and the distribution of digital products.

State of Core Q2 2024

- Despite the broader market pullback, Core’s DeFi TVL (USD) increased by 1,032% QoQ to $76.4 million. Colend topped the leaderboard for DeFi TVL, and native DEXs such as CoreX and Glyph have overtaken multichain DEX SushiSwap.

- Non-custodial BTC staking was launched in April, enabling BTC holders to earn yield without wrapping or losing custody of their tokens. 3,504 BTC, equivalent to $215 million, were staked in Q2.

- Sparks Incentive Program was launched in May, offering users loyalty rewards for activity and engagement on Core.

- Valour launched a first-of-its-kind yield bearing BTC ETP in June, providing users with exposure to a 5.65% yield on top of Bitcoin exposure. The ETP generates yield through non-custodial BTC staking on the Core blockchain.

The Core blockchain (CORE) is a scaling and programmability solution for Bitcoin that is differentiated by its Satoshi Plus consensus, EVM execution environment, Core DAO governance, and coreBTC bridge. Launched in early 2023, the Core community is building an ecosystem of Bitcoin-focused applications, leveraging Bitcoin security wherever possible along the way, such as consensus resources.

Satoshi Plus consensus involves staking and hash rate delegation from Bitcoin miners. Staking includes both the native CORE token and BTC. This combination of security resources results in a hybrid model that leverages Bitcoin mining, rewards Bitcoin miners, and still separates block production to mitigate censorship and MEV risks. Core DAO is the governing body of the network, powered by the CORE token. The network's EVM-compatibility grants Core the ability to run Ethereum-style applications and smart contracts, leveraging the existing Ethereum developer tools and ecosystem. coreBTC is the enshrined Core-native bridged BTC, which allows users to access BTC liquidity in Core's fully expressive execution environment. For a full primer on Core, refer to our Initiation of Coverage report.

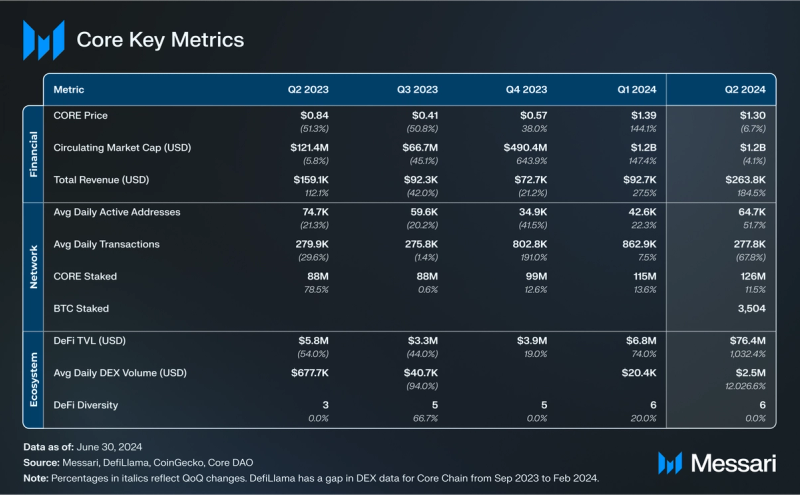

Key Metrics Financial Analysis

Financial Analysis

CORE is the native token of the Core blockchain and is used as the primary medium of exchange when transacting on the network. CORE has 3 primary use cases:

- Paying transactions fees

- Staking to secure the network and earn rewards

- Participating in onchain governance

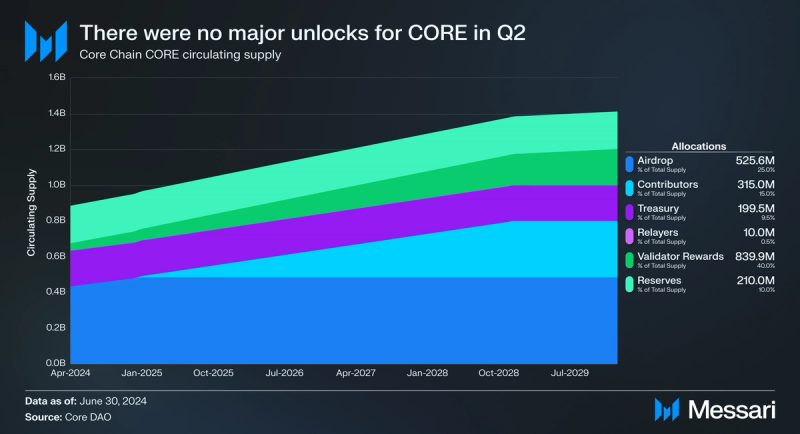

The total supply of CORE is 2.1 billion tokens, with block rewards distributed over 81 years. CORE also has a minor deflationary burn mechanism aimed to counteract inflationary pressure. Additionally, block rewards decrease by 3.6% each year.

