and the distribution of digital products.

Taking a Look at How Much Money & Cryptocurrency Exists in the World

People often try to gauge Bitcoin’s progress by measuring its market cap against “all the money in the world.”

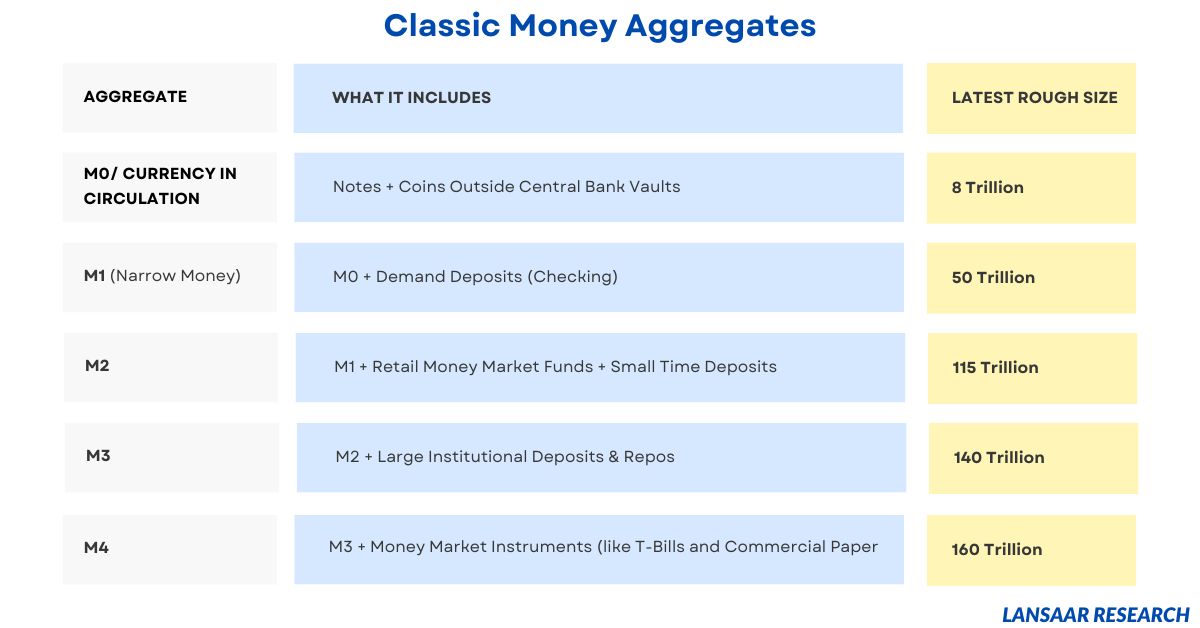

\ The value of “all the money in the world” varies depending on the definition. There are four common definitions (M1, M2, M3, M4). Each definition is broader and more nebulous than the last.

\ Before we answer the question of how Bitcoin measures up against money overall, we need to know what we’re comparing it to, and why choosing the U.S. dollar as our measuring stick matters.

1. The Classic Money Aggregates

Note that these figures are my estimates, and they are hard to measure because they fluctuate weekly and because different countries provide different kinds of data, of varying quality. You can see that as we move from narrower to broader definitions, we blur the line between "money” and “credit.”

\ The breakdowns show us that most “traditional money” is already in digital databases, not paper.

2. How Big Is Crypto?\

- Bitcoin: 19.9 million BTC × ≈ $105,500 per coin = $2.1 trillion

- Top 10 cryptocurrencies combined: just under $3 trillion in market value

\ We will cut these off at the top 10 cryptocurrencies because these account for more than 90% of the market cap of all cryptocurrencies.

\ This means that Bitcoin amounts to 1.4% of M3 money globally, while the top 10 cryptocurrencies amount to 2.1%.

3. Why The U.S. Dollar Baseline MattersThough this article - and most analyses - measure the value of Bitcoin, and cryptocurrency more broadly, in USD, theoretically Bitcoin’s value can be measured against any other unit of value, like minerals, square feet of apartment space in a chosen city, or cubes of sugar.

