and the distribution of digital products.

State of Boba Network Q3 2024

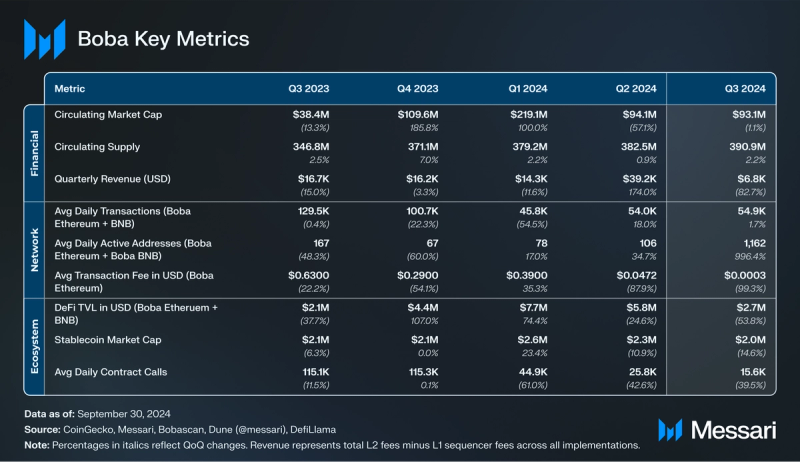

- Boba Network integrated with the Optimism Superchain, improving interoperability across L2 networks and simplifying asset transfers. This drove a 996% QoQ increase in active addresses to 1,162.

- Average daily transactions for both Boba implementations grew by 2% QoQ to 54,900, with Boba Ethereum accounting for 81% of transaction volume.

- DeFi TVL fell 54% QoQ to $2.7 million, largely driven by a 58% drop in TVL on Boba Ethereum, outpacing the 26% decline in ETH prices.

- Quarterly revenue for both Boba implementations decreased 83% QoQ to $6,800 due to a combination of reduced transaction fees and lower market cap utilization.

Boba Network (BOBA) is a Layer-2 (L2) multichain scaling solution with a focus on DeFi, gaming, AI, and RWA. Boba operates on Ethereum (ETH) and Binance Smart Chain (BNB), and it is maintained by Enya Labs. As an optimistic rollup (OR) based on Optimism’s software development kit (SDK) OP Stack, Boba offers reduced gas fees, increased transaction throughput, L1 security guarantees, and EVM compatibility for smart contracts, such as NFTs and decentralized finance (DeFi). Boba Network is also a part of Optimism’s Superchain ecosystem, providing interoperability across L2 networks within the Superchain.

This network also has unique features that set it apart from other ORs and Optimism forks, such as Hybrid Compute — the ability to connect to offchain computational resources, data, and APIs, a multichain focus, and zkRand, a non-interactive distributed verifiable random function (NI-DVRF). Boba’s combination of features — specifically Hybrid Compute — enables decentralized applications (dapps) to run at a fraction of the cost of L1 dapps, leverage offchain computation such as generative AI, and provide the multichain solutions needed for blockchain applications. Boba Network was previously active on Avalanche, Fantom, and Moonbeam, but those implementations have since been deprecated. For a full primer on Boba Network, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Key Metrics Financial Overview

Financial Overview Market Cap and Revenue

Market Cap and Revenue

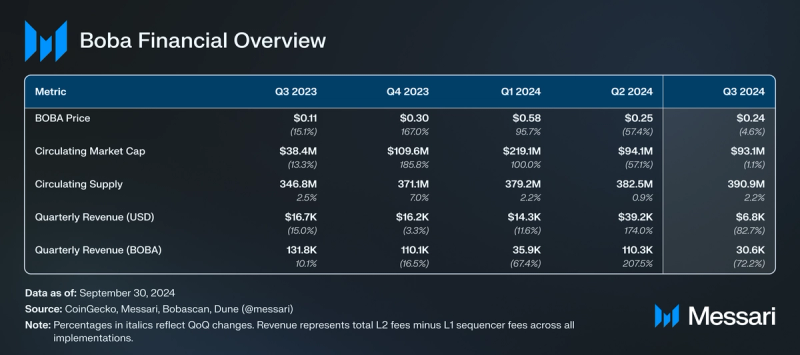

In Q3 2024, BOBA’s market cap fell 1% QoQ from $94.1 million to $93.1 million, outperforming the total crypto market’s 4% QoQ reduction.