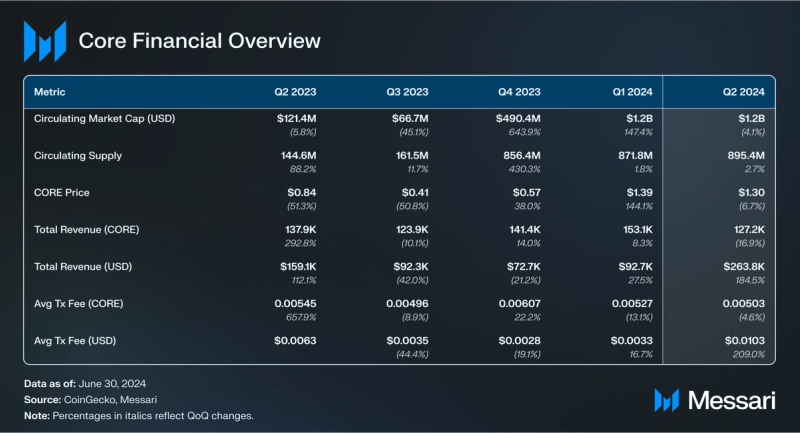

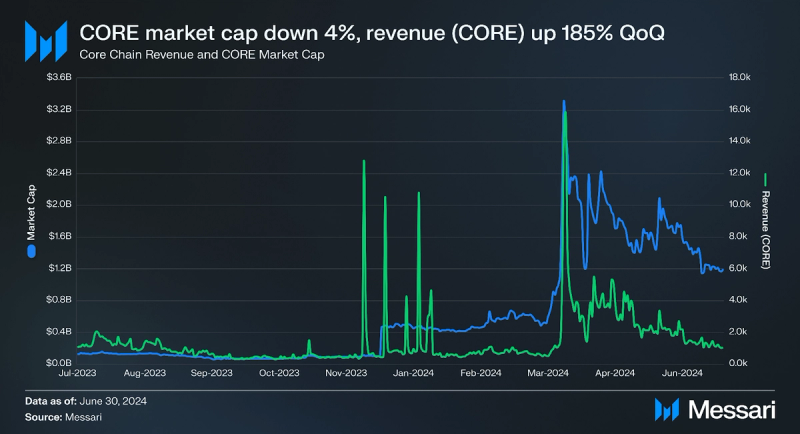

Market Cap

CORE’s market cap decreased 4% QoQ, and its price decreased similarly 7% QoQ with the discrepancy due to an increase in circulating supply. This decrease moved CORE’s market cap rank down from 58 to 64. At the end of last quarter, CORE price spiked up 218%. As such, part of the price decline in Q2 was due to a retraction from this large increase. CORE price remained 52% higher YoY at the end of June.

Token Vesting

In Q2, 24.7 million CORE tokens were unlocked. 17.0 million tokens were unlocked for airdrop participants, 7.7 million tokens were unlocked for validator rewards, and 30,900 tokens were vested for relayers. Airdrops participants will be fully vested for 525.6 million CORE by January 2025.