\ We typically use USD to price every asset, not just because it is analytically convenient - but also because much of global trade (and most crypto on-ramps) price in USD and because Federal Reserve policy often sets the opportunity cost of holding an asset.

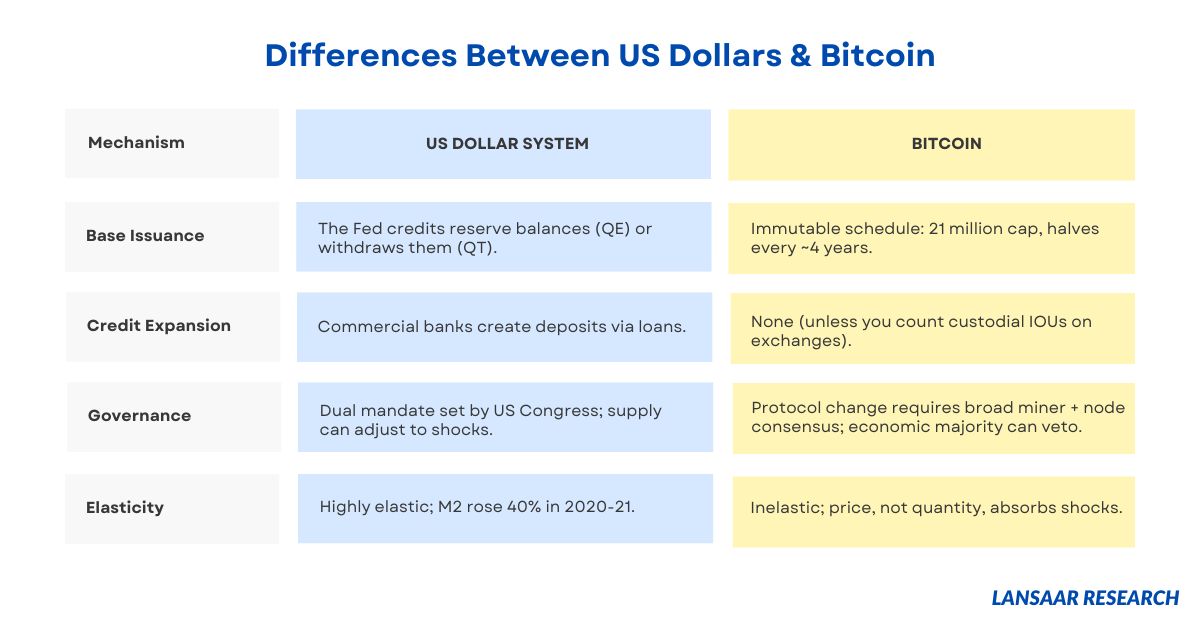

4. Reviewing Differences Between Dollars & BitcoinLet’s review how USD and Bitcoin are issued, expanded, and governed:

So, our comparison is complicated not just by how Bitcoin’s value is being measured in USD, but also by how USD money stock is naturally “stretchy,” while Bitcoin is a digital commodity with an immutable supply rule.

5. Digital Money’s Share May IncreaseTwo current policy efforts could enlarge the “crypto” slice of the pie:

Stablecoin reform: Draft U.S. bills under consideration would move dollar-backed stablecoins from an SEC gray zone to a payment-system charter under the Fed or OCC. If passed, fintech companies and banks could issue tokenized deposits at scale, backing cryptocurrencies with USD.

\

FedNow and RTP integration. Instant-payment rails could make tokenized dollars more fungible with bank deposits, lowering switching costs and giving merchants a reason to accept on-chain cash.

\ If those rules are implemented, we will likely have to update our M2, M3, and/or M4 definitions to include:

- M2-tokenized: big bank and fintech stablecoins settled in Fed master accounts.

- M3/M4: repo tokens, T-bill tokens, and wholesale CBDCs

\ If that happens, crypto will be mainstream by any measure. So, a more useful question might be - “Which part of crypto will count as ‘money’ for policy models?”

6. ConclusionBitcoin and cryptocurrencies are still small compared to more traditional forms of “money.” While USD is useful and abundant, Bitcoin is useful and scarce. Stablecoin legislation will mainstream crypto, but it also blurs the line - since the fastest-growing slice of the crypto pie may essentially become digital dollars.

\ __

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.