As the native asset of Boba Network, BOBA’s primary use cases include settling gas fees, engaging in governance, and invoking Hybrid Compute within smart contracts. BOBA is an ERC-20 on Ethereum, Boba Ethereum, and Boba BNB. BOBA ended Q3 with a circulating supply of 390.9 million. BOBA primarily experiences inflationary pressure due to staking rewards and unlocks from the initial allocation of the 500 million BOBA. Each quarter, 30 million BOBA is unlocked, which will continue until all tokens are unlocked in June 2025.

As a rollup, Boba Network implementations mainly focus on execution while outsourcing other core functions — such as settlement, consensus, and data availability — to their respective Layer-1s (L1s). As such, its revenue is measured as total L2 fees generated minus L1 sequencer fees, respectively on Boba Ethereum and Ethereum Mainnet or Boba BNB and BNB Smart Chain.

In Q3, Boba Ethereum operated at a loss of $510 due to expensive L1 settlement fees, even after the 49% improvement in Boba Ethereum revenue generated from Q2 2024. This improvement was largely due to a sustained high number of transaction activity remaining after the Anchorage update in April.

As for Boba BNB, which settles on BNB Smart Chain for low settlement costs, its revenue decreased 82% QoQ to $6,800. This large reduction in revenue on Boba BNB was likely due to the continued impact of the ROVI Network merging with the Layer-3 (L3) Habit Network, as outlined in the Boba Network Q2 report.

The significant reduction in revenue during Q3 2024 can be attributed to several factors. First, the total crypto market cap saw a reduction overall, which led to lower capital utilization across Boba Network’s protocols. However, the likely more influential factor was the marked decrease in average transaction fees on both Boba Ethereum and Boba BNB (discussed further in the Network Overview section). While this reduction in fees was designed to attract more users and increase transaction volume in the long term, it likely played a critical role in the network’s decreased revenue for Q3.

In sum, for both implementations, revenue denominated in BOBA decreased 72% QoQ to 30,600 BOBA, and revenue denominated in USD decreased 83% QoQ to $6,800.