Network Analysis

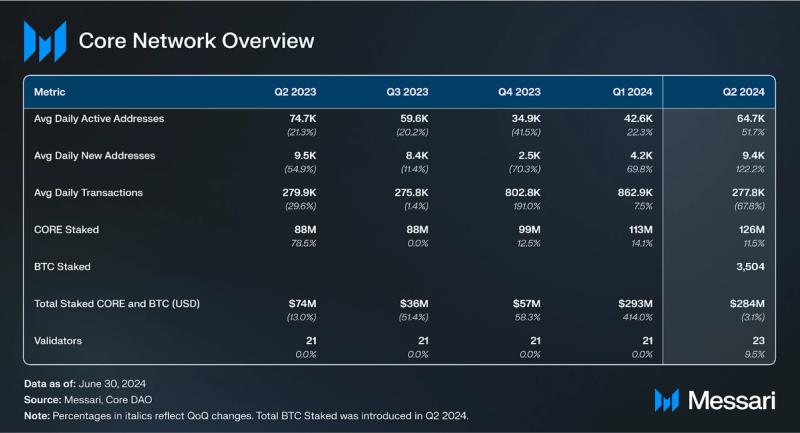

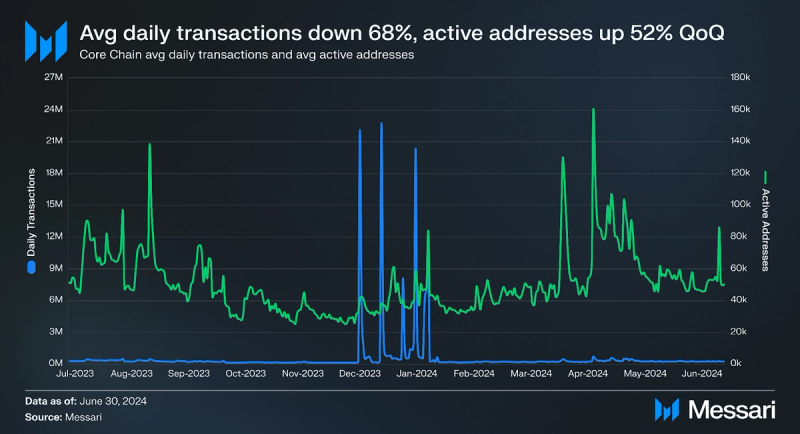

Average daily active addresses increased 52% to 64,700 and average daily transactions decreased 68% to 277,800 in Q2, respectively. From Q4 2023 to Q1 2024, inscription activity spiked, causing increases in the number of average daily transactions and average active addresses. Inscription activity began to decline by late January. As a result, average daily transactions were lower in Q2, while average active addresses were higher. In Q2, Core DAO launched its non-custodial BTC staking product (more info in Core Blockchain Components section). By quarter end, a total of 3,505 BTC, equivalent to $215 million, had been staked.

Core Blockchain ComponentsCore consists of 3 main products related to onchain assets:

Non-Custodial BTC StakingLaunched in Q2, this product allows BTC holders to earn yield in CORE without losing custody of their assets. BTC traditionally does not have any native sources of yield. Through Core’s non-custodial BTC Staking, BTC holders can access BTC-native yields. Additionally, the Core blockchain benefits from the security of staked BTC. At a minimum, users must stake 0.01 BTC for at least 10 days. BTC staking reward rates may vary by validator. Non-custodial BTC Staking is one of three parts of Satoshi Plus consensus. In addition to staked BTC, the Core network is also secured by staked CORE and delegated hash power from Bitcoin miners through Delegated Proof-of-Work.

coreBTCIn Q1, Core enshrined a trust-minimized BTC bridge into the protocol, making BTC available on the network in the form of coreBTC. Users lock their BTC up and receive an equivalent amount of coreBTC, which can then be used on Core. When a user would like their original BTC back, they can request to burn their coreBTC in return for their locked BTC tokens.

Unlike previous options limited to wrapped BTC via Layer Zero, coreBTC is trust-minimized and native to Core, so it has higher security than third-party bridged assets.

stCORELaunched in Q1, stCORE is Core’s liquid staking derivative, enabling CORE token holders to stake CORE and earn rewards while maintaining liquidity, meaning they can still use their tokens on DeFi platforms. To participate, CORE token holders can lock up CORE and receive an equivalent amount of stCORE. Rewards come in the form of an annualized return on holding stCORE, which is the projected yearly increase in its conversion ratio with CORE. This means that users can exchange for more CORE when they burn their stCORE. Unlike non-custodial BTC staking, users can unlock their tokens at any time.

Staking

CORE staked was up 12% QoQ to 126.4 million in Q2. Total CORE staked has increased the past 5 quarters, although at a diminishing rate.

Core uses the novel Satoshi Plus consensus mechanism. Satoshi Plus is a hybrid model of Delegated Proof-of-Work (DPoW), Delegated Proof-of-Stake (DPoS), and non-custodial BTC Staking. Unlike merge-mined sidechains, Core’s block production is performed by Core validators rather than the participating Bitcoin miners.

