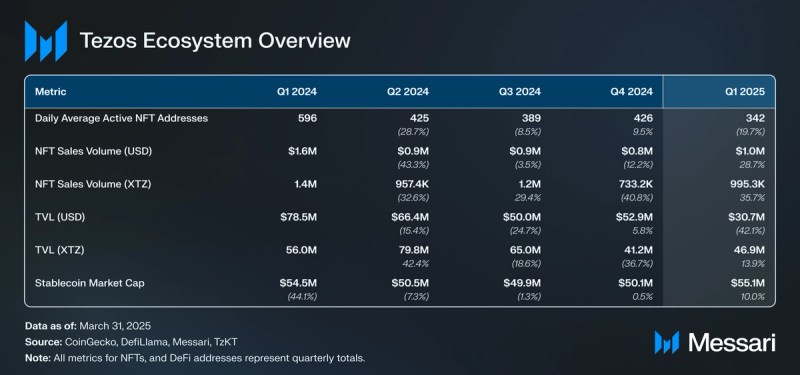

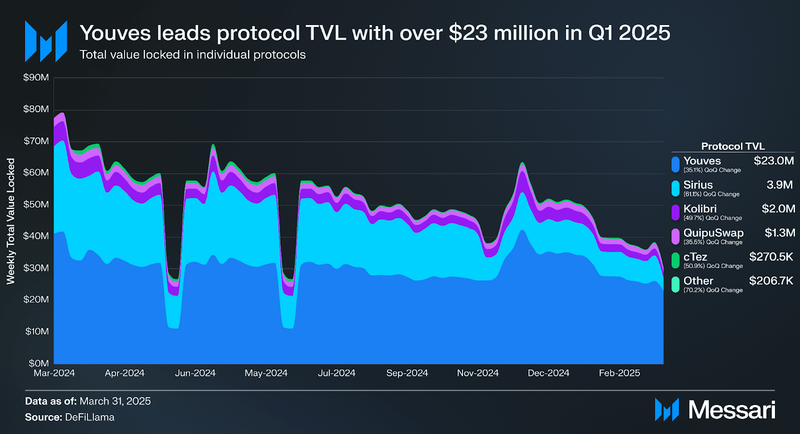

DeFiTotal value locked (TVL) in USD on Tezos fell 42.1% QoQ in Q1 2025, closing at $30.7 million. The decline was largely driven by the drop in XTZ’s price, as TVL denominated in XTZ actually rose 13.9% QoQ. This suggests that while more assets were deposited into DeFi protocols, their USD value declined due to broader market conditions.

Etherlink’s TVL surged to over $10.8 million in Q1 2025, representing a 6,200.0% increase since Q4. This growth was largely driven by Apple Farm, a $3 million incentive program announced in February 2025, designed to bootstrap DeFi activity on Etherlink. Liquidity pools participating in the program offered triple-digit APYs, attracting substantial capital. As most DeFi liquidity remains concentrated on EVM-compatible networks, Etherlink allows developers to deploy familiar protocols within the Tezos ecosystem, bringing in new communities and expanding Tezos’ DeFi footprint. By quarter’s end, more than $2.8 million in assets had been bridged from other EVM chains, signaling rising cross-chain engagement.

Youves, a decentralized synthetic assets application, was the largest protocol by TVL, securing over $23.0 million in assets, decreasing 34% since Q3. Sirius, a liquidity-baking protocol for XTZ/tzBTC pools, had the second-largest TVL at over $3.9 million.

The largest protocol on Etherlink is IguanaDEX, a concentrated liquidity decentralized exchange with over $11.0 million TVL and over $44.34 million in volume in Q1, making it the second largest protocol by TVL in the entire Tezos ecosystem. Superlend, supported by DeFi Catalyst Accelerator (DCA), is the largest lending protocol on Etherlink, with over $5.52 million in TVL.

Other notable protocols include Uranium.io, a novel permissionless RWA platform offering tokenized access to real world commodities, which reached $6.70 million in TVL, and Hanji Protocol, a decentralized savings and remittance platform designed for underbanked markets, which secured $3.37 million in TVL. These emerging platforms reflect Etherlink’s growing diversity of use cases, particularly in areas like real world assets and financial inclusion.

NFTs and Art

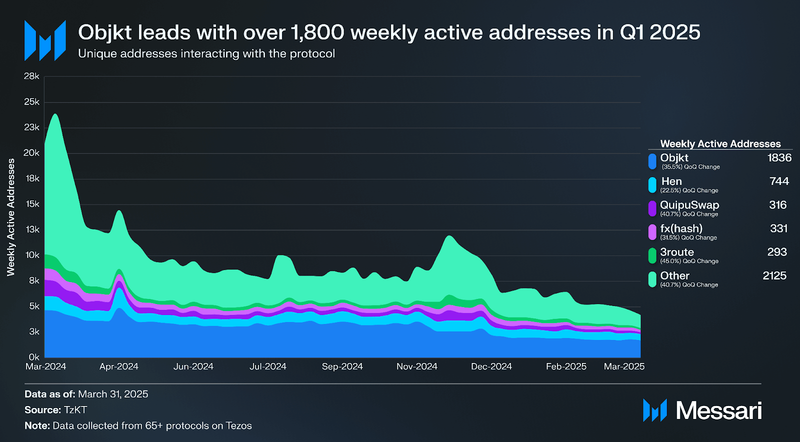

In Q1 2025, Objkt dominated the Tezos NFT market with an average of 1,800 weekly active addresses, capturing 40.0% of the user market share. The EditArt platform ran a Genuary campaign celebrating generative art in January, featuring 20 artists and generating 10,635 mints across 911 collectors, with 23,861 transactions on the Tezos network.