Network Overview Usage

Usage

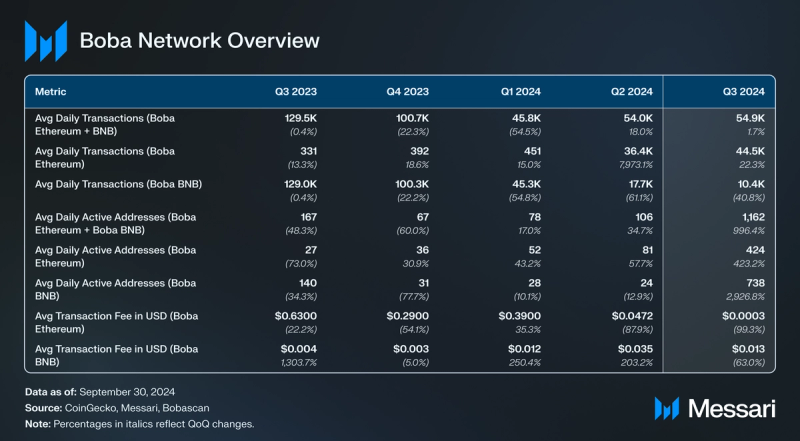

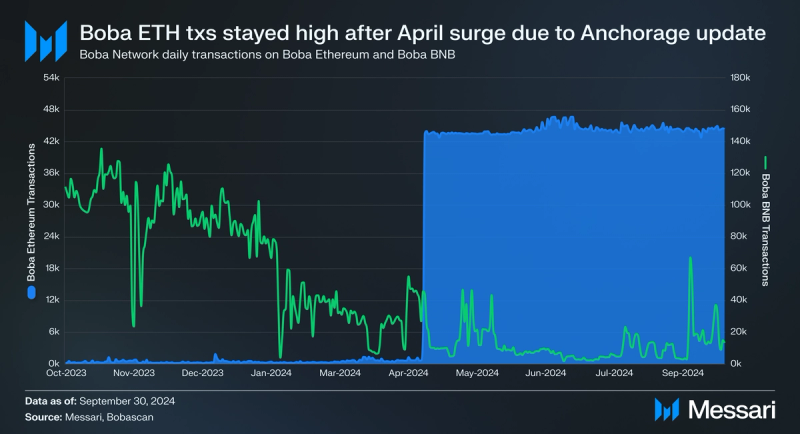

In Q3 2024, average daily transactions for both Boba Network implementations increased slightly by 2% QoQ, rising from 54,000 to 54,900. Boba Ethereum continued its recent dominance over Boba BNB in terms of daily transaction activity, accounting for 81% of the total transaction volume, while Boba BNB contributed 19%. This marked a continuation of the trend from Q2 2024, as Boba Ethereum solidified its position as the primary source of transactional activity on the network.

Boba Ethereum’s average daily transactions increased by 22% QoQ. However, since the Anchorage update in mid-April, the daily transaction count has remained relatively stable. In the period from mid-April to the end of Q2, Boba Ethereum averaged 43,900 transactions per day, compared to 44,500 in Q3 — a 1% increase.

In contrast, Boba BNB’s average daily transactions decreased by 41% QoQ, dropping from 17,700 to 10,400. This decline is largely attributed to the continued impact of the ROVI Network merging with the L3 Habit Network, as outlined in the Boba Network Q2 quarterly report. However, Boba BNB did experience a brief spike in transaction activity, reaching nearly 67,000 daily transactions between September 10th and 12th. The overall increase in daily transactions in September could be attributed to the deployment of DON TON, which launched on the Boba BNB chain on August 14.

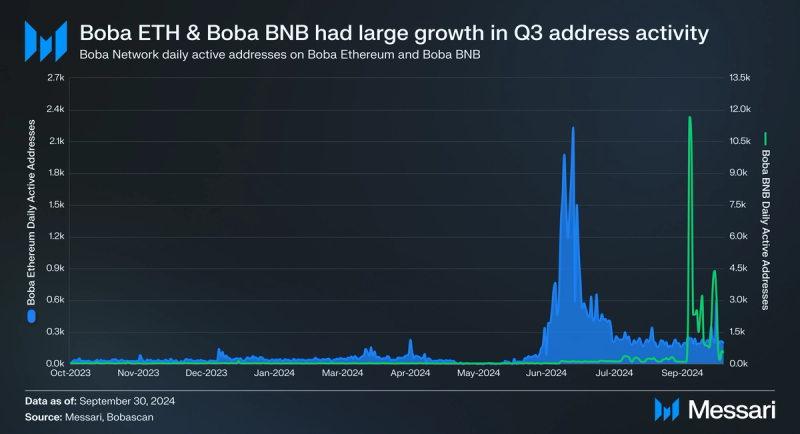

In Q3 2024, the average daily active addresses across both Boba implementations surged by 996% QoQ, rising from 106 to 1,162. This marks the third consecutive quarter of QoQ growth in active addresses, featuring the largest jump yet. Boba Ethereum contributed significantly to this increase, with a 423% rise in daily active addresses, from 81 to 424. Meanwhile, Boba BNB saw a 2,927% increase in daily active addresses, growing from 24 to 738.

This sharp growth in active addresses can be attributed to two major developments within the Boba ecosystem during Q3. First, Boba Network integrated into the Optimism Superchain, making it easier for users to bridge assets from other Ethereum-based L2s. Boba also integrated with Biconomy, simplifying user interactions with decentralized applications (dapps). Biconomy also makes it easier for developers to build a wide variety of dapps on Boba. Combined, these developments are expected to continue driving growth in unique addresses on Boba (more information on these integrations can be found in ‘Growth and Development’).