In Q2, Core proposed the gradual expansion of its active validator set from 21 to 31 by Q2 2025 to improve decentralization. Currently, Core uses its Validator Election mechanism to rank the top 23 validators based on a weighted score of their hash and stake (CORE and BTC), creating the validator set for a consensus period of 200 slots, known as an epoch.

MiningCore has multiple validators (M Labs, InfStones, OKXEarn, and others.) participating in Satoshi Plus consensus. In Q2, 4 new validators joined Core:

- ZAN, the Web3 products and services brand of Ant Digital Technologies, joined as a validator in April, strengthening ties with the Asian market.

- Kiln, an enterprise-grade staking provider recognized as a top Ethereum validator, joined in May.

- UTXO Management, a strategic crypto investment management firm, joined as a validator in May.

- Valour, a subsidiary of DeFi Technologies Inc. that manages a CORE Exchange-Traded Product and a Bitcoin Exchange-Traded Product, joined as a validator in June. In April, Valour announced plans to stake $100 million in BTC through its non-custodial staking product.

In Q2, Core had 237 EH/s out of 558 EH/s of delegated hash rate from BTC miners on the network, which represents 42% of all hash power from Bitcoin mining (i.e., 42% of all compute power on Bitcoin’s network is being redirected through the Core). This allows Core to benefit from the large pool of computing power generated to mine BTC, which the network can use to enhance security, promote decentralization, and potentially make it easier to use BTC on Core.