Building on this momentum, the Tezos NFT and cultural ecosystem continued to expand. At the end of March, InfiniteInk launched as a new platform designed to simplify smart contract deployment for artists and creators working on Tezos.

NFT activity on Etherlink, Tezos’ EVM-compatible scaling solution, also gained traction in Q1. Over 15,000 NFTs were collected on Rarible via Etherlink, marking a notable increase in cross-platform engagement.

Tezos had a strong presence at NFT Paris, participating in four major events. Two booths—Cyberforms and Paintboxed: Tezos World Tour—showcased artists and projects building on Tezos. Multiple gallery curations further highlighted the ecosystem’s creative breadth. During the AI Action Summit, the French President was introduced to {Lumina} by Agoria on fx(hash) and Σ Lumina on Objkt One, both developed through the 2024 partnership between the Tezos Foundation and the Musée d’Orsay.

In the U.S., the Tezos Foundation and New York’s Museum of the Moving Image unveiled Compositions in Code, the third exhibit in their year-long collaboration. The generative art showcase featured work by artists using p5.js and Processing, and launched with an opening reception at the museum. Meanwhile, in Switzerland, the Haus der Elektronischen Künste (HEK) acquired several works from The Second Guess, a curated exhibition of generative art minted on Tezos.

Education and regional outreach remained a strategic focus. A year-long partnership with Newtro Arts, an Argentina-based artist collective, was launched to support local creators, promote education, and raise awareness about Tezos throughout Latin America.

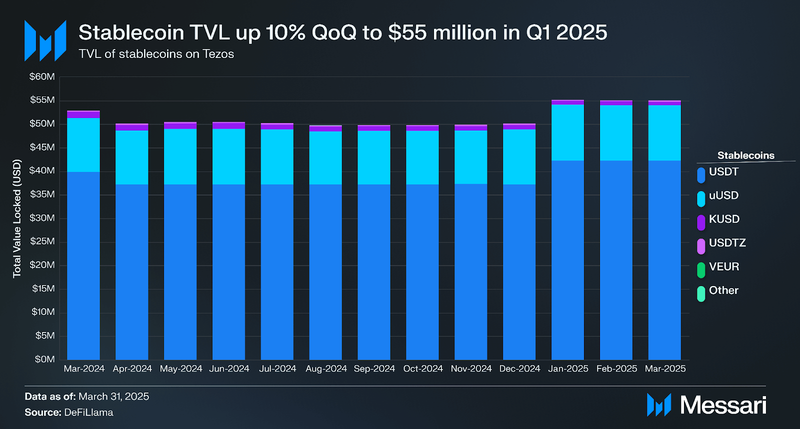

The overall stablecoin market was up 10.0% in QoQ, hitting a 12-month high of $55.0 million. Tether's total USDT issuance on Tezos reached $42.2 million, making it the largest stablecoin on the network. It was followed by uUSD, which reached $11.7 million. The largest stablecoins exclusively issued on Tezos were Kolibri’s kUSD and USDTez’s USDtz, with over $810,000 and $229,000 in circulation at the end of Q1, respectively.

Partnerships and IntegrationsTezos continued to strengthen its network in Q1 2025 through a range of strategic partnerships and ecosystem initiatives focused on infrastructure expansion, startup development, and community engagement.

A key collaboration this quarter was with Lumia, a blockchain platform focused on Real-World Assets (RWAs). The partnership is designed to enhance interoperability between Tezos and other networks, enabling cross-chain liquidity and extending the reach of Tezos-based assets into broader tokenized RWA markets. This move supports Tezos’ efforts to position itself as a base layer for compliant, multi-chain asset infrastructure.

On the developer side, Fortify Labs launched its second cohort, providing tailored support to early-stage Web3 startups building on Tezos and Etherlink. Run by TZ APAC, the program includes technical mentorship, marketing assistance, and milestone-based funding of up to $200,000 per project. The 2025 cohort features ventures across multiple verticals, including Bluwhale, Facial DN(A+I) Network, IDRX, Lilypad, and Predictwise. These teams are working on projects ranging from AI-powered tooling to digital identity solutions, contributing to a more diverse and utility-driven application layer.

Community participation also saw renewed attention with the launch of the Tezos Trailblazers program. An evolution of earlier community incentive efforts, the initiative offers task-based missions for contributors ranging from content creation to testing and event support. Participants earn TEZ Tokens, gain early access to new products, and receive formal recognition for their work, reinforcing grassroots involvement in protocol growth.

Closing SummaryTezos advanced its protocol roadmap in Q1 2025 with the activation of the Quebec upgrade, which reduced block times to 8 seconds and introduced refinements to staking parameters and Adaptive Issuance. While Layer 1 usage fell 27% quarter-over-quarter, activity continued to shift toward Etherlink, which averaged 1.4 million monthly transactions and overtook L1 in fee revenue. Etherlink’s total value locked (TVL) rose to $10.8 million, driven by the launch of the Apple Farm incentive program targeting DeFi growth.

Etherlink is also emerging as a notable player in the RWA DeFi space, with the deployment of several Midas tokens, the launch of an innovative permissionless Uranium token, and the introduction of Spiko’s tokenized Euro bills tailored for SME users. These developments reflect a broader trend of experimentation with real-world assets on Tezos’ Layer 2.

The effort to activate the Data Availability Layer (DAL) gained momentum during the quarter, while early discussions around the next protocol upgrade, codenamed “R”, began to take shape. On the network security front, the validator stake increased to 97 million XTZ, a 9.5% quarter-over-quarter rise, helping reinforce the stability and resilience of the Tezos protocol.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.