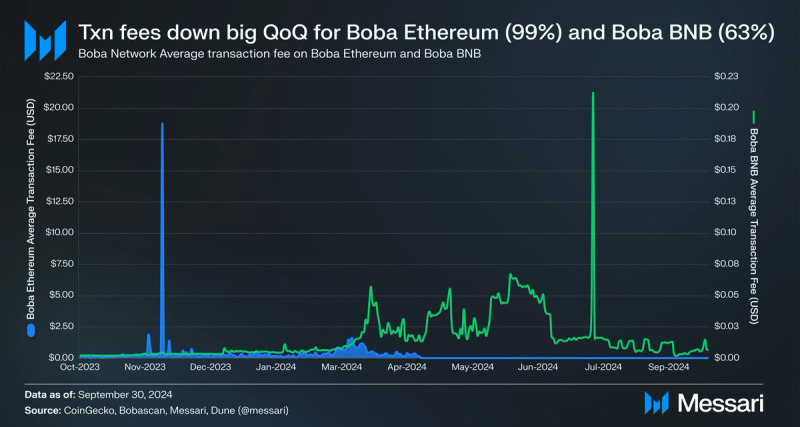

Transaction fees on Boba Ethereum are paid in ETH, while transaction fees on Boba BNB are paid in BOBA. The average transaction fee on Boba Ethereum in Q3 decreased 99% QoQ from $0.0472 to $0.0003. However, after the Anchorage update went live in Q2, the average transaction fee was $0.00077. In other words, the Q3 average fee was similar to the average fee of the post-Anchorage update Q2 fee.

As for Boba BNB, the average transaction fee decreased 63% QoQ from $0.035 to $0.013. While there was an overall decrease in average transaction fees throughout Q3 compared to Q2, the sharpness of this decrease was accentuated after the Fjord upgrade went live, with transaction fees averaging $0.005 from September 10 to 30.

PartnershipsThis quarter, Boba partnered with multiple protocols and teams to improve its network offerings. The first partnership was with Epiko (X / Twitter), which launched Epiko Market 2.0, a multichain NFT hub on Boba Network. By integrating with Boba, Epiko now allows users to mint and trade NFTs with greater flexibility and reduced transaction costs. Epiko has a variety of unique features for NFT users, including:

- Multi Blockchain Support: Allowing users to mint and trade NFTs across multiple blockchains, including Boba Network.

- Royalty Management: Epiko’s royalty system allows creators to set and receive ongoing royalties from secondary sales. In addition, they can designate collaborators on their work so that collaborators can also receive royalty percentages.

- Dynamic Bidding and Cart Functionalities: These features streamline the shopping experience, making it more efficient and engaging. Users can place bids on timed auctions and use the ‘Add to Cart’ feature for bulk purchasing.

These overall features, paired with Boba’s low fees and fast transaction speeds, are strong incentives for creators to launch products on Epiko Market 2.0’s offering on the Boba Network.

Key partnerships for Boba this quarter included Burrito Wallet, Lynx, and LendLand.

Burrito Wallet is a wallet that allows users to connect to decentralized exchanges (DEXs), DeFi platforms, NFT marketplaces, and a wide array of decentralized applications (dapps). It has a strong user base, with over 280,000 active users in the South Korean and global crypto community. The wallet ensures compliance and security with semi-KYC and whitelisting processes.

Lynx is a gasless perpetuals DEX now live on the Boba Ethereum Network. The platform is used for trading crypto, forex, and commodity perpetuals using any token as collateral. Currently, Lynx supports over 23 unique collateral options across eight blockchains and is actively onboarding partners to bring new utility to all tokens in the crypto space.

To celebrate the launch on Boba Ethereum, Lynx hosted a competition featuring its gasless perpetuals DEX with up to 100x leverage using BOBA and USDC as collateral to compete in a weekly prize pool of 5,000 BOBA.