Ecosystem Analysis

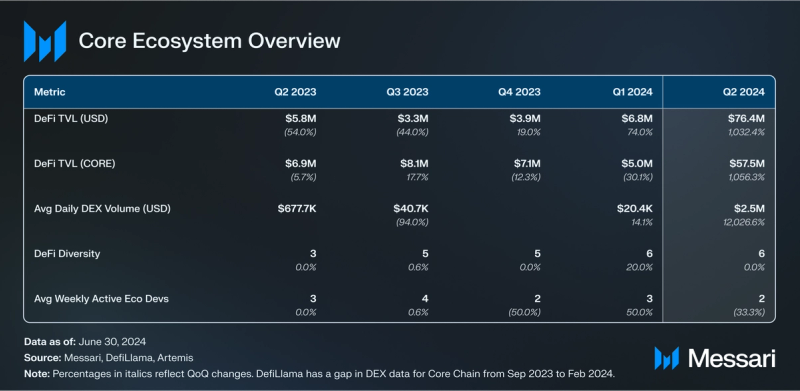

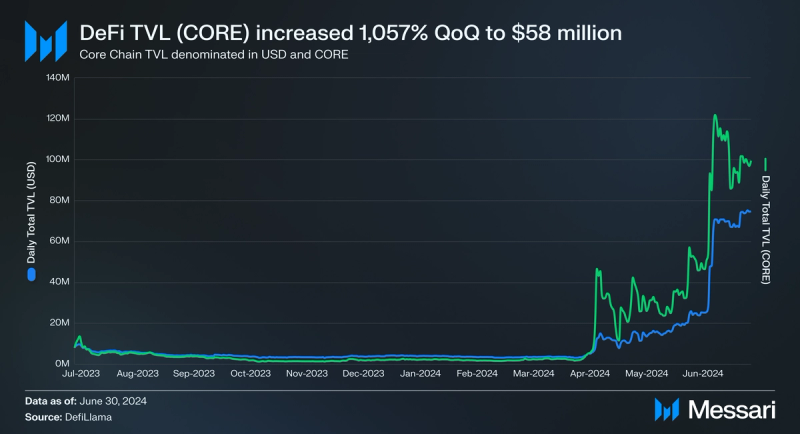

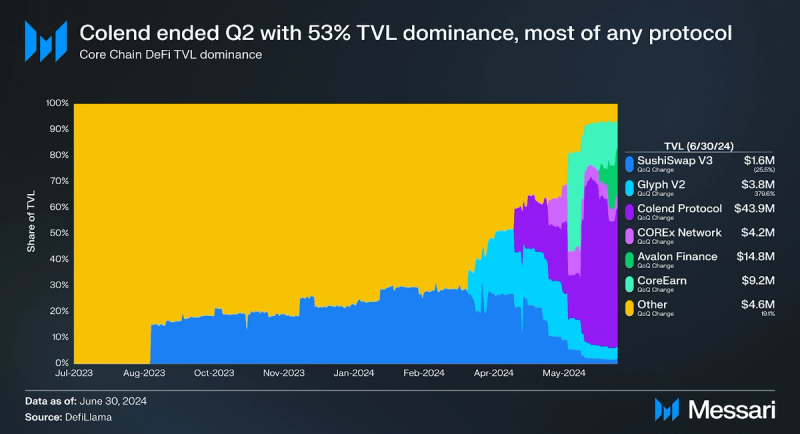

DeFi TVL (CORE) increased 1,057% QoQ, marking an all-time-high for the protocol. Similarly, DeFi TVL (USD) increased by 1,032% QoQ. Similar increases denominated in USD and CORE indicate that the TVL increase was due to capital inflows.

Core saw a 48% rise in dApps integrated into their ecosystem QoQ, totaling 34 new dApps that were onboarded to the Core ecosystem compared to 23 dApps in Q2. Notable integrations include Colend, COREx, and Avalon. As of Q2, Core has 61 dApps per DappRadar (non-exhaustive) integrated into their ecosystem. The accelerating rate of capital being locked in the protocol suggests higher adoption and usage of CORE throughout the ecosystem, especially as the Core ecosystem grows. The influx of new dApps offers users a number of unique, competitive ways to manage capital and find yield.

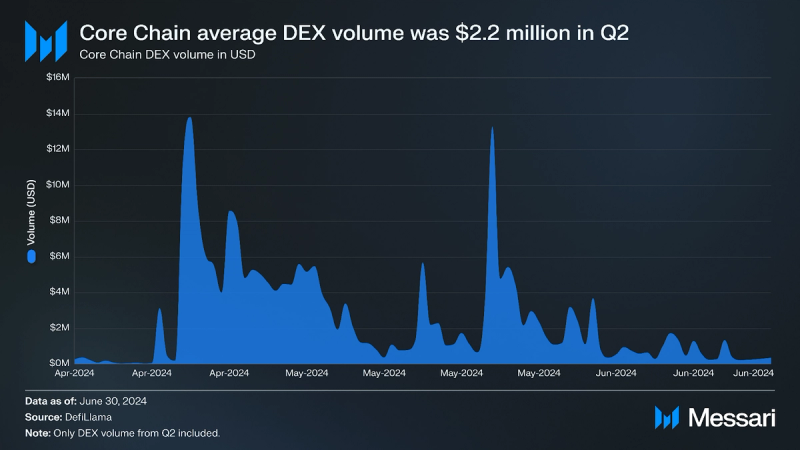

Core had an average daily DEX volume of $2.2 million in Q2. DEX Volume maxed out at $13.8 million on April 16, the same day Colend, a lending and borrowing platform, launched on Core. DEX volume decreases coincided with wider onchain decreases across the crypto market.

DeFi

The TVL surge can largely be attributed to Colend, a lending and borrowing platform native to Core that spiked in June, netting $43.9 million in TVL. The majority of Colend’s TVL increase came from users’ supplying SolvBTC, a bridged version of BTC. The TVL on Colend surged 655% the week of June 3 following the announcement that SolvBTC will be supported on Colend and also receive a 5x Sparks Incentive Multiplier (Core DAO’s program to reward user engagement, refer to Sparks Incentive Program for more information).

Valour, the asset management arm of DeFi Technologies, collaborated with Core DAO to introduce the first yield-bearing BTC exchange-traded product in June. It’s currently available to German Investors on Börse Frankfurt, the largest German stock exchange. Valour generates yield by delegating BTC to their validator node on Core through the non-custodial BTC staking feature. The yield is attributed to the Net Asset Value on a daily basis, providing investors yield without having to sell or trade their BTC holdings.

COREx, a V3-style DEX forked from Uniswap, launched on Core in May 2024. It offers some unique features, such as copy trading and AI-enhanced analytics. COREx finished Q2 with $4.2 million in TVL. Other DEX’s such as SushiSwap and Glyph all saw decreased TVL in Q2.