LendLand is a decentralized lending and borrowing platform that provides users with an algorithmic money market where they can supply cryptocurrency collateral, borrow against their assets, and earn competitive APYs.

Other partnerships for Boba in Q3 included:

- DON TON, a multiplayer Web3 game deployed on TON (The Open Network).

- AntierSolutions, a full-stack blockchain consulting firm.

- iOlyWorld, a digital gaming entertainment ecosystem.

- Gate Web3, a Web3 wallet.

In Q3 2024, Boba Network announced five version upgrades, with four of them executed in Q3 and one set for Q4 2024. These releases demonstrate Boba Network's commitment to the continuous improvement of its blockchain infrastructure. The new features and updates introduced in these versions were designed to enhance the scalability, efficiency, and overall functionality of the network, ensuring better support for decentralized applications and improving user experience. Details for each version release are as follows:

- V1.6.8 - Boba Mainnet Fjord Release: This release included the Boba Fjord Sepolia Upgrade on Boba Mainnet Chains, which brought the addition of the Mainnet Geth snapshot. It updated the L2 standard bridge to the Boba Mainnet subgraph and added a fraud-proof contract upgrade script.

- V1.6.11 - Boba Mainnet Granite Release: A highly important upgrade that will be released on Boba Ethereum Mainnet, scheduled to activate on October 24, 2024. This release includes several enhancements, such as updates to documentation to improve querying data, fixes to contract artifact releases to GCP storage, and the addition of a guide for users on integrating Biconomy to send transactions on Boba Chain. These improvements will make transactions easier and more accessible for users, which could lead to increased adoption and engagement with the Boba Network.

DeFi

DeFi

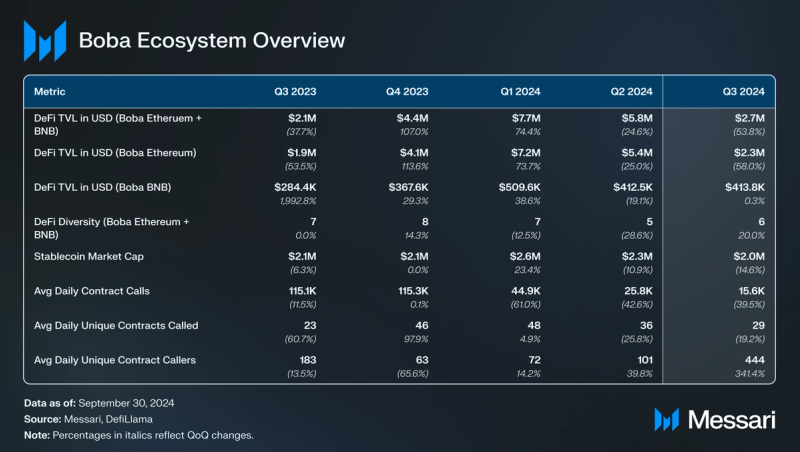

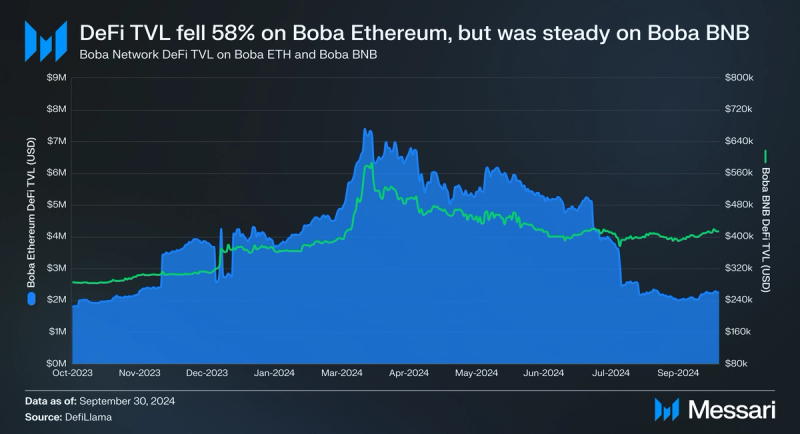

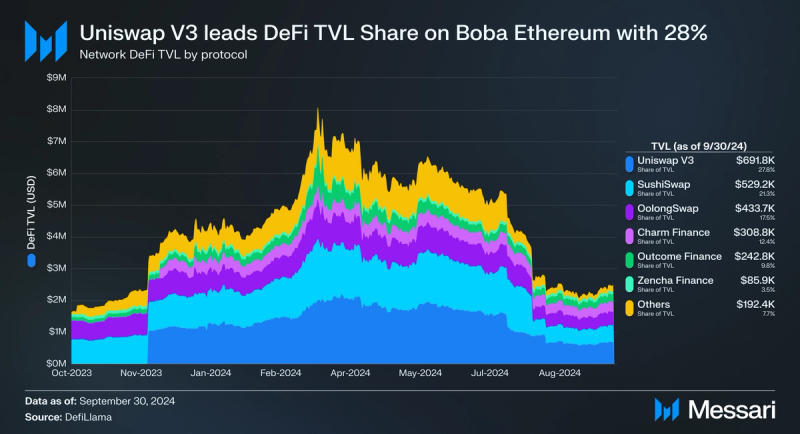

In Q3 2024, DeFi total value locked (TVL) for both Boba implementations fell 54% QoQ, dropping from $5.8 million to $2.7 million. This decline was primarily driven by a significant reduction in TVL on Boba Ethereum, which fell by 58% QoQ, from $5.4 million to $2.3 million. Given that Boba Ethereum accounts for the vast majority of TVL on the network, its performance was the main factor behind this overall Boba Network decrease. As for Boba BNB, its TVL slightly increased QoQ from $412,500 to $413,800.

The substantial TVL decrease on Boba Ethereum can be partially explained by the 26% QoQ decrease in the price of ETH, the token used for transaction fees on Boba Ethereum. However, the 58% decline in TVL on Boba Ethereum notably outpaced this ETH price drop, indicating an outflow of value from the network’s DeFi apps.

In Q3 2024, the top three protocols on Boba Ethereum, Uniswap V3, SushiSwap, and OolongSwap, accounted for 67% of the total DeFi TVL.

Note that Uniswap V3’s liquidity pools on Boba Network are accessed through Oku Trade’s front-end, as Uniswap did not deploy its own interface. For consistency, this report will refer to these pools as Uniswap V3.

Uniswap V3, the largest protocol by TVL, held a 28% market share. Uniswap, a widely-used AMM deployed across multiple EVM networks, launched its V3 version on Boba Ethereum in November 2023. Despite its leading position, Uniswap’s TVL decreased by 58% QoQ, falling from $1.7 million to $0.7 million. This decline could be attributed to the Uniswap Labs announcement of an upcoming wallet browser extension on Chrome, which will support 11 blockchains but does not include Boba. The wallet extension aims to offer a more user-friendly UX, which may have led users to shift their Uniswap activity to blockchains supported by the extension.

SushiSwap, another prominent multichain AMM DEX, held the second-largest TVL share with 21%. Its TVL declined by 63% QoQ, dropping from $1.4 million to $0.5 million.

The third-largest protocol at the end of Q3 was OolongSwap, an AMM DEX forked from Uniswap V2, which replaced Teahouse Finance in the rankings. OolongSwap closed the quarter with a TVL of $0.4 million. In contrast, Teahouse Finance experienced a 90% QoQ decrease in TVL, dropping from $866,800 to $83,526. This drop reduced its market share of TVL to 3% from 16% in Q2. The likely cause of Teahouse Finance’s sharp decline in TVL was the conclusion of its 24-week liquidity incentives program on July 15, which had offered 980,000 BOBA in rewards to users who deposited liquidity into three pools (USDC-WETH, USDC-BOBA, and WBTC-WETH).