Avalon Finance, a decentralized lending protocol, launched in June 2024. It offers overcollateralized lending to reduce lender risk. Less than a month after launching, Avalon ended Q2 with $14.8 million in TVL.

stCORE, Core’s native liquid staking product, was launched in January 2024. The token is designed to give CORE stakers liquidity in order to participate in DeFi and other yield opportunities while still contributing to the Core blockchain. stCORE ended Q2 with $9.3 million in TVL, which is roughly 5% of the 126 million CORE tokens staked (valued at $168.5 million at the end of Q2).

Ecosystem and GrowthThe Core ecosystem is defined by two mutually reinforcing offerings:

- Bitcoin Yield Product

- EVM-Compatible BTCfi Platform

Non-custodial BTC staking both secures the Core network and delivers yield to Bitcoin holders. The yield is sourced from Core’s BTCfi platform, providing an endogenous source of Bitcoin value creation.

The Core network uses the EVM, which means much of Ethereum’s infrastructure is used. Wallets like MetaMask, developer tooling such as Hardhat, and DEXs such as SushiSwap are found on Core. This familiarity greatly reduces the development overhead and has other benefits, such as reducing the risk of exploits. Core’s ecosystem developers can leverage the learnings of EVM development on Ethereum, Arbitrum, Avalanche, and other EVM chains.

Sparks Incentive ProgramIn May 2024, Core DAO updated the Core Ignition Incentive Program to introduce Sparks, the network’s way of measuring user activity and engagement. This is synonymous with the “points” tracking that a number of popular pre-airdrop protocols began offering the past year.

Users receive a daily allocation of Sparks, determined by their level of engagement and participation in the Core ecosystem. The more active and involved a user is, the greater their daily allocation of Sparks will be. Additionally, Core offers a multiplier on certain assets that adjusts your conversion rate (i.e., if you hold an asset with a 1.5x multiplier and earn 100 base Sparks a day, you'll receive an additional 50 Sparks through the asset multiplier, totaling 150 Sparks for the day).

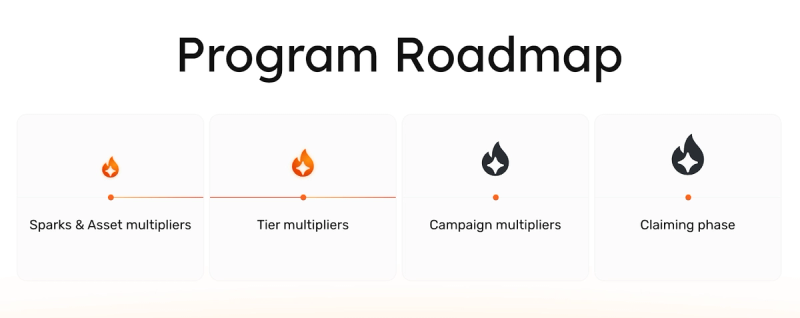

Source: Core DAO

Core DAO announced a roadmap for the Sparks incentive program that includes additional multipliers based on tiers, which you can level up through network activity, and campaign multipliers, which are expected to start in late 2024.

Other Key DevelopmentsSeveral other key developments and initiatives took place in Q2:

- Crypto Debit Card (April 8) - In partnership with Mobilum, Core DAO launched a crypto debit card, aiming to give users an easier time transitioning between crypto and fiat on Core.

- Various DeFi Integrations (May 8) - Symbiosis integrated Core into their DeFi product offerings, introducing cross-chain trading and asset management for several coins on the network.

- New Venture Partnership (May 28) - Merkle 3s Capital joined the Core Venture network.

- SolvBTC Integration (June 3) - Solv Protocol, an omnichain yield and liquidity infrastructure, integrated SolvBTC on Core.

- Fireblocks Integration (June 6) Fireblocks, a digital asset manager with a large institutional user base, integrated Core.

Q2 marked a period of growth and innovation within the network. The launch of non-custodial BTC staking and the expansion of DeFi protocols have driven increases in revenue, TVL, and active addresses. As Core continues to build its ecosystem around BTC, it is well-positioned to lead the next wave of BTC DeFi, offering secure, scalable, and programmable solutions for the broader blockchain community.

Core's continued success will depend on its ability to maintain its unique hybrid consensus model, attract new developers, and capitalize on idle liquidity to build a vibrant DeFi space on BTC. With its strong foundation and growing community, Core is poised for continued growth and resilience.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.