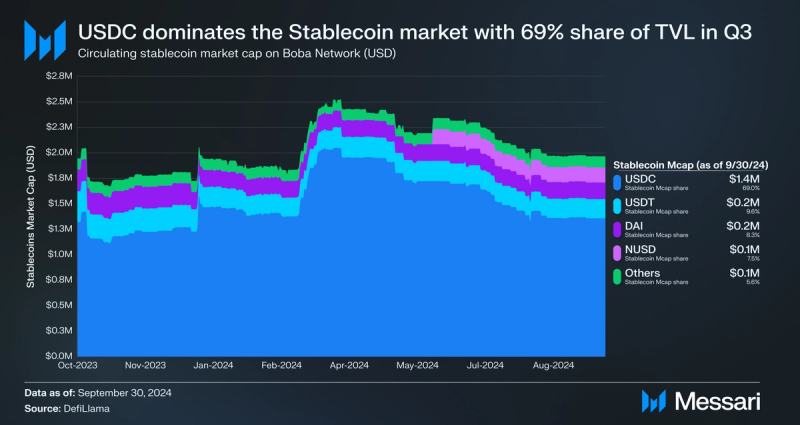

USDC dominates the stablecoin market on Boba Ethereum, with a 69% market share. This value reduced by 20% QoQ from $1.7 million to $1.4 million. All of the other stablecoins on Boba Ethereum experienced very little to no change QoQ, remaining within 1% of their end of Q2 value locked.

Contract Activity

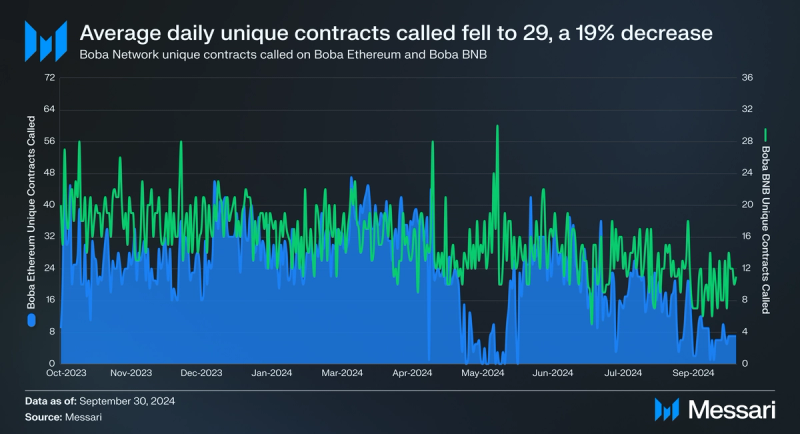

The average daily unique contract calls for both Boba implementations decreased by 19% QoQ from 36 to 29. Furthermore, the average daily unique contract calls decreased for both Boba implementations. Boba Ethereum was down 19% QoQ from 21 to 17, while Boba BNB was down 20% QoQ from 15 to 12.

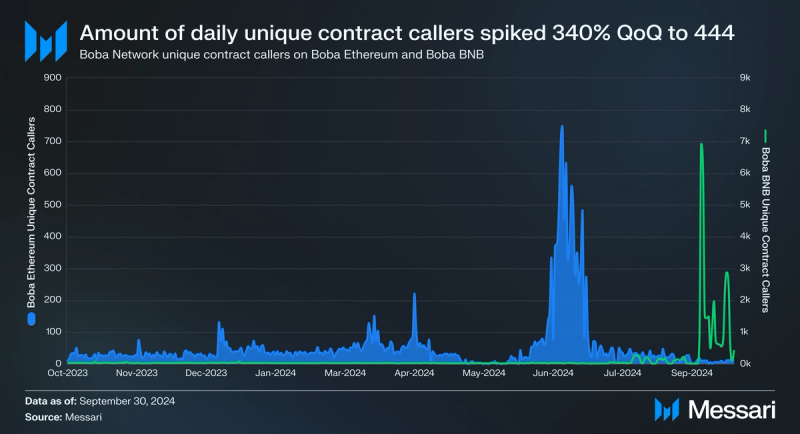

Despite the decrease in average daily unique contract calls, the number of unique contract callers increased in Q3, up 341% QoQ from 101 to 444. The majority of unique contract callers were on Boba BNB, which was correlated to the large increase in unique address activity on Boba BNB. Unique contract callers on Boba BNB increased 1,677% QoQ from 23 to 417, while on Boba Ethereum, they decreased 9% QoQ from 77 to 70.

Growth and DevelopmentSuperchainOne of the biggest developments for the Boba Network in Q3 was the announcement of joining the Superchain ecosystem. The Superchain ecosystem represents a collaborative vision for the future of blockchain technology being spearheaded by Optimism. It aims to create a web of L2 solutions working together to scale Ethereum and other blockchains while maintaining decentralization, security, and user-centric design. One of Boba Network’s major contributions to the Superchain Ecosystem was its development work on Erigon as its execution client. Additionally, building on Optimism’s Custom Gas Token, Boba Network open-sourced a method to configure L2 OP Stack chains to use custom gas tokens, including the ability to bridge ETH.

By joining the Superchain on Optimism, Boba Network gains the key benefit of gaining access to native interoperability across L2 networks within the Superchain, including OP Mainnet, Base, and Mode Network. This interoperability allows for user-friendly asset transfers and application development across these networks. In addition to improving the user experience, it addresses the issue of fragmentation that often limits scalability in blockchain ecosystems.

Also, Boba enhanced its L2 market positioning by joining the Superchain. Optimism’s efforts to simplify user experiences and improve asset portability give the network a stronger footing against competitors like Arbitrum and Polygon. This strategic move allows Boba to remain competitive in a rapidly evolving L2 landscape.

BiconomyOn September 6, Boba Network announced the integration of Biconomy, a blockchain infrastructure platform designed to simplify user interactions with decentralized applications (dapps) across multiple blockchains. This was achieved by providing developers with tools to create:

- User-friendly dapps and wallets, and

- Abstract the complexities of gas fees for transactions.

With this integration, users can use their BOBA, USDC, or USDT tokens as native gas tokens for transaction fees.

Biconomy’s technology, which includes gas-efficient features and a simplified one-click user experience, is intended to make the user onboarding process more seamless. This could improve user retention and accessibility, especially for non-technical users.

Boba Liftoff Accelerator ProgramBoba Network launched the Boba Liftoff Accelerator Program on July 22, 2024, as part of its expansion strategy in Q3 2024. Developed with Brinc, this program aims to support decentralized applications built on the Boba Network. The 10-week initiative focuses on innovation in key sectors, including DeFi, real-world assets (RWAs), gaming, and AI.

The accelerator offers a $1 million grant pool, distributed based on project milestones. The program provides additional support through remote workshops, mentorship, and investor connections. This approach aims to equip participants with financial resources, knowledge, and improved networks for the blockchain sector.

The program received more than 250 applications before the August 26, 2024, deadline. Alan Chiu, Boba Network's co-founder, has expressed support for the initiative, noting its potential to scale projects and expand the network.

Closing SummaryIn Q3 2024, Boba Network maintained resilience despite a 1% QoQ reduction in its market cap, outperforming the total crypto market cap. Boba Ethereum continued to drive network activity, with average daily transactions increasing by 22% QoQ, sustaining the momentum gained from the Anchorage update and EIP-4844 upgrade. However, DeFi TVL for both Boba Ethereum and Boba BNB fell, driven primarily by a 58% QoQ drop in Boba Ethereum’s DeFi TVL.

On the technical side, Boba Network made significant strides with the integration of Biconomy and its entry into the Optimism Superchain. These developments improved interoperability and user experience, particularly through account abstraction and the simplification of asset bridging across L2 networks. Boba’s focus on reducing transaction fees aims to attract more users, which is expected to support future growth in transaction activity and active addresses.

With these advancements, Boba Network continues to position itself for continued development. Its technical improvements, combined with expanded use cases and partnerships, set the foundation for ongoing expansion in the competitive L2 ecosystem.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.